Americans Keep Slashing Credit Card Debt, Racking up Student Loans

The consumer debt deleveraging trend in the U.S. continued in the second quarter of this year, led once again by a decline in real estate-related debt, we learn from the latest Household Debt and Credit quarterly report, issued by the Federal Reserve Bank of New York (FRBNY). It was the thirteenth such decrease in the past fourteen quarters.

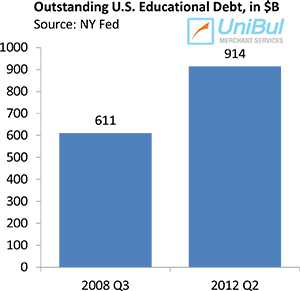

Credit card debt also fell, to a level not seen in ten years, and so did the credit card delinquency rate. However, the student debt total continued its upward trend, as did the delinquency rate. Strikingly, since the peak in household debt in 2008 Q3, the student debt total has risen by a half, even as the overall total has fallen by about 13 percent. Let’s take a closer look at the numbers.

U.S. Consumer Debt Down by $53B

The headline news to come out of the FRBNY report is that the aggregate indebtedness of U.S. households at the end of June 2012 was $11.38 trillion. That is $53 billion (0.5 percent) lower than the corresponding total at the end of the previous quarter. The new total is lower by 12.9 percent, or $1.3 trillion, than the peak of $12.68 trillion recorded in the third quarter of 2008, at the end of which the collapse of Lehman Brothers ushered in the financial crisis.

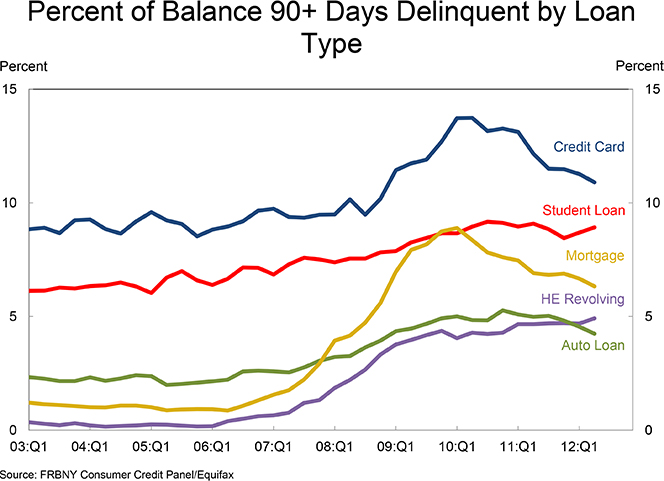

The overall delinquency rate also improved in 2012 Q2, we learn. As of the end of June, 9.0 percent of all outstanding debt — 1.02 trillion — was delinquent, down from 9.3 percent at the end of the previous quarter. About three-quarters — $765 billion — of that total was “seriously delinquent” — at least 90 days late, the NY Fed tells us. As you can see in the chart below, whereas the delinquency rates of credit cards and mortgages have been steadily declining since reaching a peak in early 2010, that hasn’t been the case for student loans and home equity lines of credit.

Credit Card Debt Down, Student Loans Up

And now here are the credit card and student loan numbers.

Credit Cards

- Aggregate credit card limits were down by $19 billion — 0.7 percent — from the previous quarter.

- The number of open credit card accounts fell to 383 million, 23 percent below the 2008 Q2 peak of 496 million.

- Outstanding credit card balances fell to $672 billion, 22.4 percent below the 2008 Q4 peak of $866 billion.

- Credit card delinquencies — 10.9 percent — were at the lowest level since Q4 2008.

Student Loans

Student Loans

- Student loan debt rose by $10 billion to $914 billion.

- Since the peak in household debt in 2008 Q3, student loan debt has increased by $303 billion, while the other forms of debt have fallen by a combined $1.6 trillion.

- The student loan delinquency rates increased for the second consecutive quarter. The share of student loan balances delinquent by 90 or more days rose to 8.9 percent from 8.7 percent in 2012 Q1.

It’s been an amazing turnaround.?á Only four years ago, the student debt total was lower by about a quarter than the credit card total. By 2012 Q2, the roles have been completely reversed and the student loans were bigger by a quarter.

The Takeaway

So the latest NY Fed data confirm that the post-Lehman trends are still ongoing. What we are seeing is a continuation of the aggregate debt deleveraging trend, with the twist of a sharp increase in the student debt total. Here is how Wilbert van Der Klaauw, vice president and economist at the New York Fed, reads the data:

The continuing decrease in delinquency rates suggests that consumers are managing their debts better. As they continue to pay down debt and take advantage of low interest rates, Americans are moving forward with rebalancing their household finances.

That sums it up pretty well. However, it should be noted that the student debt growth is unsustainable at its present rate and the quickly inflating bubble will inevitably pop. Let’s hope that it won’t do too much damage when it does.

Image credit: Investorplace.com.