Apple’s iPad and iPhone Dominate Mobile Payments

That is what yet another report, this one just released by Adyen, a European payment processor, confirms. For the period from September to December of last year, Adyen tells us, close to three-quarters of all global mobile payments transactions were made on an Apple mobile device. Google’s Android-powered devices, much more numerous than Apple’s, accounted for just over a quarter of all mobile payments transactions, although they seem to be quickly catching up with the leader.

Adyen’s report tallies with the findings of IBM’s Holiday Benchmark Reports, which covered only U.S. sales and showed Apple soundly defeating Google in every single holiday mobile shopping category on Thanksgiving / Black Friday, as well as on Cyber Monday.

Adyen’s report shows that, globally, consumers increasingly prefer using tablets to make large-ticket transactions. Surprisingly, to me at least, the researchers find that transactions completed on tablets have had comparatively far higher average value not only than smartphones, but even than PCs in four out of the five examined industry verticals. Let’s take a closer look at Adyen’s findings.

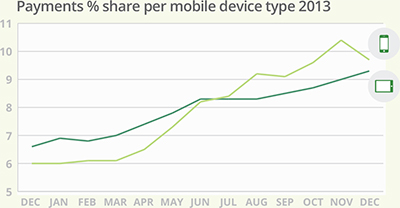

M-Payments Make up 19.5% of December E-Commerce Transactions

Adyen tells us that mobile payments accounted for 19.5 percent of all transactions worldwide in December, a 55-percent increase from the 12.6-percent share measured in December 2012. As seen in the chart below, tablets and smart phones have ended the year having almost equal shares of the global transaction volume.

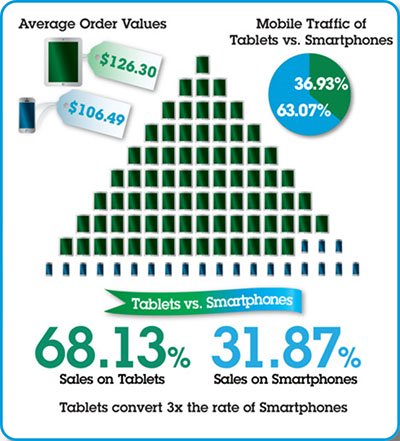

In comparison, in the U.S., tablets held a huge advantage over smartphones on both Thanksgiving / Black Friday and Cyber Monday. On Cyber Monday, for example, tablets made up 11.7 percent of all online sales, more than twice the share of smartphones — 5.5 percent.

Tablets Rule the M-Payments Roost

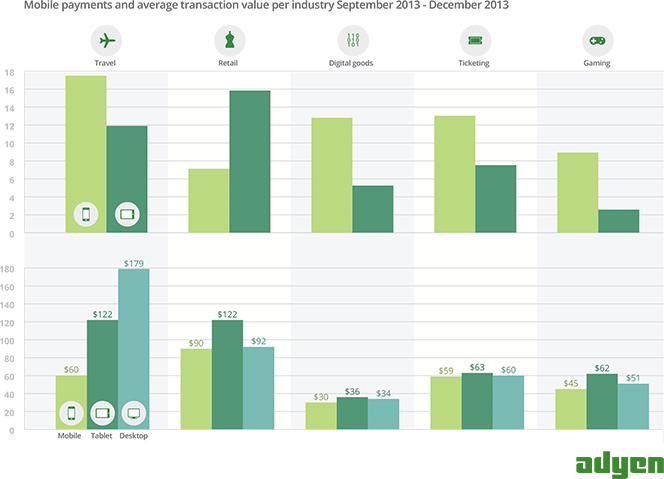

Adyen has looked into both the volume and value of mobile payments in five industry verticals: travel, digital goods, gaming, retail and ticketing. The researchers have found that, for all verticals except retail, smartphone payments have outweighed tablet payments in volume. However, tablets have had a far higher average transaction value than smartphones and even PCs in the majority of cases. Of the five verticals, we learn, travel is the only one where PCs have had a higher transaction value than tablets, despite having the highest share of mobile payments in volume. The researchers conclude that users are more comfortable making more expensive airfare purchases on larger-screen devices.

Adoption of mobile devices for payments has been rapidly increasing across all sectors. Travel has seen an annual increase of 22 percent in mobile payments, we learn, and the share of nearly 30 percent of all transactions made over smartphone or tablet in that vertical is higher than it is in any other’s. Gaming has had the biggest increase in mobile payments — up by 35 percent to 12 percent. In retail, mobile transaction volume has also increased by a third — to 23 percent. In ticketing, 20 percent of all transactions take place on mobile devices — up by 12 percent — and digital goods payments are now 18-percent mobile — up by 9 percent.

As you see, the retail industry has had the highest share of tablet transaction volume among the five verticals and it stands out in having a higher transaction volume for tablets than for smartphones. Furthermore, retail recorded the largest average transaction amount for tablets comparative to smartphones and PCs in its vertical. The researchers take this as an indication that the retail industry as a whole is doing better than the others in improving the tablet user experience for e-commerce, and particularly in “streamlining the payment process to encourage more conversions”. Here is what Roelant Prins, Adyen’s Chief Commerce Officer has to say about his findings:

Ease of payment is vital for merchants to keep up with the evolution of mobile devices and consumer behavior. Businesses are focusing on enhancing their payment interface over mobile channels to make it responsive, simple and clear for users. That’s why having access to data on transaction volume and value is highly useful for merchants looking to optimise the user experience across mobile channels. It’s fascinating to look at a trend like tablets emerging as the leading device for more expensive purchases, and using this knowledge strategically to increase conversion rates.

Apple Dominates, but Google Is Catching Up

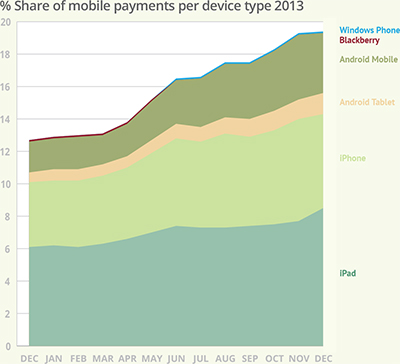

Apple continues to be the most popular mobile payments platform, Adyen finds. The iPad had the highest share of holiday shopping transactions in 2013, making up 41 percent of all mobile transactions from September to December. ?áThe second place, at 31.6 percent, belonged to the iPhone.

Android-powered smartphones, with a 20-percent share of the mobile transaction total, were more popular than Android tablets, whose share was 6.6 percent. Windows Mobile devices had a minuscule share of 0.6 percent and BlackBerry phones — an even lower one of 0.2 percent.

The good news for Google, despite Apple’s continuing dominance, is that Android seems to be steadily closing the gap with the leader. In April 2013, we are told, Apple’s iOS had a 68.5-percent share of mobile transactions, compared to Android’s 30.7 percent. By August, the respective shares had changed to 62.5 percent and 35.9 percent and in December 2013, iOS’s share was down to 60 percent, compared to Android’s 38.6 percent. The researchers put this ongoing shift down to the quickly increasing share of Android devices in the smartphone market. In particular, the report singles out the growing popularity of Samsung, who sold a third of all smartphones in 2013.

The Takeaway

So Adyen’s report clearly shows that, globally, mobile payments are taking off, and their findings, as already noted, are but the latest confirmation of the trend. And as the mobile payments industry is still in its infancy, it is reasonable to expect its fast growth to continue for years to come.

Apple and Google are by far the dominant platforms on which mobile transactions take place. However, there is a huge number of service providers, which have successfully built on these two platforms and are doing the actual processing of mobile transactions. Just as importantly, these service providers are collecting the associated payment processing fees. Of course, Apple and Google are still collecting the reams of data generated by all these transactions and these data are arguably worth much more to them than any processing fees they could be collecting.

Image credit: Visa.