American Express Transaction Cycle and Authorization Requirements

The payment card industry devotes significant amounts of time and resources to developing authorization systems and decision models in an effort to mitigate the financial losses. Every transaction begins and ends with the cardholder. Between the time the cardholder presents the card for payment and receives the goods or services, however, a great deal of data is exchanged, analyzed and processed. A process that literally takes seconds at the point of sale is actually a highly complex approach to analyzing each transaction.

The authorization process begins when the merchant provides an authorization request to your Merchant Services Provider. After requesting authorization, the merchant receives an Authorization response, which she uses, in part, to determine whether to proceed with the transaction.

The purpose of an authorization is to provide the merchant with information that will help her determine whether or not to proceed with a transaction.

For every transaction, the merchant is required to obtain an authorization approval from American Express for the full amount of the charge except for merchants that are classified in the restaurant, lodging and vehicle rental industries.

An AmEx authorization approval does not guarantee that:

- The person making the charge is the cardholder.

- The transaction is in fact valid or bona fide.

- The merchant will be paid for the transaction.

- The merchant will not be subject to a chargeback.

Possible Authorization Responses

Responses to requests for authorization are generated by the card issuers and transmitted to the merchant. The following are among the most commonly generated responses to a request for authorization. The exact wording may vary, so check with your Merchant Services Provider to determine what authorization responses will display on your equipment.

| Authorization Response | What It Means |

| Approved | The transaction is approved. |

| Partially Approved

(for use with Prepaid Cards only) |

The transaction is approved. The approval is for an amount less than the value originally requested. The transaction must only be submitted for the approved amount. Collect the remaining funds due from the cardholder via another form of payment. |

| Declined or Card Not Accepted | The transaction is not approved. Do not submit the transaction. If you nevertheless choose to submit the Charge, you will be subject to a chargeback. Inform the cardholder promptly that the card has been declined. If the cardholder has questions or concerns, advise her to call the customer service telephone number on the back of the card. Never discuss the reason for the decline. |

| Please Call or Referral | Additional information is required to complete the transaction. Call your Merchant Services Provider for assistance to complete the transaction. |

| Pick up | You may receive an issuer point of sale response indicating that you must pick up the Card. Follow your internal policies when you receive this response. Never put yourself or your employees in unsafe situations. Contact your Merchant Services Provider for further information regarding a Pick Up Card response. |

Obtaining an Electronic Authorization

Generally, merchants must obtain an electronic authorization. You must ensure that all authorization requests comply with American Express’ technical specifications. If the authorization request does not comply with the technical specifications, the submission may be rejected or you may be subject to a chargeback. Contact your Merchant Services Provider for information about your obligations to comply with the technical specifications.

If the card is unreadable and you have to key-enter the transaction to obtain an authorization, then you must follow the requirements for key-entered transactions.

If you use an electronic point-of-sale (POS) system to obtain authorization, the approval must be printed automatically on the charge record.

Occasionally, obtaining an electronic authorization may not be possible (e.g., due to POS system problems, system outages or other disruptions of an electronic charge0. In these instances, you must obtain a voice authorization.

Obtaining a Voice Authorization

When authorization is required, if your electronic POS system is unable to reach American Express’ authorization system, or you do not have an electronic POS system, you must seek authorization using the following steps:

- Call your Merchant Services Provider’s authorization department.

- The following minimum information will be requested:

-

- Card Number.

- Merchant Number.

- Charge amount.

Note: In some situations, you may be asked for additional information such as Expiration Date or CID Number.

-

- A response will be provided. If the request for authorization is approved, capture the approval for submission.

- If you are submitting electronically, you must enter the approval into your POS system. For instructions on how to complete this type of transaction, refer to your Merchant Services Provider’s operating instructions or contact them directly.

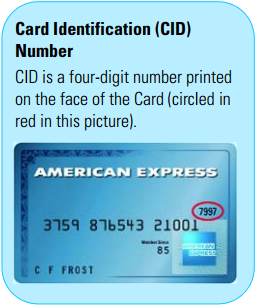

Card Identification (CID) Number

The Card Identification (CID) Number provides an extra level of cardholder validation and is part of the authorization process. The CID Number is printed on the American Express card.

The Card Identification (CID) Number provides an extra level of cardholder validation and is part of the authorization process. The CID Number is printed on the American Express card.

If, during the authorization, a response is received that indicates the CID Number given by the person attempting the transaction does not match the CID Number that is printed on the card, re-prompt the customer at least one more time for the CID Number. If it fails to match again, follow your internal policies.

Note: CID Numbers must not be stored for any purpose. They are available for real time transactions only.

Authorization Reversal

It is a good practice to reverse an American Express authorization for an approved transaction if you do not intend to send a submission to your Merchant Services Provider within the authorization time limits. You may reverse an authorization for a corresponding transaction by:

- Initiating an authorization reversal message, or

- Contacting your Merchant Services Provider for instructions on how to reverse an authorization.

After a Charge Record has been submitted, however, the authorization cannot be canceled or changed. For example, if you make an error in a transaction but have already submitted the Charge Record, you cannot systematically request a change in the transaction. You must instead, follow the procedures for processing a credit.

Authorization Time Limit

Authorization approvals are valid for seven (7) days after the authorization date, except for certain transactions from merchants that are classified in the lodging and vehicle rental industries. You must obtain a new approval if you submit the transaction to your Merchant Services Provider more than seven (7) days after the original authorization date.

For transactions of goods or services that are shipped or provided more than seven (7) days after an order is placed, you must obtain an approval for the transaction at the time the order is placed and again at the time you ship or provide the goods or services to the cardholder.

The new approval must be included in the Charge Record. If either of the authorization requests is declined, do not provide the goods or services or submit the transaction. If you do, you will be subject to a chargeback.

Floor Limit

You must obtain an authorization on all purchases, regardless of the amount, as a zero-dollar Floor Limit applies for all American Express charges.

Pre-Authorization

A pre-authorization is an authorization request that you submit in advance of providing the goods or services, allowing you then to submit the Approved Charge (e.g., fuel pump CATs).

Additional Authorization Requirements

There are instances, which are outlined in the following table, when additional authorization requirements apply.

Merchants classified in certain industries are also subject to additional specific authorization requirements.

| Topic | Additional Requirements |

| Recurring Billing | You must flag all requests for authorization with a Recurring Billing indicator. To improve the likelihood of obtaining an approval to an authorization request, it is recommended that you periodically verify with cardholders that all their information (e.g., Card Number, Expiration Date, and billing address) is still accurate. |

| American Express Gift Cheques and

American Express Travelers Cheques |

You are not required to obtain Authorization prior to accepting Gift and Travelers Cheques. You must, however, follow the appropriate procedures outlined. Questions concerning the validity of Gift or Travelers Cheques can be addressed by calling the Travelers Cheque / Gift Cheque Customer Service at 1-866-296-5198. |

| Split Tender | During a Split Tender Transaction, the cardholder uses multiple forms of payment for a single purchase (e.g., prepaid cards, cash, card). You may follow your policy on combining payment on prepaid cards with any other payment products or methods of payment. If the other payment method is a credit card, then you are required to follow all provisions of the agreement. Check with your Merchant Services Provider to determine if your POS system is set up for Split Tender functionality. |

As payment cannot occur until the transactions are submitted, you are encouraged to submit transactions daily, or more frequently, to your Merchant Services Provider, even though you have up to seven (7) days to do so.

Collect transactions during the business day and submit them according to the instructions provided by your Merchant Services Provider.

You must submit transactions electronically except under extraordinary circumstances. When you transmit Charge Data and Transmission Data electronically, you must still complete and retain Charge Records and Credit Records.

Charge Submissions

You must submit all charges to your Merchant Services Provider within seven (7) days of the date they are incurred. Charges are deemed “incurred” on the date the cardholder indicates to you that they will pay for the goods or services purchased with the card.

Charges must not be submitted to your Merchant Services Provider until after the goods are shipped, provided or the services are rendered. You must submit all charges under the establishment where the charge originated.

For aggregated charges, the charge must be submitted within seven (7) days of the date of the last purchase (and / or refund as applicable) that comprises the Aggregated Charge. Delayed Delivery Charges and Advance Payment Charges may be submitted before the goods are shipped, provided or the services are rendered.

Credit Submissions

You must submit all credits to Merchant Services Provider within seven (7) days of determining that a credit is due. You must submit each credit under the establishment where the credit originated.

Submission Requirements — Paper

If, under extraordinary circumstances, you submit transactions on paper, you must do so in accordance with instructions provided by your Merchant Services Provider.

Examples of circumstances that may prevent merchants from submitting electronically are:

- Special events (e.g., conferences, outdoor marketplaces, concerts),

- Merchants that do not conduct business from fixed locations,

- Remote locations or merchants who experience system outages.

If you submit charges on paper, you must create a Charge Record containing all of the following required data:

- Full Card Number and Expiration Date (pursuant to Applicable Law) and, if available, cardholder name.

- The date the charge was incurred.

- The Authorization Approval.

- A clear description of the goods or services purchased by the cardholder.

- An imprint or other descriptor of your name, address, Merchant Number and, if applicable, store number.

- The words “No Refunds” if you have a no refund policy, and your return and / or cancellation policies.

- If a Card Present Charge, the cardholder’s signature.

- If a Card Not Present Charge, the words “telephone order”, “mail order”, “Internet Order”, or “signature on file”, as applicable.

Charge Records submitted on paper must comply with the applicable requirements. Charges must be submitted in accordance with the applicable requirements. Refer to your Merchant Services Provider’s instructions when submitting Transactions on paper.

How to Submit

In many cases, your POS system automatically processes the transactions in batches at the end of the day. On busy days, your transaction volume may be greater than your POS system’s storage capability.

Consult information provided by your Merchant Services Provider to determine POS storage capacity and whether it’s necessary to submit multiple batches (e.g., submit a batch at midday and again in the evening).

Contact your Merchant Services Provider for additional information regarding submission requirements.

Image source: Wikimedia.