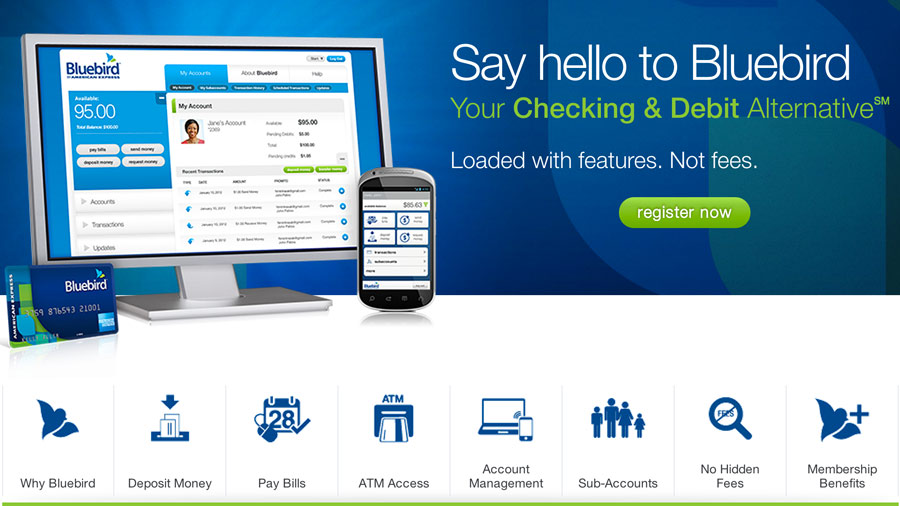

Bluebird, the American Express Debit Card: What You Need to Know

Bluebird is the new checking and debit card alternative developed jointly by Walmart and American Express and designed to help consumers better manage and control their everyday finances.

But Bluebird is more than the American Express debit card alternative. It is designed to merge the best of today’s features capabilities found in the payments, technology, and financial services space, and packages it all into something that provides consumers with simple and convenient access to their funds, so they can better manage and streamline their money management.

Built upon American Express’ Serve payments platform, Bluebird’s features allow consumers to make transactions both online and offline in the way that best suits their everyday needs.

Bluebird Features

For registered Bluebird account holders, features include the ability to:

- Add Money: Once members register and receive their personalized Bluebird card, funds can be loaded online through a bank account such as a savings or checking account, debit cards, direct deposit, mailing a check to American Express, adding a check via smartphones and cash loading at Walmart registers. The total Bluebird account balance limit is $100,000 annually.

- Make Purchases: The Bluebird card can be used for purchases at millions of locations where American Express debit cards and credit cards are accepted, both in the U.S. and internationally.

- Pay Bills: Bluebird account holders can pay bills to any person or business in the U.S., either online or with the Bluebird mobile app.

- Create Subaccounts: Bluebird offers its account holders the ability to easily create, manage and specify subaccounts for their friends, family members or colleagues. Members can create up to four subaccounts, which are all linked to the master Bluebird account and allow the account holder to set spending limits, set up text/email alerts, and enable/disable key features like ATM access.

- Transact through the Bluebird Mobile App: The Bluebird mobile app comes with no fees and is available on any iPhone and Android phone. Once installed, Bluebird account holders can send and receive money, view transactions, add money, and manage their subaccounts.

- Get Cash Access: Bluebird users can use their Bluebird card for ATM withdrawals anywhere around the world that accepts American Express debit cards and credit cards. Bluebird account holders who are enrolled in direct deposit can get fee-free and surcharge-free cash access through the MoneyPass’ network, which has 22,000 ATMs nationwide. Withdrawals at an out-of-network ATM will have a $2 fee and additional fees may be assessed by the ATM owner or operator. For Bluebird users who are not enrolled in direct deposit, each ATM withdrawal at any MoneyPass ATM nationwide will have a $2 fee.

- Pre-Authorized Check Writing: Bluebird users have the ability to order Bluebird checks which they can use to pay bills and make purchases without worrying about insufficient funds or incurring overdraft fees because an account holder’s funds are set aside during the pre-authorization process. To preauthorize a Bluebird check, a user will follow just two simple steps:

- Obtain a unique authorization code online or through the Bluebird mobile app. Note: once a Bluebird check is pre-authorized, the funds associated with that check are immediately deducted from the user’s balance and are held until the check is presented for payment.

- Write the authorization code on the check and give to the payee. This ensures for the consumer that sufficient funds are available to cover the Bluebird check being written. The payee can confirm that sufficient funds are available by calling American Express.

- FDIC Insurance Coverage: Funds in all permanent Bluebird accounts will now be eligible for FDIC insurance, which allows members to arrange for direct deposit of U.S. government payments. Funds from temporary accounts will not be FDIC insured. Other restrictions may apply. For more information see www.bluebird.com/fdic.

- Get Access To Valuable Benefits: Users have access to benefits (subject to terms and conditions), which include:

- Purchase protection, which can provide coverage against accidental damage or theft of eligible items for 90 days from date of purchase, up to $1,000 per occurrence, up to $50,000 per cardholder account per calendar year.

- Roadside assistance, which may arrange for the following services: towing, winching, jump starts, flat tire change when spare is available, lockout service when key is in vehicle and delivery of up to 2 gallons of fuel.

- Global Assist Services, which provide pre-trip planning assistance as well as emergency assistance when the cardholder is traveling more than 100 miles from home.

- The 24-7 customer service that is available to all American Express cardholders.

- Initiate Bluebird to Bluebird Transfers: Immediate person-to-person (P2P) money transfers to other Bluebird users can be conducted online or through the Bluebird mobile app.

- Set up Money Management Tools: Online management tools provide controls and full transparency for how the Bluebird account is used. Either online or via the mobile app, users can:

- View real-time transaction history and monitor spending.

- Receive email or text alerts.

- Disable/enable ATM access (master accounts only).

- Inquire about their balance 24 hours a day/7 days a week.

- Schedule reloading of funds automatically.

Bluebird Account Fee Summary

| Fee Category | Fee Type | Amount |

| Cost of Set Up | Monthly/Annual Fee | $0 |

| Activation Fee | $0 | |

| Card Price – Online | $0 | |

| Card Price – Retail locations | Up to $5 | |

| Add Funds | Direct Deposit | $0 |

| Cash or Debit Card at Walmart | $0 | |

| Cash at Other Participating Retail Locations | Up to $3.95 | |

| Online with a Debit Card | $0 | |

| Mobile Check Capture by Ingo Money: | ||

| · Money in 10 Days | $0 | |

| · Money in Minutes | 1% or 5% of check ($5 min fee) | |

| Withdraw Funds | Withdrawal at MoneyPass ATMs | $0 |

| Withdrawal at non-MoneyPass ATMs (ATM operator fees may also apply) | $2.50 | |

| Cash Pickup Powered by Ria: | ||

| · Cash out up to $500 | $3 | |

| · Cash out $500.01 – $900 | $6 | |

| · Cash out $900.01 – $2,900 (tax refund only) | $9 | |

| Payments | Bill Pay | $0 |

| Bluebird Check Transaction (Checkbook fee of $19.95 + shipping & tax apply, 40 checks per checkbook) | $0 | |

| Stop Payment Fee | $0 | |

| Send Money | Send Money Between Bluebird Accounts | $0 |

| Bluebird 2 Walmart Money Transfer Powered by Ria: | ||

| Send up to $50 | $4 | |

| Send $50.01 – $1,000 | $8 | |

| Send $1,000.01 – $2,500 | $16 | |

| Other | Foreign Exchange Fee | $0 |

| Replacement Card | $0 | |

| Inactivity/Dormancy Fee | $0 | |

| Customer Service Calls | $0 |

*If your check is returned unpaid within the 10 day period, your Account will not be funded. No minimum check amount.

**1% fee on payroll or government checks with preprinted signatures or 5% fee on other checks; $5 minimum fee applies; $20 check minimum. See bluebird.com/checkcapture for more details.

***Withdrawals greater than $900 are available to Bluebird Accountholders who receive their tax refund or refund advance via Direct Deposit into their Bluebird Account. Withdrawals greater than $900 are not available for Bluebird Accountholders with an Arizona address on file.

Bluebird is available online at www.bluebird.com and in more than 4,000 Walmart stores.

Image credit: www.bluebird.com.