Are Facebook and Twitter Enablers for the Credit Card Companies?

Dow Jones Newswires’ Andrew R. Johnson is giving as a detailed overview of what U.S. credit card companies have been up to on Facebook, Twitter and other social networks in an excellent piece for the WSJ. There is a lot to be learned there, not least the fact that Capital One has made it possible for FarmVille players to interact with a goat. But Johnson’s reporting is actually focused on a rather less glamorous issue: the issuers’ use of social media as a way to circumvent regulatory restrictions on the marketing of credit cards to consumers under the age of 21. I can’t help but get away with the feeling that Facebook and Twitter have become enablers in a fiendishly clever plot to arm our young with credit cards.

Johnson doesn’t offer any suggestion on how to deal with the issue, nor is he citing anyone who does, so I thought I’d throw my two cents in. The CARD Act is doing a good job of ensuring that no credit card is issued to anyone under the age of 21 who can’t afford it. Making it even more difficult for youngsters to get a credit card would only serve to penalize those among them who are responsible with credit. Moreover, in our society at some point everyone needs to start learning how to manage debt. It is the parents’ responsibility to get that process started, but if they fail to do so or if such an option is unavailable, the learning curve will still need to start somewhere. So I don’t see how placing even more regulatory hurdles will do any good.

What Are the Issuers up To?

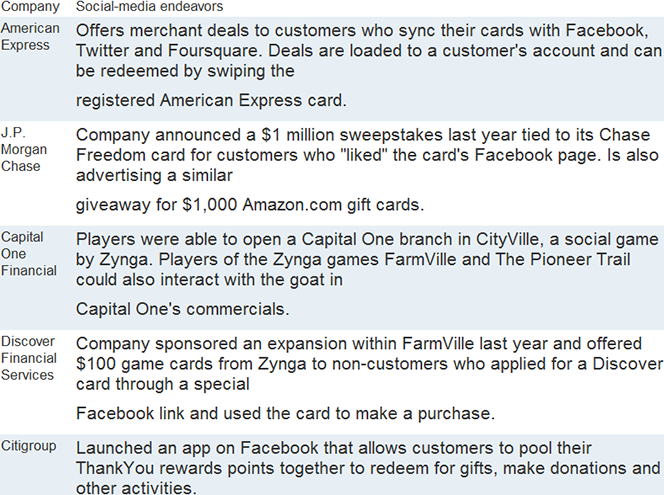

Johnson is giving us the following examples of how the issuers are testing the social waters:

Actually, there is a lot more, so go read the article. I have to say that I do like many of these campaigns. We’ve reviewed both Citi’s socialized rewards project and American Express’ sync program on this blog and have only had positive things to say about them. If you had a Citi or AmEx credit card, you could only gain from participating in these programs; there is absolutely no downside associated with either of them. So what’s the issue?

How Much Protection Is too Much?

As Johnson says, what gets some people concerned is precisely the fact that some of these social initiatives are incredibly attractive and “may give lenders another door around rules that took effect two years ago aimed at protecting young consumers.”

The rules in question are the restrictions the CARD Act of 2009 imposed on the issuers’ ability to market credit cards to people under the age of 21 and the requirement that lenders prove that the youngsters have the means to repay the debt or otherwise get a cosigner, before they can get approved for a credit card. I think that’s a great piece of legislation. It bars the issuers from setting shop on college campuses and prevents them from giving cards to those who can’t afford them. Isn’t that enough of a protection?

Short of banning credit card companies from promoting their products on Facebook and Twitter altogether, I just don’t see what we can do to prevent youngsters from getting exposed to them. But if we did that, we would also have to ban them from airing TV and radio ads. Where would we stop? More importantly, would that help?

Whether or not college kids were exposed to credit card marketing of one kind or another, they would have to eventually start dealing with them in real life. And they’d better be prepared to do so, because any misuse may haunt them for years to come. And it seems to me that that’s what we should be focusing on, not on how to make it more difficult for issuers to interact with us.

The Takeaway

As anyone who pays his outstanding balance on time and in full each month will tell you, credit cards can actually do great things for you. The social media initiatives mentioned above offer some examples, but there are better ones. As we wrote just yesterday, credit card rewards are now better than ever and issuers are falling over one another to attract new customers, offering sign-up bonuses that in some cases are worth more than $1,000. Of course, such bonuses, as well as the best rewards programs are reserved for the most creditworthy consumers, but that’s precisely the point. Rather than trying to push issuers out of our sight, which is in any case a losing proposition, our goal should be to take advantage of what they have to offer and that can only be done through education. Of course common sense always helps too.

Image credit: American Express.

I like what American Express is doing with its Twitter Sync thing and have already used it. Whatever reasons Twitter may have for doing it, as long as its users are benefiting from it, I see no issue at all.

Jenna,

That’s exactly the way I see it.

College kids should at some point start learning how to use credit cards. I got my first card when I was 19 and I didn’t do anything stupid. I know that many others spent way more than they could pay back but for them that would’ve been the case if they got the cards at 21.

Anakha,

I agree, there comes a time when you need to take responsibility and you can only delay the moment for so long.