Americans Whip out Their Credit Cards in May

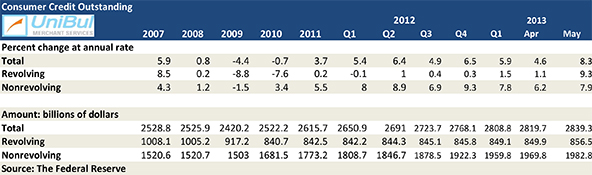

Total outstanding consumer debt in the U.S. rose again in May — the 21st consecutive monthly increase — we learn from the latest Federal Reserve consumer credit data release. Unlike in previous months, however, the increase in the Fed’s credit total in May was the result of robust growth in both its non-revolving and revolving components. Up until now, auto loans and student debt were the primary drivers of the growth in consumer debt, whereas the credit card total had been practically flat since the end of 2010.

The increase of the debt total is widely seen as a welcome sign of an improving economy and rising consumer confidence, as it is the direct result of rising consumer spending, which, as economists keep reminding us, accounts for 70 percent of U.S. economic activity. Yet, not all consumer spending is created equal. Whereas credit card charge-off and delinquency rates are at historic lows, indicating that Americans are using plastic well within their means, the growth of the student debt total is alarming — delinquencies are up in record-high territory and half of all student loans are now in deferment. But let’s take a look at the latest Fed data.

Credit Card Debt up 9.3% in May

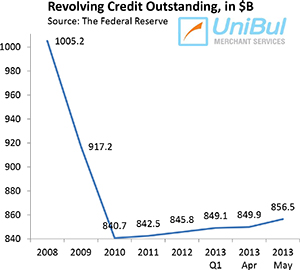

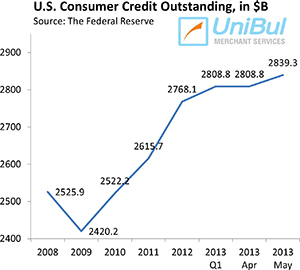

The total consumer revolving credit in the U.S., which is made up almost exclusively of unpaid credit card balances, rose in May at a seasonally adjusted annual rate of 9.3 percent, or $6.6 billion, from the previous month’s level, after a 1.1 percent increase in April. Following the collapse of Lehman Brothers in September 2008, the Fed’s revolving credit total began a free fall, which ended sometime in 2010, as you can see in the chart to the right.

The total consumer revolving credit in the U.S., which is made up almost exclusively of unpaid credit card balances, rose in May at a seasonally adjusted annual rate of 9.3 percent, or $6.6 billion, from the previous month’s level, after a 1.1 percent increase in April. Following the collapse of Lehman Brothers in September 2008, the Fed’s revolving credit total began a free fall, which ended sometime in 2010, as you can see in the chart to the right.

The total for May — $856.5 billion — is still just 1.9 percent, or $15.8 billion, above the total recorded at the end of 2010 ($840.7 billion) — at the height of the credit card debt deleveraging process. Moreover, the new total is still lower by 15.2 percent, or $153.8 billion, than the peak of $1,010.3 billion recorded at the end of 2008.

Overall Consumer Credit up 8.3%

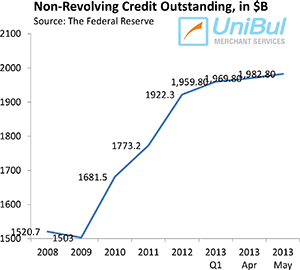

The non-revolving portion of the U.S. consumer debt total, comprised of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, continued its long-standing upward trend. The Federal Reserve reported a $13 billion — or 7.9 percent — increase in May from April’s level, lifting the total up to $1,982.8 billion. That followed an upwardly revised $10 billion increase in April.

The non-revolving portion of the U.S. consumer debt total, comprised of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, continued its long-standing upward trend. The Federal Reserve reported a $13 billion — or 7.9 percent — increase in May from April’s level, lifting the total up to $1,982.8 billion. That followed an upwardly revised $10 billion increase in April.

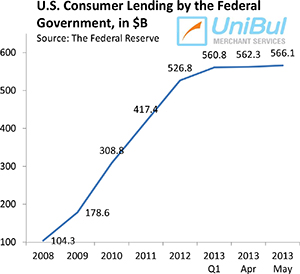

Demand for federal student loans remained strong in May. The Fed’s report shows that lending to consumers by the federal government — primarily educational loans — rose by $3.8 billion for the month to $566.1, following a $1.5 billion increase in April. However, growth in recent months has been markedly slower than it had been until January of this year when we saw the last really big increase — $25.9 billion. Overall, since the end of 2008, the total of outstanding federal government loans to consumers has risen by an astonishing 442.8 percent, or $461.8 billion.

following a $1.5 billion increase in April. However, growth in recent months has been markedly slower than it had been until January of this year when we saw the last really big increase — $25.9 billion. Overall, since the end of 2008, the total of outstanding federal government loans to consumers has risen by an astonishing 442.8 percent, or $461.8 billion.

Helped by low interest rates, cars and trucks continued to sell well in June, at a 15.9 million annualized rate, according to the Ward’s Automotive Group. That is up from 15.26 million in May.

In all, with the exception of August 2011 when it fell by 5.2 percent, we have now seen an increase in the non-revolving debt total in every month since July 2010. The figure for May was higher by 24 percent, or $384.1 billion, than the total of $1,598.7 billion, recorded at the end of 2008.

In all, with the exception of August 2011 when it fell by 5.2 percent, we have now seen an increase in the non-revolving debt total in every month since July 2010. The figure for May was higher by 24 percent, or $384.1 billion, than the total of $1,598.7 billion, recorded at the end of 2008.

The total amount of outstanding U.S. consumer credit — the sum of its revolving and non-revolving parts — rose by 8.3 percent, or $19.6 billion, to $2,839.3 billion in May. The new total is larger by $251.9 billion, or 9.7 percent, than the pre-Lehman record-high of $2,587.4 billion, measured in July 2008.

The Takeaway

The Fed’s latest monthly consumer credit data may be indicating a shift in consumer attitude toward taking on more credit card debt and that is certainly how many commentators are interpreting it. Then again, this might just be an aberration, of which we have seen a few in the post-Lehman period, and which could be fully reversed in the coming months. I think it is too early to tell. What we do know is that Americans are still quite averse to taking on credit card debt, unless they can repay it quickly, as evidenced by record-low delinquency rate — 1.4 percent — and charge-off rate — 3.71 percent — and especially by a record-high monthly payment rate of 25.3 percent in June. For as long as these metrics remain at such levels, or close, credit card debt will not be an issue. What has become a huge issue is the unsustainably high level of student debt and I’m afraid that this one will not be resolved quietly.