Americans Cutting Back on Credit Card Debt Again

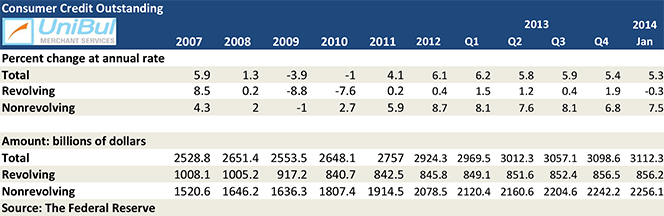

The U.S. consumer debt total rose for yet another month in January of this year, the Federal Reserve told us in its latest consumer credit data release on Friday. This was also the 29th consecutive monthly increase. Following a downwardly revised $15.9 billion increase in December, the January total rose by $13.7 billion — less than expected.

As has become the norm in the post-Lehman years, January’s aggregate consumer debt growth was exclusively the result of yet another big rise of its non-revolving component and, especially, of the auto and student loan totals. The growth of the former total has been fueled by the ongoing economic recovery. The latter, however, has relentlessly kept increasing through crisis, recession and recovery alike.

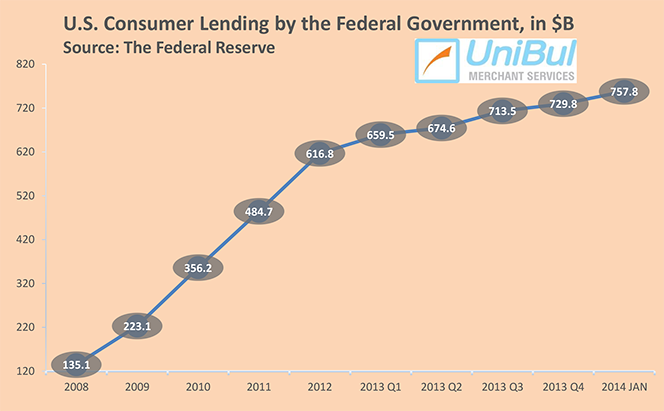

The unrelenting rise of the federal student loan total had slowed down substantially at the beginning of 2013, which was welcome news, considering the huge expansion it had undergone over the past decade, and especially in the past five years, as you can see in the relevant chart further down. In turn, that growth, paired with a stubbornly high unemployment rate, has caused the student loan charge-off and delinquency rates to spike, a process which is not only ongoing, but is likely to intensify as the year progresses, even as the economy continues to recover.

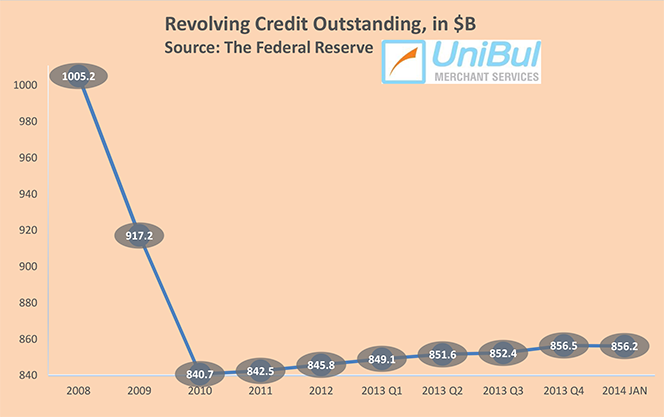

In a reversal of December’s developments, when the credit card debt total spiked by the largest amount in seven months, January total fell, albeit modestly. Furthermore, December’s spike was downwardly revised by a substantial amount. By the way, that has been one of the most characteristic stories of the post-Lehman period: every single time we’ve had an unusually large monthly increase in the revolving total, it has been immediately reversed in the following month or two. And this is why, even with the only partially reversed December spike, that total is negligibly higher than the peak reached at the end of 2008.

Last month I wondered whether it was possible that the post-crisis era of subdued credit card debt accumulation was finally over and that the December increase in revolving credit indicated that Americans had rediscovered their penchant for a more liberal credit card use. After all, I noted, the economic recovery had been gaining ground and the unemployment rate just keeps falling. Not to mention that Americans now have much healthier credit card accounts than they’ve had in decades. And the trend of record-low and falling credit card delinquency and charge-off rates and record-high and rising monthly repayment rate (MPR) has continued in the first two months of this year, rendering the absolute debt level mostly irrelevant.

Well, despite all that, last month I admitted to having no idea whether we had turned a corner on credit card spending and now January’s data indicate that the December splurge may have been just another blip. But let’s take a closer look at the latest Fed data.

Credit Card Debt down by 0.3% in January

The total amount of outstanding consumer revolving credit in the U.S., which is made up almost exclusively of unpaid credit card balances, fell in January at a seasonally adjusted annual rate of 0.3 percent, or $225.6 million, from the previous month’s level, after a downwardly revised 4.3-percent increase in December. As you can see in the chart below, that total went into a free fall in the immediate aftermath of the financial crisis in September 2008 and then just kept falling until about the end of 2010. Since then, however, it has vacillated up and down, but has remained virtually unchanged.

The total for January — $856.2 billion — is only 1.8 percent, or $15.5 billion, above the total measured at the end of 2010 ($840.7 billion) — at the height of the credit card debt deleveraging process. Moreover, the current total is lower by 14.8 percent, or $149.0 billion, than the all-time record-high of $1,005.2 billion, recorded at the end of 2008.

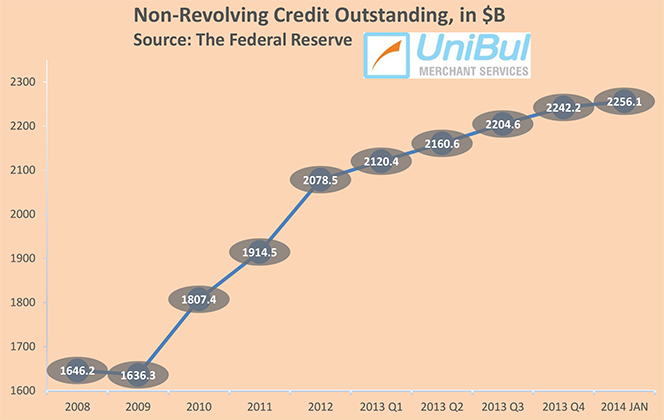

Non-Revolving Consumer Credit up by 7.5%

The non-revolving component of the U.S. consumer debt total, a mixture of student loans, auto loans and loans for mobile homes, boats and trailers, but not including home mortgages and loans for other real estate-backed assets, continued to grow, in keeping with its long-standing trend. The Federal Reserve reported a $13.9 billion — or 7.5 percent — uptick for January, bringing the total up to $2,256.1 billion. That followed a downwardly revised 6.9 percent ($12.8 billion) increase in December.

As you can see in the chart below, the non-revolving portion of the consumer debt total didn’t fall nearly as steeply as the revolving one in the immediate aftermath of the financial meltdown and then it was much quicker to rebound.

In all, with the lone exception of August 2011 when it fell by 5.2 percent, the non-revolving debt total has risen in every month since July 2010. The figure for January was higher by 39.5 percent, or $638.7 billion, than the pre-crisis peak of $1,617.4 billion, reported in July of 2008.

Student, Auto Loans Up

As already noted, the federal student loan total’s growth had slowed down significantly at the beginning of 2013, but then it picked up again in August. The latest Fed data show that lending to American consumers by the federal government — which is mostly comprised of educational loans — shot up by $28 billion, or 3.8 percent, to $757.8 billion in January, following a $5.6 billion increase in December. The biggest increase last year was reported also in January when the total rose by $25.9 billion. Overall, since the end of 2008, when it stood at only $135.1 billion, the total of outstanding federal government loans to American consumers has skyrocketed by an astounding 460.9 percent, or $622.7 billion.

Low interest rates kept auto sales in the U.S. strong, even as exceptionally cold winter in many regions of the country kept people out of showrooms. In January, cars and trucks sold at a 15.2 million annualized rate, slightly down from the 15.3 million pace of December, which had capped the best year for the industry since 2007, according to Bloomberg, citing data from the Ward’s Automotive Group. There is every reason to expect the pace to quicken as the weather warms up and the economic environment continues to improve.

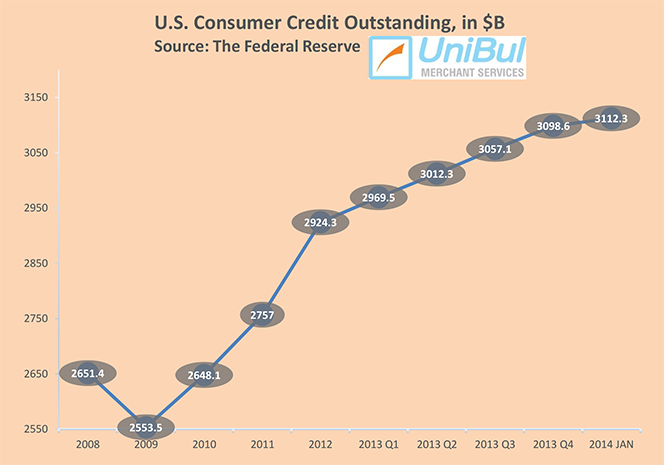

Overall Consumer Credit up by 5.3%

The aggregate amount of outstanding U.S. consumer credit — the sum of its revolving and non-revolving portions — rose by 5.3 percent, or $13.7 billion, to $3,112.3 billion in January, following a downwardly revised $15.9 billion (6.2 percent) increase in December.

The new total is larger by $524.8 billion, or 20.3 percent, than the pre-Lehman record-high of $2,587.5 billion, recorded in July 2008. The entire increase during the post-crisis period is due to the growth of the non-revolving credit segment, as the revolving one has actually fallen quite significantly, as we saw above, and is yet to start recovering in any meaningful way.

The Takeaway

So the non-housing-related consumer debt total, having picked up quite substantially in 2013, has risen by a healthy amount in the first month of 2014 and there is every reason to expect the trend to hold, and very probably to intensify, in the coming months. The credit card debt total has started the year with a slight decrease and I have absolutely no idea what to expect of it in the months to come. It is very unlikely that it will fall (barring some major economic shakedown), but there is also nothing to lead me to believe that it will increase in any meaningful way. Yet, who knows what’s going to happen once the economy starts roaring again.

What we do know for certain is that Americans remain quite averse to using more of their credit card balances than they can repay in full at the end of the month. Both the credit card charge-off and delinquency rates have ended January in record-low territory, and the MPR has recorded yet another record-high.

The U.S. credit card delinquency rate at the end of January was 1.21 percent — just a single basis point above the all-time record-low reached in the previous month, according to Fitch Ratings, which began tracking the index in 1991. The delinquency rate has declined by 25 percent on an annual basis and is now 73 percent below its highest level reached at the end of 2009 (4.54 percent), we are told. The charge-off rate fell by 19 basis points for the month to its lowest level ever recorded — 2.96 percent. That index has declined by 24 percent on an annual basis and is now 74 percent below the historical high of 11.52 percent, reached in September 2009.

At the same time, Fitch’s monthly payment rate (MPR) — the portion of their total credit card debt Americans pay at the end of each month — has just reached yet another record-high. The MPR rose by 12 basis points from the previous month’s level to 27.25 percent. January’s MPR was up by 10 percent year-over-year and is more than 35 percent above the levels reached before the financial crisis. As I keep saying, as long as these three indices remain remotely close to their current levels, credit card debt will not be an issue in the U.S. Then again, it is student debt that worries me.

Image credit: Flickr / GuySie.