Economists Keep Telling Them This Cannot Go On. Yet Americans Keep Slashing Credit Card Debt. Wow.

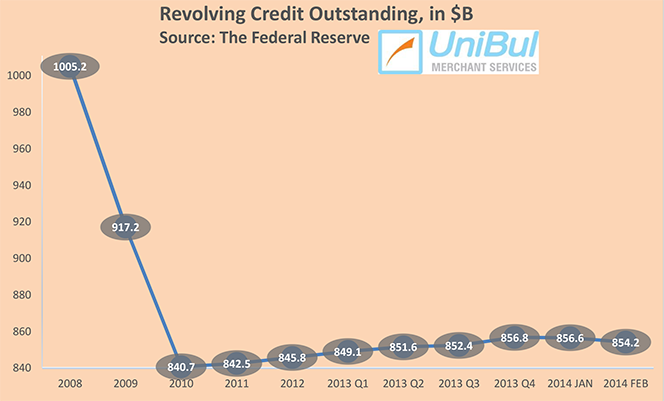

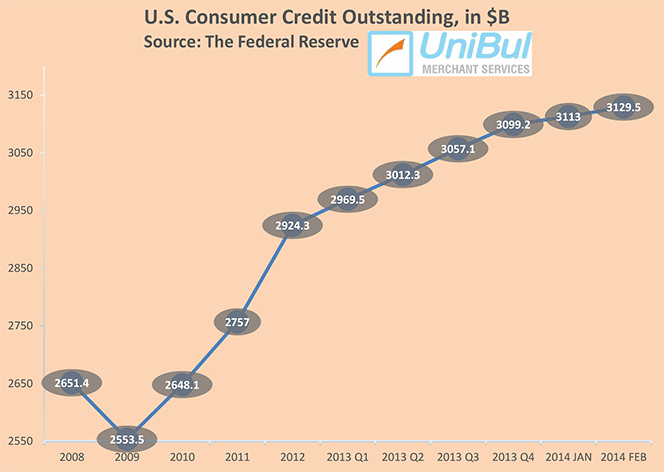

More than 5.5 years after the collapse of Lehman Brothers crippled the financial infrastructure of the Western World, the aftershocks of the catastrophe are still being felt. Still, just how is it possible that our collective credit card debt is much, much lower than its level at the eve of the meltdown and has remained just about flat for about four years now? After all, the recession is long gone and the recovery, such as it is, has pushed us onward. Not to mention that the population has just kept growing. Well, here we have more of the same in February.

American Consumer Debt — A Mixed Picture

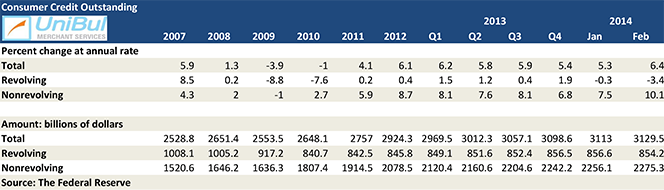

First, here is the overall snapshot.

Credit Card Debt down by 3.4%

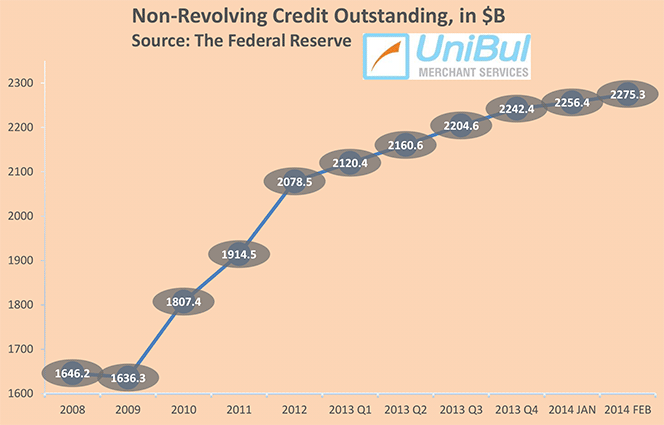

Non-Revolving Consumer Credit up by 7.5%

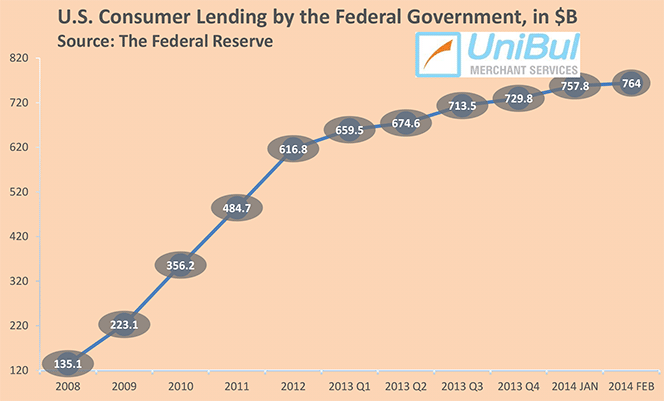

Student, Auto Loans Up

Overall Consumer Credit up by 5.3%

So the divergence between the path credit card debt has been on for several years and that of all other debt categories could not be more striking. What should we expect in the months to come? I have no idea… share these charts with others by clicking on the buttons below.

Image credit: Wikimedia Commons.