Americans’ Credit Card Payments Timeliest in 17 Years

At the end of the second quarter of this year Americans were repaying their credit card debt on time at a higher rate than at any time since 1994, according to the latest data released on Tuesday by TransUnion, one of the three national credit reporting agencies.

Having fallen to its lowest level in more than a decade in the previous quarter, the average amount of credit card debt owed by American consumers remained virtually unchanged, rising by only 0.43 percent on a quarter-over-quarter basis.

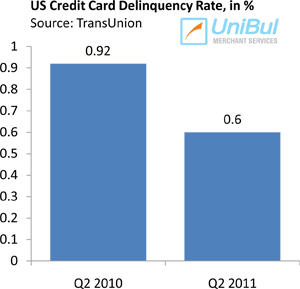

Credit Card Delinquency Rate Lowest in 17 Years

The report’s headline news is that the U.S. credit card delinquency rate declined to 0.60 percent in the second quarter of this year, down 18.9 percent from the previous quarter (0.74 percent) and 34.8 percent on a year-over-year basis. It is the lowest delinquency level in 17 years, TransUnion tells us.

The report’s headline news is that the U.S. credit card delinquency rate declined to 0.60 percent in the second quarter of this year, down 18.9 percent from the previous quarter (0.74 percent) and 34.8 percent on a year-over-year basis. It is the lowest delinquency level in 17 years, TransUnion tells us.

TransUnion’s data are more valuable than the monthly reports we receive from the credit card issuers in their regulatory filings, as we get a more comprehensive picture of consumer debt repayment behavior.

While the issuers measure their late payment ratios on a per-account basis, rather than per account holder, TransUnion calculates its delinquency rate as the proportion of cardholders late on a payment to any one of their credit cards. What’s more, the credit agency defines a payment as delinquent if it is 90 days or more past due, whereas the issuers use two shorter periods: early-stage delinquency rate for payments overdue by 30 – 59 days and late-stage delinquencies for ones late by 60 days or more.

Nevada Has the Highest Delinquency Rate, Alaska — the Lowest

Listed below are the leading states by credit card delinquency rate on both ends of TransUnion’s table:

1. Nevada — 0.93%.

2. Georgia — 0.78%.

3. Florida — 0.77%.

…

48. Iowa — 0.41%.

49. North Dakota — 0.40%.

50. Alaska — 0.39%.

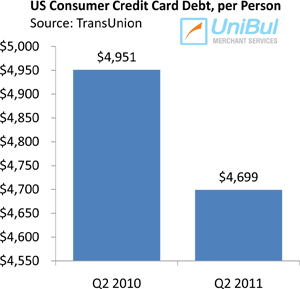

Credit Card Debt at Near-Record Lows

Outstanding credit card balances in the U.S. rose by $20 in Q2 2011, to $4,699, but still remain at near record low levels. The aggregate amount of credit card debt per American cardholder decreased from $5,776 to $5,165 between Q1 2009 and Q1 2010 and then to $4,679 in Q1 2011, which was the lowest level in 10 years.

Outstanding credit card balances in the U.S. rose by $20 in Q2 2011, to $4,699, but still remain at near record low levels. The aggregate amount of credit card debt per American cardholder decreased from $5,776 to $5,165 between Q1 2009 and Q1 2010 and then to $4,679 in Q1 2011, which was the lowest level in 10 years.

Moreover, Americans paid $72 billion more towards reducing their credit card balances than for purchases between Q1 2009 and Q2 2010, according to another TransUnion report. By contrast, in 2004 Americans made $2.1 billion more in purchases than credit card payments. That represents a $75 billion turnaround in payment preferences!

Here are the leading states by average outstanding credit card balance per cardholder on both ends of the table:

1. Alaska — $6,926.

2. North Carolina — $5,433.

3. Colorado — $5,246.

…

48. Wisconsin — $4,021.

49. North Dakota — $3,923.

50. Iowa — $3,731.

The Takeaway

At this point I think it should be clear to anyone who’s paying any attention to the constant stream of statistical data on debt repayment in the U.S. that Americans are now placing a much higher importance on the good standing of their credit card accounts than they have in a very long time.

At this point I think it should be clear to anyone who’s paying any attention to the constant stream of statistical data on debt repayment in the U.S. that Americans are now placing a much higher importance on the good standing of their credit card accounts than they have in a very long time.

Earlier this week, for example, Experian, one of TransUnion’s major rivals, reported that more U.S. consumers are now current on their credit card payments than on their mortgages than at any time in recent memory, something TransUnion was the first to point out to a few months ago.

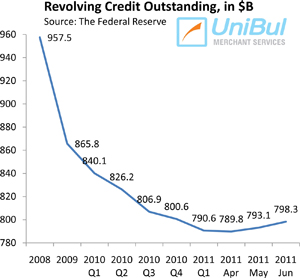

We are about to find out in the coming months just how firm this newly-developed resolve to keep credit card debt under control really is. With credit card offers becoming more numerous and attractive and credit lines expanding, Americans are once again using their credit cards more freely. Outstanding credit card balances spiked by 7.9 percent in June, having reached in April their lowest level in seven years. So far, the debt repayment rate holds up at record high levels, suggesting that consumers are using credit within their means. Can they keep it up?

Image credit: Iid.de.