CARD Act Saves Americans $21B a Year

The 2009 Credit Card Accountability Responsibility and Disclosure (CARD) Act’s limits on credit card fees have reduced Americans’ overall borrowing costs by 2.8 percent of their average daily balances, we learn from a recent National Bureau of Economic Research (NBER) paper published by four economists. Moreover, at 10 percent, the reduction in fees for consumers with the lowest FICO scores has been more than three times as great. And the authors have found no evidence that these lower fees have been offset by higher interest charges or a lower access to credit.

The paper estimates that, overall, the CARD Act’s fee reductions have saved American consumers $20.8 billion per year. Furthermore, the authors find that the CARD Act’s requirement that credit card statements disclose the savings accruing from paying off balances in 36 months, rather than only making the minimum payments, has increased the number of cardholders making the 36-month payment amount by 0.5 percent. So the paper lends more support to the now generally accepted view that the CARD Act has benefited American consumers. Let’s take a look at the paper.

Nudging Cardholders to Pay More Each Month

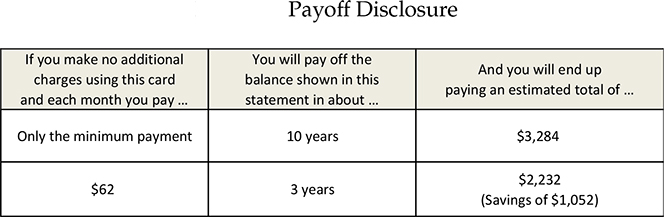

The CARD Act mandated that debt repayment disclosures were included in cardholders’ monthly credit card statements. In particular, the authors remind us, it required that the following information were provided:

- The number of months that it would take to pay the outstanding balance in full, if the cardholder only paid the required minimum monthly payments.

- The total cost to the cardholder — the sum of interest and principal payments — of paying off that balance, if she only made the required minimum monthly payments.

- The monthly payment amount that would pay the outstanding balance in full in 36 months, and the total cost to the cardholder, including interest and principal payments, of paying that balance in full.

Here is an example of the way this information can be displayed on credit card statements:

Furthermore, the CARD Act placed restrictions on interest rate increases for new transactions within the first year of opening the card and on existing balances for at least six months, except in cases where the prior rate was temporary (for example, an introductory rate) or if the minimum payment were not received for no less 60 days. For credit cards with multiple interest rates (for example, a balance-transfer and a purchase rate), issuers were required to apply payments first to the balances with the highest rate.

The CARD Act also regulated payment due dates and times, so that any payments received before 5 pm on the payment due date have to be accepted. If the payment date falls on a weekend or a holiday, a payment received on the next business day cannot be treated as late.

Finally, the CARD Act mandated that bank fees are “reasonable and proportional”. In practice, that means that a card issuer cannot charge a late fee of more than $25 unless one of the last six payments was late, in which case the fee may be as high as $35. Additionally, the late fee could no longer be larger than the minimum payment amount and the over-the-limit (overdraft) fees were capped at the actual over-the-limit amount. Inactivity fees were banned, as were multiple fees assessed for a single violation and lenders were required to reevaluate any new rate increases every six months.

CARD Act’s Fee Reduction by the Numbers

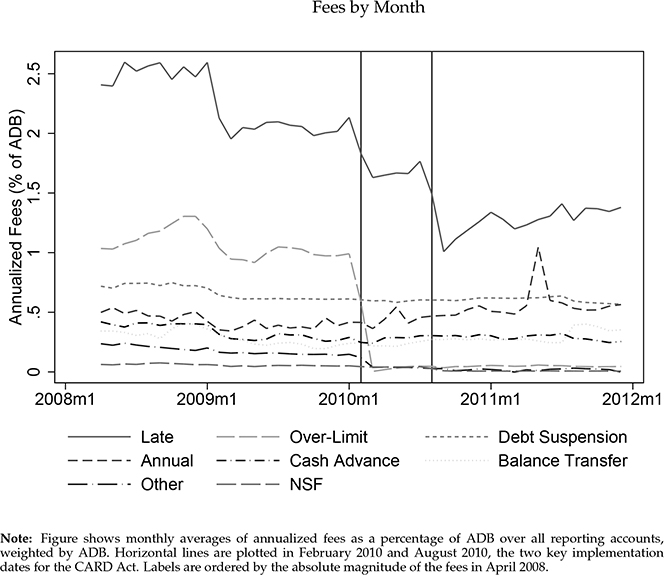

The paper finds that CARD Act’s “regulations to limit fees were highly effective”:

Over-limit fees dropped from an annualized 1% of average daily balances to zero in February 2010. Late fees dropped by 0.5 percentage points in February 2010 and another 0.5 percentage points in August 2010, for a combined decline of 1 percentage point on a base of 2%. Combined across the various implementation phases, the CARD Act seems to have reduced overall fee costs by an annualized 2.8% of borrowing volume.

Here is a chart illustrating the CARD-Act effect on consumer fees. First, by month:

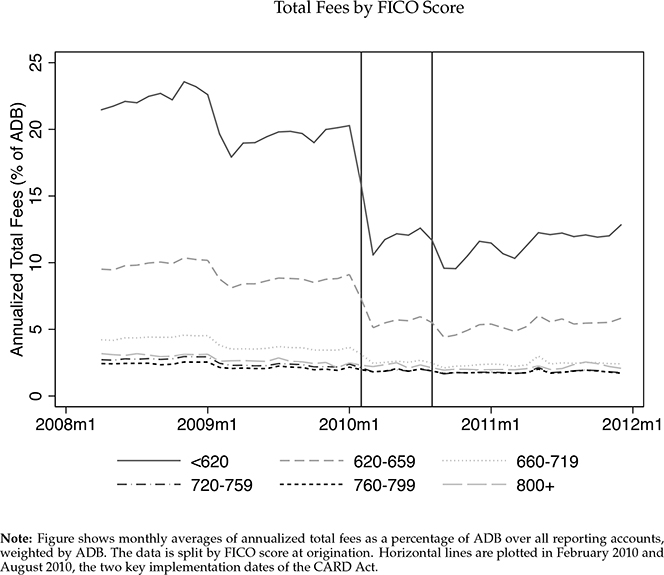

And here is the chart showing the drop in fees, broken down by FICO score:

The authors have calculated that overall annual cost savings for U.S. cardholders amounted to $20.8 billion. And the reduction in fees was the largest for consumers with low FICO scores. Card issuers’ overall fee revenue from borrowers with FICO scores below 620 dropped by more than half, from 23 percent to about 9 percent of the borrowers’ average daily balances. Moreover, these low-FICO-score borrowers did not experience any resulting increase in their interest rates relative to their high-FICO-score counterparts who saw virtually no decline in fee revenue. In fact, no uptick in interest charges was observed either during the CARD Act implementation period or over a longer time horizon.

Finally, the paper finds no reduction in the overall availability of credit — the number of newly-opened accounts and the credit limits on new and existing card accounts have been unaffected or may have even been increasing during the CARD Act’s implementation period.

The Takeaway

The paper’s conclusion is quite unambiguous:

We find that the CARD Act was successful at reducing borrowing costs, in particular for borrowers with the lowest FICO scores. We find no evidence for offsetting increases in other costs or a decline in access to credit. In addition, we find that the disclosure requirements of the CARD Act had a small by significant impact on borrower’s repayment behavior.

So the CARD Act has been an across-the-board success.

Image credit: Flickr / SimonQ.