Visa Purchase Alerts: All You Need to Know

Visa has created a tool to help consumers concerned about potentially fraudulent charges made on their credit and debit cards and it’s called Visa purchase alerts. To the vast majority of cardholders who check their account balances carefully and regularly, the alerts offer a proactive way to make sure that of all the charges made with their payment cards are legitimate.

More than two-thirds of consumers (69 percent, to be precise) do not know or have not signed up for the transaction alert services offered by their banks, even though they offer security, control and the ability to identify fraudulent charges and to track spending.

For U.S. cardholders, Visa transaction alerts can be set for specific transaction amounts, locales or transaction types (e.g. e-commerce, phone and mail orders). Once an alert is triggered, the cardholder gets a notification in near real-time via email, text message or push notification.

For card issuers, the alert service enables their customers to report fraud as soon as possible, which adds an additional layer of fraud protection. Let’s take a look at how Visa purchase alerts work.

Table of Contents

- Setting up Visa Purchase Alerts

- Visa Purchase Alerts Triggers

- Visa Purchase Alerts in a Nutshell

- Visa Purchase Alerts Frequently Asked Questions

Setting up Visa Purchase Alerts

Visa Purchase Alerts allow Visa cardholders to get alert messages via text or email when purchases are made with their Visa credit or debit cards.

To enroll into Visa’s alert service, go to the payment network’s website here. Once there, here is what you need to do.

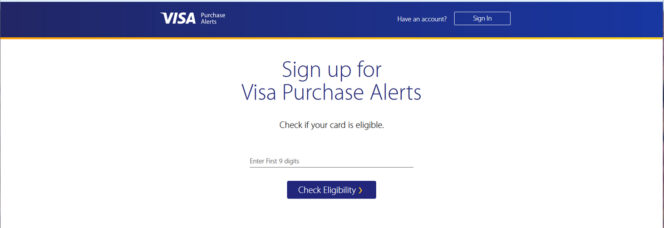

Step 1: Check Eligibility

Click on “Check eligibility”.

Step 2: Enter Your Card’s First 9 Digits

Enter the first 9 digits of your debit or credit card. Then click “Check Eligibility”.

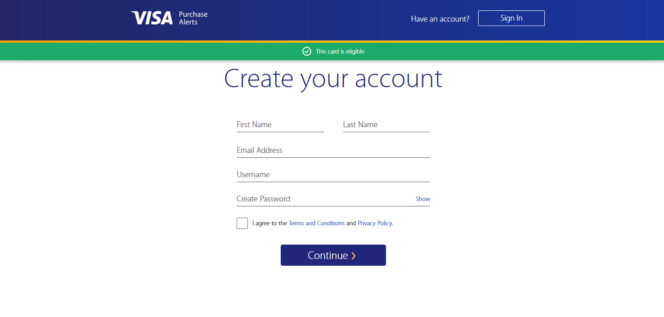

Step 3: Enter Your First and Last Names

Enter your first and last names as they appear on your card, an email address and a username. Make sure your email address is correct as entered, as the verification to activate your alerts will be sent to that address.

Ensure you choose a password that contains letters and numbers. After reviewing the Terms and Conditions and the Privacy Policy, click on the box to agree. Then click “Continue”.

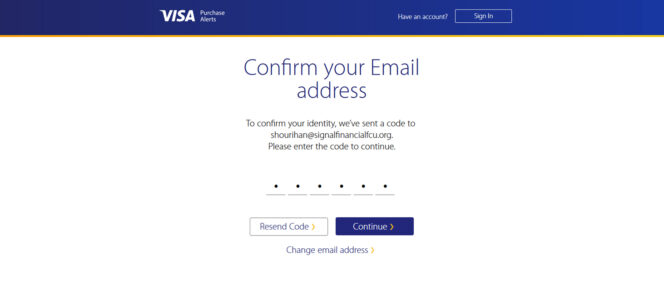

Step 4: Check Your Email Account

Check your email account: a confirmation code will be sent to the email address you provided. Please allow up to 15 minutes to receive the email.

Note that the code expires quickly, so enter it as soon as it is received. If you click the “Resend Code” button, a new code will be generated and sent and the previous one will expire. Then click “Continue”.

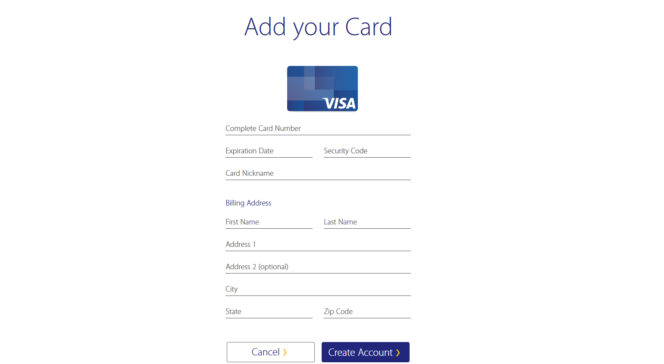

Step 5: Enter Your Card Information

Once you have entered the verification code, you will be prompted to enter your card information. Make sure you double check all of the information you enter for accuracy.

Note that “Card Nickname” is a required field, where you cannot use spaces or symbols, only numbers or letters.

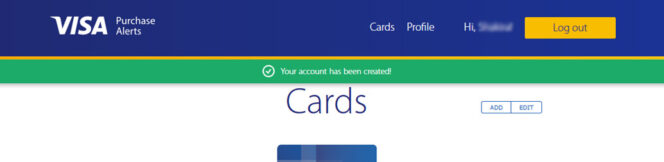

Once you have completed the form, click “Create Account”.

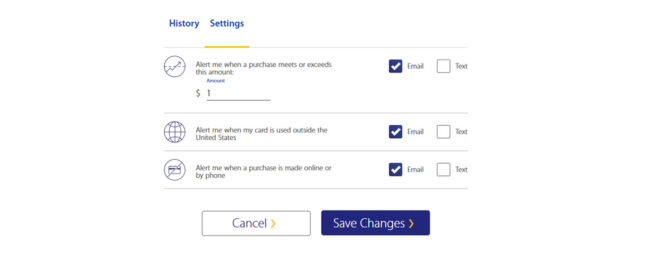

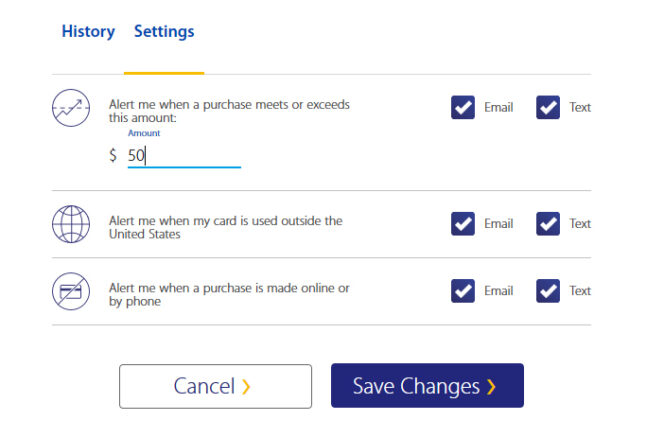

Step 6: Choose Your Alerts Settings

Select your Visa alerts settings. Email alerts are selected by default. If you wish to receive alerts only by email, choose the purchase amount and triggering events for your alerts and then click “Save Changes”.

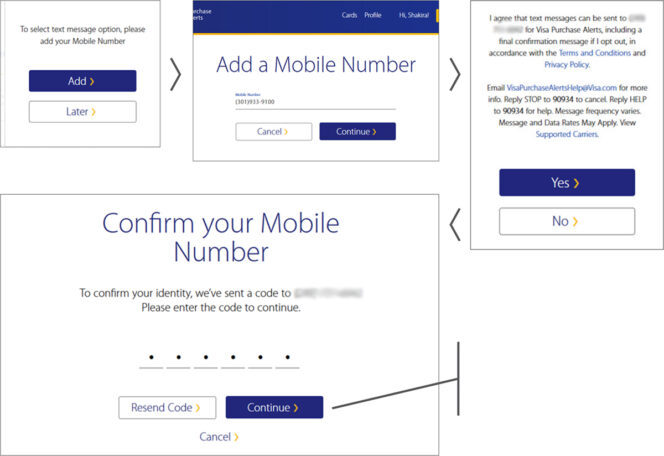

If you select “Text”, you will be prompted to enter and confirm your mobile number. Review the disclosure notification and click “Yes” if you agree to the Terms and Conditions and Privacy Policy for receiving text alerts. Alternatively, click “No” if you choose not to proceed with text alerts.

Check your mobile phone for the confirmation code, then enter it into the next screen. Then click “Continue”.

Once you are done creating or making changes to your alerts, click “Save Changes”.

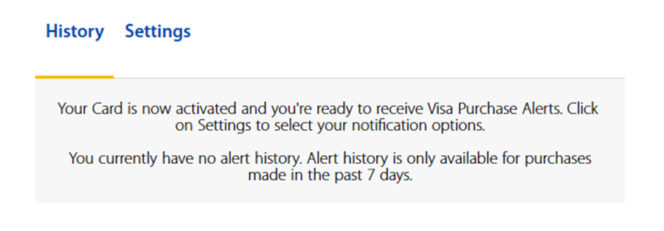

Step 7: Click History

Click “History” to see alerts from the past seven days.

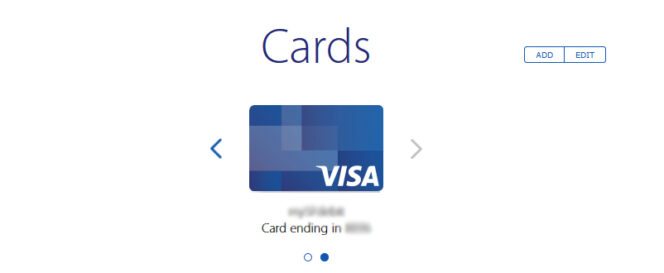

Step 8: Add Another Card

You now have the option to add another card and set up alerts for it in the same way. Use “Edit” to change the saved information for the selected card.

If more than one card is registered for Visa purchase alerts, arrows will appear next to the card icon. The nickname and the last four digits of the selected card will be shown below.

Step 9: Log Out

Log out, once you have finished setting up your Visa purchase alerts.

Step 10: Log Back in to Make Changes

Visit https://purchasealerts.visa.com to log back in and make changes or add other cards in the future.

Visa Purchase Alerts Triggers

You can set notifications for the types of transactions that you think carry the highest risk. Let’s take a look at your options:

- Reaching a purchase amount threshold.

- International transactions.

- Payments made on the internet or over the phone.

- Whenever a credit is being processed on your card.

- When a payment is declined.

Visa Purchase Alerts in a Nutshell

Here is the set-up process, step-by-step:

Source: Visa

Now let’s take a look at the program details people are always asking about.

Visa Purchase Alerts Frequently Asked Questions

What Is a Visa Purchase Alert?

Visa Purchase Alerts are electronic messages, which are sent to you to help manage and track your signature-based Visa card transactions. These alerts provide near real-time notification of your Visa transaction activity based on your pre-selected alert settings.

You can choose specific alerts and specify the settings for those you want to receive (for example, you may choose to be notified when a payment exceeds a certain value).

Information in the alert message contains the amount of the transaction, the merchant name and location (if available) and the last 4 digits of your Visa credit or debit card. Alerts can be sent to your email address or to your mobile phone via an SMS text message.

What Are the Benefits of Purchase Alerts?

The advantages of enrolling in Purchase Alerts are that it:

- Allows cardholders to monitor their card’s signature-based purchase transactions in near-real-time.

- Provides timely information to help monitor Visa card transactions for potential fraud.

- Offers customers a secure tool to help manage their money.

What Types of Cards Can Be Enrolled in Purchase Alerts?

Most Visa credit and debit cards can be enrolled, though Purchase Alerts are not available for debit card purchases made with PIN numbers.

Purchase Alerts are an option for business cards as well, though at this time they are not available for business purchasing cards or commercial cards.

Can Multiple Visa Credit Cards on One Account Get Purchase Alerts?

Yes, Purchase Alerts can be sent to up to two credit cardholders on a shared account. One of the cardholders would receive an SMS message, while the other would receive the email alert message. The primary account holder will set up the Purchase Alert settings and designate a mobile number to receive the SMS Message Alert and an email account to receive the email alert.

Can Multiple Visa Debit Cards on One Account Get Purchase Alerts?

Yes, up to two Visa debit cardholders who share the same account can each receive Purchase Alerts. Each cardholder would log into the banking account linked to the debit card to enroll in Purchase Alerts, customize their Purchase Alert options and designate whether they would like to receive SMS alert messages or email messages.

Can Visa Business Cards Be Set Up to Receive Purchase Alerts?

Yes, Purchase Alerts can be sent to business cardholders (excluding purchase cards and commercial cards). Note that only the CSA (Company System Administrators) can set up or manage Purchase Alerts. The CSA can set up and manage Purchase Alerts by logging into Online Banking.

Will the CSA Be the Recipient of the Purchase Alerts?

The CSA can set up Purchase Alerts to either be sent to a centralized email account / mobile phone or to the cardholder’s email address / mobile phone.

Can You Have Different Purchase Alerts Settings for Different Cards or Should All of Your Cards Be Enrolled with the Same Alert Options?

Yes, each card can be set up with unique alert settings.

Is There a Fee to Enroll in Purchase Alerts?

There is no charge to enroll in Purchase Alerts. Standard mobile text and data fess apply for SMS message alerts.

How Long After Enrollment in Purchase Alerts Can You Start Receiving Alerts?

Once enrolled, you are immediately able to receive alerts messages.

Can You Enroll in Purchase Alerts from a Mobile Phone?

At present, the Visa enrollment page cannot work with mobile devices. An attempt to enroll from a mobile phone will prompt the following error: “An error has occurred while performing some function”.

What Types of Purchase Alerts Are Available?

At present, the following alerts are available:

- Threshold transaction: An alert is triggered when a purchase amount is bigger than a pre-set dollar amount.

- Card-not-present transaction: An alert is triggered when a payment is made without having to physically present the card at the point of sale, for example when a purchase is made online or by telephone.

- International transaction: An alert is triggered when a purchase is made outside the country that issued the Visa card.

- Declined transaction: An alert is triggered when the bank or Visa on behalf of a bank declines a transaction for whatever reason.

- Gasoline transaction: An alert is triggered when a payment is made at a gas station (e.g. fuel or car wash).

- Spend aggregation: An alert is triggered when a payment causes the customer to exceed their pre-set weekly and / or monthly spending threshold.

How Do You Enroll in Purchase Alerts from Your Bank?

The instructions for enrolling in Visa Purchase Alert are as follows:

- Log in to your bank account.

- Go to the Services tab (for consumer accounts).

- Find and select Purchase Alerts.

- Choose the card(s) for which you want to set up alerts.

- Review enrollment information and accept the Terms and Conditions.

- Provide your mobile phone number and / or email address, at which you would want to receive alerts.

- Choose the alert options which you would want to receive.

- Select “Save Updates” to save your settings and complete the process.

What Information Is Needed for Enrollment?

You are required to provide your:

- Email address (to receive email alert messages) and / or

- Mobile number (to receive SMS alert messages)

Note that you will never be asked to provide your Visa card account information for the alerts service.

Can You Customize the Threshold Transaction Amounts? If so, How Do You Change the Settings?

Yes, you can change the threshold transaction amount setting by following these steps:

- Log in to your bank account.

- Go to the Services tab.

- Find and choose Purchase Alerts.

- Select the card(s), for which you want to customize the threshold transaction amount.

- Change the threshold transaction amount in the transaction amount window.

- Select “Save Updates” to save your new settings and finalize the process.

Where Are the Visa Purchase Alerts Sent?

Depending on your preferences, alerts can be sent to two locations, as follows:

- Your email address.

- Your mobile number, via an SMS messages.

What Happens After You Receive a Purchase Alert?

With email alert messages, you will get an email in your email inbox. SMS alert messages are managed by your mobile phone in the same way as any other messages that are received while you are on a call and it will trigger the handset setting that you have set up (e.g. tone, vibration or other related features). Your call should not be disrupted.

When your mobile phone receives an SMS alert, your mobile phone’s notification mechanism is triggered.

Can You Receive Purchase Alerts on Your Mobile Phone?

In the U.S., you can get Purchase Alerts on your mobile phone, so long as your mobile carrier supports the service and you have a wireless service plan that allows you to receive text messages and you have sufficient wireless data service coverage in your area at the time the alert is being sent to your mobile phone.

Mobile carriers supporting the service include, but are not limited to, Verizon Wireless, AT&T Wireless, Sprint and T-Mobile USA. If you are using a different mobile carrier, or you are not sure of the details of your wireless service, ask your mobile carrier for more details.

Will Your Mobile Carrier Charge You for Purchase Alerts?

Standard text messaging rates from your mobile carrier may apply to SMS alert messages, depending on your data service plan. You should take a look at your service plan and if you have any questions about whether you are charged for text messages, have text message limits and over-the-limit fees, just contact your mobile carrier’s customer service.

Do Purchase Alerts Reference Your Visa Card Number?

Not the whole Visa card number. For your protection, only the last 4 digits of your number are displayed in a Visa alert.

What Would Happen to Your Enrollment Status if Your Mobile Phone Is Lost or Stolen?

As long as you can still use your mobile phone number and simply change your device, nothing will change. If, however, you lose your mobile phone and can’t regain your mobile number, you would need to register a new one, in which case you would need to go to the mobile / email preference page of the alerts set-up (see above) and register the new number.

You would then be sent a validation code via an SMS message. You would need to enter this validation code on the alerts page. Once you have successfully validated your new mobile phone number, all existing triggers would apply and you would continue to receive alerts as you did before.

What Would Happen to Your Enrollment Status if You Change Your Mobile Number?

If you change your mobile phone number, for whatever reason, you would need to go to the mobile / email preference page of the Visa alerts set-up and register the new number.

You would then be sent a validation code via an SMS message. You would need to enter this validation code on the alerts set-up page. Once you’ve successfully verified your new mobile phone number, all existing triggers would apply and you would continue to receive alerts as before.

What Would Happen if You Change Your Mobile Carrier but Keep Your Mobile Phone Number?

If you replace your mobile carrier but keep your mobile phone number, you would have to go through the process once again to confirm that you would still like to continue receive alerts via SMS.

You would be asked via an SMS message whether or not you would like to continue receiving alerts on that phone number under the new carrier. If you respond in the affirmative to that text message, Visa Purchase Alerts would continue to be sent to your mobile phone number.

Otherwise, you would need to visit the mobile / email preferences set-up page to update your mobile phone number. You would need to complete the process of receiving a validation code via an SMS message and entering it on the alerts page, in order to confirm the new carrier and continue to receive alerts.

Can You Enroll an Authorized User on Your Visa Card for Purchase Alerts?

Yes, you can do that by adding your card’s authorized user’s mobile number and email address when you register for alerts as the primary cardholder. Note that if you remove the authorized user from your account after you have registered them for alerts, deleting their information from the registration page would be sufficient to stop the alerts.

Do You Receive Purchase Alerts if You Share an Enrolled Visa Card with Someone Else?

Yes, if you both have the same Visa card number, you would both receive alerts.

If Your Transaction Meets the Criteria for Multiple Purchase Alert Triggers, Do You Receive Multiple Alerts?

No, in such case you would receive only one alert per transaction, based on the alert type priority. The alert type with the top priority is a declined card payment.

Do You Receive a Purchase Alert when You Return an Item You Have Bought?

No, you get alerts only for purchase transactions, not for returns or adjustments.

Can You Have Email Purchase Alerts Sent to Your Mobile Phone?

Yes, email alert messages can be delivered to your mobile phone, but only if:

- You opt to receive email alert messages and provide a valid email address during the enrollment set-up process and

- You own a mobile phone, which has the capability to receive emails.

What Are the Differences Between the Purchase Alerts Email Formats?

If you have enrolled for the email alerts service, you will be able to select email alert messages from the following options:

- To receive emails with formatted text and graphics, opt for “HTML”.

- To get emails with formatted text but no graphics, select “rich text”.

- To receive emails only with plain text (no formatting or graphics), choose “plain text”.

You can set your email preferences on the mobile / email preferences page of the alerts set-up page. If you have enrolled only for the alerts service via SMS messages, you would not need to customize any email formats, as your bank would not be sending you alerts via email.

How Do You Opt Out of Visa Purchase Alerts?

To opt out of the Visa alerts service at any time, you need to take one of the following actions:

- Uncheck all the boxes on the “Manage Alerts” section of the alerts set-up process. At this point, you would still be enrolled in the service, but you would not be receiving alerts. If you then decide that you want to start receiving alerts again, you would not have to re-enroll. Simply go back to the alerts page and choose your options.

- Opt out of the alerts service using the “Opt Out” section of the alerts set-up process. At this time you would stop receiving alerts and would be officially un-enrolled from the service. If you then decide to start receiving alerts again, you would need to re-enroll.

- Text back “Stop” from your mobile phone to any Visa alert you have received. This would un-enroll you from receiving SMS message alerts. However, if you are still signed up for the email alerts option, you would continue to receive email alerts. To restore SMS message alerts, you would need to add your mobile phone number back in the system through the alerts set-up process and again accept the Terms and Conditions, once you have verified your enrollment information.

What Do You Do if You Receive a Purchase Alert for a Transaction You Do not Recognize?

In this case, first check to see if the transaction in question is one of the following:

- An automatic bill payment you have previously set up for a recurring service (e.g. cable or telephone).

- A large payment that was divided into multiple smaller transactions.

- An aggregated transaction (i.e. multiple small payments combined into one, such as buying $0.99 songs online).

- A payment initiated by an authorized cardholder who has the same Visa card number.

- An authorization charge from a hotel or a restaurant.

If, having gone through the list above, you still cannot identify the transaction in question, call the number on the back of your Visa card and ask about it.

Why Did You Receive Multiple Purchase Alerts for a Single Transaction?

This is a rare occurrence, but it can happen if a merchant:

- Is a portal, which means that the merchant sells merchandise from other merchants (e.g., Ebay.com). If you bought more than one item, each merchant may charge you separately for its portion of the total amount.

- Charges applicable taxes separately from the total purchase amount, as airlines often do.

- Needs to re-send the transaction information to Visa, because the initial authorization has expired.

- Requests an initial authorization amount of $1, or another small amount, to verify that your Visa card account is valid. If you come across this problem repeatedly, you may want to call the number on the back of your Visa card.

Why Did You Receive One Visa Purchase Alert for Multiple Transactions?

Some transactions, such as buying $0.99 songs online, are aggregated into a single large transaction. The sum of these small amounts may be recorded as one larger transaction.

Why Did You Receive a Purchase Alert Hours or Days after the Transaction Took Place?

Sometimes an alert may be delayed if the merchant does not immediately submit your transaction information to Visa for processing. The merchant may be waiting until your order is shipped or may not have immediate access to a power source for transmitting transaction data.

Why Did You Receive a Purchase Alert for an Online Payment Before You Even Submitted the Transaction?

Some transactions may trigger an initial authorization amount of $1 or some other small amount, in order to verify that your Visa card is valid. You may then receive a second alert for the actual transaction amount, once you have submitted your online payment. Note that you would only be charged for the actual amount of your payment.

Why Did You Receive a Purchase Alert for a $1 Transaction, or Some Other Small Amount, when You Made an Online Payment?

Some online merchants may request an initial authorization amount of $1 or some other small amount to verify that your Visa card is valid. Purchase alerts are triggered based on the initial authorization amount, so in this case you are likely to receive a second alert for the actual transaction amount, once you have submitted your online payment. Note that you will be charged only for the actual amount of your purchase.

Why Did You not Receive a Purchase Alert when You Expected One?

Visa Purchase Alerts are not sent if the:

- Dollar amount of your payment is lower than the amount you specified for your alerts.

- Merchant processes their transactions through the bank’s system instead of Visa’s.

- Merchant has not yet submitted the transaction data to Visa.

An SMS message alert may not be received by your mobile phone for many reasons, including:

- Your mobile carrier drops the SMS message.

- Your mobile phone is out of the service coverage area at the time Visa sends the alert and the phone remains out of coverage for a period of time afterward.

- Your mobile carrier blocks the SMS messages.

- Your phone plan does not include SMS messages.

Why Does the Amount in the Purchase Alert Differ from the Amount on Your Restaurant Bill?

Visa Purchase Alerts are triggered based on the initial authorization amount, which the restaurant sends to Visa, which may or may not include the amount of the estimated tip and is not necessarily the final amount for which you signed the restaurant bill.

Why Does the Amount in the Purchase Alert Differ from the Amount on Your Hotel Bill?

Visa Transaction Alerts are triggered based on the initial authorization amount, which the hotel sends to Visa. That amount does not include any applicable discretionary charges, such as room service, dry cleaning, wireless internet service, parking, etc.

Why Is the Amount not Included in the Visa Purchase Alert?

Some businesses, including hotels, restaurants and rental car companies, send an estimated transaction amount to Visa for an initial authorization. If that estimated amount meets the transaction amount threshold, which you have selected during set-up, Visa sends you an alert to inform you that your card has been used, without specifying the amount.

Why Is the Merchant’s Name not Stated in the Visa Purchase Alert?

The merchant’s name is stated in the Visa Transaction Alert, provided it is available to Visa. Please review the transaction in your online banking for more details.

How Can You Find out Where a Specific Payment Was Made?

Your bank may be able to help you identify the merchant’s actual location. The Visa Transaction Alert includes the merchant’s name and location only when they are made available to Visa. When you have questions about a specific transaction, or to file a dispute for a transaction you do not recognize, call the customer service on the back of your card.

Can You Use a Visa Purchase Alert as a Replacement for a Transaction Receipt?

No, a Visa Transaction Alert cannot be considered a replacement for a sales receipt.

If You Delete a Visa Purchase Alert Email or SMS, Will It Still Be Stored Anywhere Else?

Visa Alerts are stored for 90 days in the “View History” section of the alerts page and remain there even after you delete them from your email service or your mobile phone’s SMS inbox.

How Many Visa Alerts Are Stored on the Alerts Program Page?

The “View History” section of the alerts page will contain records of your alerts history for the last 90 days.

Can You Sort the Visa Purchase Alerts on the Alerts Program Page?

Yes, you can sort your Visa alerts in the alerts page.

Image source: Visa screenshot.