What APR Means (Annual Percentage Rate)?

Financial institutions and banks make money from the deposit that customers deposit. They profit by charging those who borrow from them a specific proportion of the money they borrow. Borrowing money through an institution or lending funds comes with the cost of borrowing. So, what APR means, and what is its part in all of this?

We will explain the meaning of the annual percentage rate (APR), the different types, and the methods to calculate it.

TABLE OF CONTENTS:

- What APR Means?

- What Does the APR Tell Us?

- How does APR work?

- Different Types of APR

- How to Calculate APR?

- APR vs APY (Annual Percentage Yield)

- APR vs Nominal Interest Rate

- Disadvantages of Annual Percentage Rate (APR)

What APR Means?

According to the Consumer Financial Protection Bureau, APR is (Annual Percentage Rate) a more comprehensive measure of the cost of borrowing money than an interest rate. The APR represents an interest charge, the fees for mortgage brokers, points, and other fees you must pay to obtain the loan. This is why your APR is typically greater than your interest rate.

If you have to go more into details:

APR provides us with a figure closer to the expenses (in cases of loans) as well as the financial product’s actual performance (if it’s an investment).

The APR provides us with a more accurate value than what is revealed by nominal interest rates (TIN) because it incorporates in its calculation not only the nominal interest but bank charges, commissions, and the duration of the transaction.

For instance, the APR for mortgages will always be greater than personal loans with an identical nominal rate (TIN). This is because the mortgages typically carry higher commissions (survey or discovery commissions).

Thus, APR gives us more precise but not exactly accurate data while when it calculates, it has more bases than the nominal rate, but it doesn’t consider the total cost of borrowing.

For instance, it does not consider taxes, notary fees, fees for transfers of funds, insurance or guarantee charges, etc.

What Does the APR Tell Us?

Once the deposit has been negotiated, you will know the amount you’ve put in, the APR, and the expiry date. With the sum of this information, you can calculate a figure that will indicate the efficiency of the process.

You can see that after you pay the interest, it will be lower than the math result you received. Why? This is because there are expenses that APR doesn’t cover. There is no way to be perfect, and it isn’t going to be.

How does APR work?

Once the deposit has been negotiated, you will know the amount you’ve put in, the APR, and the expiry date. With the sum of this information, you can calculate a figure that will indicate the efficiency of the process.

You can see that after you pay the interest, it will be lower than the math result you received. Why? This is because there are expenses that APR doesn’t cover. There is no way to be perfect, and it isn’t going to be.

Different Types of APR

Purchase APR

Like it sounds, it is the rate applied to the purchase made using the card.

Cash Advance APR

APR for cash advances represents the price of borrowing cash from your own credit card. It is usually more than the acquisition APR. Be aware that other activities could be considered as cash advances, even if the actual cash does not touch your fingers. This includes buying casino chips, lottery tickets, or converting dollars into foreign currencies. They also do not have any grace time. This means you’ll probably begin accruing interest right away.

Penalty APR

If you breach the conditions of your card’s contract, for example, making a mistake, such as not paying the payment or becoming late in paying a bill, the APR of your card could increase for a certain amount of time.

Make sure you read your card’s terms and any notification your issuer gives you regarding your account.

APR for Introductory or Promotional

A new credit line could benefit from a lower APR, in a limited time. It may apply to transactions specific to the purchase, such as the transfer of an account transfer.

APR for Bank Loans

The majority of bank loans have Fixed or Variable APRs.

- Fixed: The fixed APR is not subject to change. There will be no change in the rate and the amount you pay per year to borrow the amount remains the same. The APR calculated based on the interest rate is also fixed.

- Variable: A variable APR can fluctuate because the rate of interest applied to the principal is different in time. It’s based on the change in the U.S. prime lending rate. This is because the prime lending rate fluctuates. The lender is charged more when there is an increase in the interest rates.

The APR that borrowers pay is based on their credit score. The rates that are offered to people who have excellent credit scores are considerably less than the rates offered to people with low credit scores.

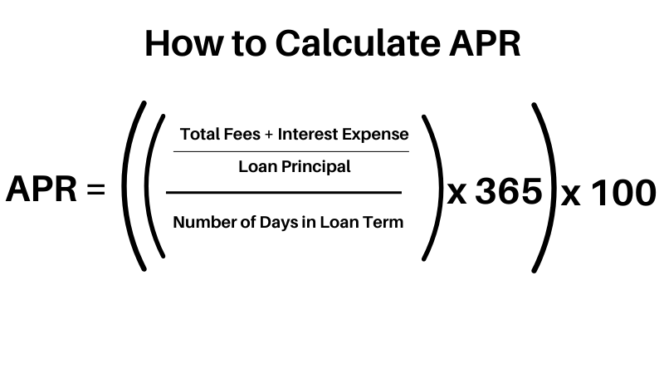

How to Calculate APR?

APR can be calculated as a result of multiplying the monthly percentage of the interest charged by the time during the year it was used. It doesn’t indicate the number of times that rate applies to the amount.

To calculate the APR follow these steps:

- Calculate the Periodic Interest Rate.

Periodic Interest Rate = [(Interest Expense + Total Fees) / Loan Principal] / Number of Days in Loan Term

- Multiply the Periodic Interest Rate by 365.

- Multiply the result from step 2 by 100.

APR vs APY (Annual Percentage Yield)

A common error is misinterpreting the Annual Percentage Rates (APR) in conjunction with Annual Percentage Yield (APY).

To differentiate between the two, APR is the interest you pay on loans, and APY is the rate of interest you’d hope to earn from an investment. It represents the amount that the lender can earn through investing their money, considering the amount of times it was compounded.

- APR Interest Due

APR = [ [ [(Interest Expense + Total Fees) / Loan Principal] / Number of Days in Loan Term] x 365] x 100

- Interest Earned APY

APY = 100[(1+ interest/principal) ^ (365/days in loan term)-1]

APR is a simple annual interest rate, while the APY calculation takes into account the effect that compounding has on compounding.

Generally, the greater the interest rate and the shorter the compounding times, the more significant the differences between APR and APY will be.

APR vs Nominal Interest Rate

A nominal interest rate is the amount of interest without considering inflation. The nominal interest rate isn’t necessarily the true interest rate that banks employ. When adjusted to reflect inflation, the nominal interest rate is the real interest rates, and is generally different from the nominal rate.

When banks announce their rates of interest, it’s typically nominal rates they advertise. Nominal rates are base rates banks employ to make lending.

When depositors deposit or invest, they anticipate earning money from their investment. The amount earned will be determined by the actual interest rates, not just the nominal rate.

The actual interest rate could change or increase. If the rate increases, the depositor will earn more money. If the rates decrease, they earn less.

Disadvantages of Annual Percentage Rate (APR)

The APR may not be an accurate reflection of the overall amount of the loan.

In reality, it might underestimate the true cost of borrowing. The reason is that the calculations are based on the long-term repayment plan.

The fees and costs are not distributed evenly in APR computations for loans that are paid quicker or with shorter repayment terms.

For example, closing costs for mortgages are less when the expenses are believed to be spread out over 30 years rather than 7 to 10 years.

The lenders have a lot of power to decide the best way to determine the APR, which includes or excludes various charges and fees.

APR is also a problem regarding variable-rate mortgages (ARMs). Estimates are always based on a constant interest rate. However, even though APR includes rate caps, the final figure is still dependent on fixed rates. Since the interest rate on an ARM may change after the fixed-rate period has ended, APR estimates can severely understate the actual costs of borrowing when interest rates for mortgages increase shortly.

Mortgage APRs could or might not contain additional costs, including appraisals titles, appraisals, credit reports applications, life insurance attorneys, notaries and appraisals, and even document preparation. Other fees are intentionally excluded, such as late fees and other one-time charges.

This can cause it to be difficult to compare similar products as the charges included and excluded vary from one institution to the next.

A prospective borrower should determine the fees to evaluate different offers accurately. To ensure that they are thorough in their calculations, determine the APR by using the nominal rate of interest and other information about costs.