Americans Pay down Credit Card Debt, Student Debt Keeps Rising

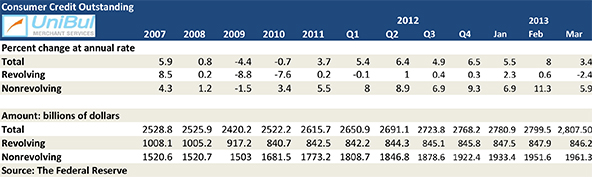

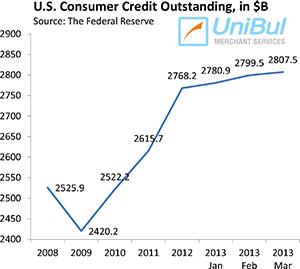

Consumer debt in the U.S. rose for yet another month in March — the eight consecutive increase — we learn from the latest Federal Reserve consumer credit data release, though the increase wasn’t as big as anticipated. In fact, Americans managed to pay down some of their outstanding credit card balances, reversing the gains made in the first two months of the year and maintaining the trend that began in the immediate aftermath of the financial crisis of 2008. The ongoing credit card debt deleveraging process has become one of the most enduring features of the post-Lehman adjustment period.

The increase in the Fed’s credit total is once again entirely due to the growth of its non-revolving components and especially of its student loan and auto loan constituents. The ironic thing about the growth of these two totals is that it happens for diametrically opposed reasons: whereas the strong demand for auto loans is seen as a sign of improving economy and rising consumer confidence, the alarming growth of the student loan total is interpreted as reflecting the reality of still-limited job opportunities. Let’s take a look at the latest Fed data.

Credit Card Debt Down in March

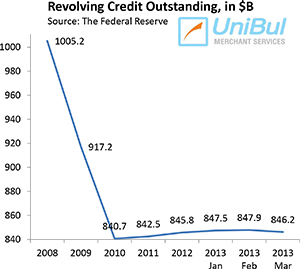

The total amount of outstanding consumer revolving credit in the U.S., which is made up almost exclusively of unpaid credit card balances, fell in March at a seasonally adjusted annual rate of 2.4 percent, or $1.71 billion, from the previous month’s level, after an downwardly revised $452.7 million decrease in February, bringing the total down to $846.2 billion — just 0.7 percent, or $5.5 billion, above the total measured at the end of 2010 ($840.7 billion) — at the height of the credit card debt deleveraging process.

The total amount of outstanding consumer revolving credit in the U.S., which is made up almost exclusively of unpaid credit card balances, fell in March at a seasonally adjusted annual rate of 2.4 percent, or $1.71 billion, from the previous month’s level, after an downwardly revised $452.7 million decrease in February, bringing the total down to $846.2 billion — just 0.7 percent, or $5.5 billion, above the total measured at the end of 2010 ($840.7 billion) — at the height of the credit card debt deleveraging process.

The Fed’s revolving credit total had been falling continually since the onset of the financial crisis in September 2008 until the end of 2010. The sharp fall ended sometime in 2011, for which year half of the Federal Reserve’s monthly credit releases, including each of the last four monthly reports, revealed slight increases in the revolving debt total. However, as the chart to the right clearly shows, as of the end of March, that total has barely changed since reaching its lowest point at the end of 2010 — revolving credit is lower by 16.2 percent, or $164.1 billion, than the $1,010.3 total measured at the end of 2008.

Overall Consumer Credit up 3.4%

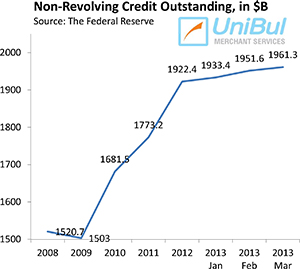

The non-revolving component of the U.S. consumer debt total, comprised of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, continued its long-standing upward trend. The Federal Reserve reported a $9.7 billion — or 5.9 percent — increase in March from February’s level, lifting the total up to $1,961.3 billion. This February increase — already the biggest one since at least 2006 — was revised upwards to $18.2 billion.

The non-revolving component of the U.S. consumer debt total, comprised of student loans, auto loans and loans for mobile homes, boats and trailers, but excluding home mortgages and loans for other real estate-backed assets, continued its long-standing upward trend. The Federal Reserve reported a $9.7 billion — or 5.9 percent — increase in March from February’s level, lifting the total up to $1,961.3 billion. This February increase — already the biggest one since at least 2006 — was revised upwards to $18.2 billion.

March’s rise of non-credit-card consumer debt was once again driven almost exclusively by increases in the auto and federal educational loan totals. The report showed that lending to consumers by the federal government — mainly educational loans — rose by $3.9 billion, following a $4.2 billion increase in February and a whopping $25.9 billion growth in January, before seasonal adjustments. Over the past year alone, the total of outstanding federal government loans to consumers rose by $108 billion, most of which is student debt.

Record-low interest rates continue to prop up demand for cars and trucks, which sold at an average annual rate of 15.3 million in the first quarter of the year, according to the Ward’s Automotive Group. In April, the figure was slightly lower, but still respectable — 14.9 million.

The Fed has now reported an increase in the non-revolving debt total in every month since July 2010, with the lonely exception of August 2011 when it fell by 5.2 percent. The figure for March is higher by 22.7 percent, or $362.6 billion, than the total of $1,598.7 billion, measured at the end of 2008.

The Fed has now reported an increase in the non-revolving debt total in every month since July 2010, with the lonely exception of August 2011 when it fell by 5.2 percent. The figure for March is higher by 22.7 percent, or $362.6 billion, than the total of $1,598.7 billion, measured at the end of 2008.

The total amount of outstanding U.S. consumer credit — the sum of its revolving and non-revolving components — rose by 0.7 percent, or $18.1 billion, to $2,807.5 billion in March. The new total is larger by $220.1 billion, or 8.5 percent, than the pre-Lehman record-high of $2,587.4 billion, recorded in July 2008.

The Takeaway

The Fed’s latest monthly credit report reveals nothing new about the attitudes of U.S. borrowers toward non-home-mortgage types of consumer debt. Americans keep assiduously paying down their credit card balances just as quickly as they can, which is once again confirmed not only by the static level of the Fed’s revolving debt total, but also by the historically low, and still falling, delinquency rates. According to the latest data released by Fitch Ratings, the average credit card delinquency rate during the first quarter of this year was 1.63 percent, down from 1.71 percent in the previous quarter and lower by 28 percent than the rate measured at the end of the first quarter of last year.

However, at this stage, credit card debt is no longer an issue. What is rapidly becoming a much greater concern is the skyrocketing student debt total. The lack of job opportunities has convinced many working-age Americans that now is a good time to head back to school, improve their skills and reap the benefits once the labor picture finally gets back to normal. For the same reason, a larger-than-usual number of younger Americans choose to stay in school and rack up student loans in the process. Let’s hope their strategy pans out.