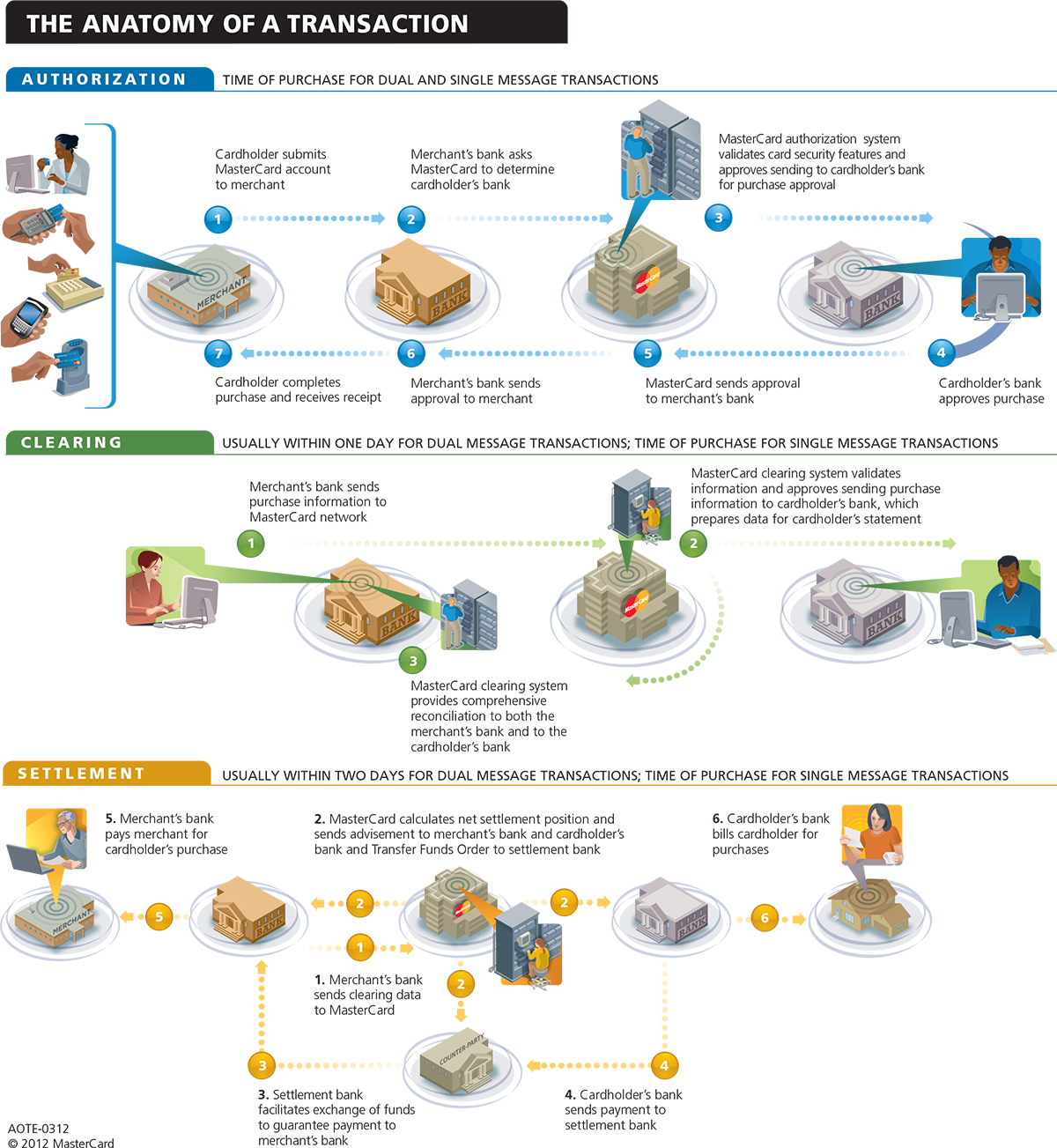

Authorization, Clearing and Settlement: How MasterCard Works

The credit card companies are proud with the reliability of their payment processing systems. The big ones are processing millions of transactions every hour and yet, MasterCard, for example, claims that its own payment network is up 99.9 percent of the time. Not to be undone, Visa boasts that its system has been functioning uninterruptedly 100 percent of the time for 18 consecutive “peak seasons”.

Now, before we get too excited, we should note that the huge complexity of both Visa’s and MasterCard’s ecosystems makes it possible, indeed inevitable, that at any given time many merchants would not be able to connect to their networks, even though they may be up and running perfectly smoothly. The reason, of course, is that merchants connect to Visa and MasterCard through their payment processors’ systems, which are beyond the two networks’ control.

Nevertheless, the leading card networks have built two amazingly robust payment processing infrastructures, each processing astonishingly large amounts of data at an incredible speed. Card transactions — whether debit or credit, online or in-person — are processed in seconds, during which time a long series of interactions takes place. Once the payment information is collected by the merchant, it is sent to the payment processor and from there to the card network (Visa or MasterCard), then on to the card issuer for transaction approval and then back through the same channel to the merchant.

And now think about that: MasterCard says that it is facilitating more than 65,000 such transactions every minute and without a hitch! How does it do it? Well, this is the process that I will examine today. Before I get started, I should say that I’ve written on this subject many times before, but today I will delve much deeper than I’ve ever done before. Many readers may find that, say, this post covers the topic well enough for you, but I am certain that many others, especially those of you running larger operations, will benefit from a more complete understanding of the way your transactions are processed. Let’s get going.

The First Stage: Authorization

When you take your customer’s card payment, your payment system (whether a POS terminal or its web-based counterpart — the payment gateway) immediately transmits the transaction information to the card’s issuer, at which point a series of tests and decisions is initiated.

The first thing to be done is the authentication of the card’s validity. The process also confirms that the account is open, in good standing and has sufficient available funds to cover the amount of the purchase. Anti-fraud measures are applied at various steps along the way and the end result is returned to your system. This result directs you how to proceed with the transaction, as shown in the table below:

|

Response |

Description |

| Approve | The transaction is authorized as reported. For magnetic stripe, chip, and key-entered transactions, the issuer provides a six-digit authorization code to the acquirer for each approved sales transaction. The merchant still needs to perform its normal review process (e.g. verifying the validity of the card, matching the signature on the back of the card to the one on the sales receipt, etc.) before completing the transaction. |

| Decline | The merchant should not accept the card, but return it to the customer and request another form of payment. |

| Refer to the card issuer | The merchant is required to contact the issuer for further instructions. |

| Capture card | The merchant is required to keep the card, but only by reasonable and peaceful means. |

| Valid | This response is used only for inquiry transaction types, such as balance inquiries, address verification requests or other non-financial types of requests. Merchants use these types of authorization responses to provide information to the cardholder or to determine if further authorization decision-making is needed. |

A record of the transaction information exchange (an “authorization”) is created within your payments system and also at the cardholder’s bank. And all this is done in a couple of seconds. That’s the transaction approval part. Now let’s move on to the money part.

Clearing and Settlement: The Basics

To facilitate the exchange of money between the merchants and their customers, the card networks conduct interbank “clearing” and “settlement” of each card transaction. These interactions (exchanges of data and related funds) take place between “acquiring” banks, which serve the merchants and are their link to the payments systems, and “issuing” banks, which service the consumers’ card accounts.

Settlement is the final process in the series of stages that begins with authorization and follows clearing, which is the non-monetary exchange of transaction-related information. Data exchanged during the clearing process serve to provide the verification for the amounts debited from the issuers and credited to the acquirers. Clearing data also provide the details needed by acquirers in making credits to their merchants’ accounts and by issuers for debiting their cardholders’ accounts. Additionally, banks also use the clearing data for their own account management purposes.

For clearing purposes, there are two distinct types of card transactions and they need to be examined separately.

Clearing of Dual-Message Transactions

The “dual-message” clearing protocol typically requires either a physical or virtual signature and includes credit card transactions (with the exception of ATM cash advances) and signature-authenticated debit transactions. When a merchant receives an authorization message, its payment processing system creates a record of that authorization through something called “electronic draft capture” (EDC). These electronic drafts are then stored in a “batch” until it is processed. For most merchants, batch processing occurs once a day, however high-volume merchants may do it multiple times a day and very low-volume merchants may do so less frequently than on a daily basis. Whatever the frequency, however, merchants submit all of their authorized transactions to their acquirer in batch mode, not individually.

MasterCard has defined time frames for the submission of transaction information. Merchants are required to submit records of their authorized transactions to their acquirers within a specified time period and those acquirers, in turn, have their own time period to comply with for submitting these transactions into network clearing. As long as those time periods are met, issuers are required to honor the transaction. Additionally, issuers are required to honor transactions cleared outside of the defined time period, as long as the cardholders’ accounts are still open and in good standing.

MasterCard provides multiple windows for dual-message batch processes. Once received, these records are organized into electronic reports and transmitted to the respective issuers. These reports contain all the data that the issuer needs for the posting of transactions to cardholder accounts and facilitating disputes on behalf of its cardholders.

The processing of all these transaction records also enables MasterCard to calculate the total amount owed by each issuer and the amount owed to each acquirer. This function of the clearing process is essential to the final settlement stage, as we will see in a bit.

Clearing of Single-Message Transactions

In most of the world, including the U.S., but excluding Europe, all card transactions authenticated with a PIN are single-message transactions. (Europe uses dual messaging for all card transactions, whether signature- or PIN-based.) With single-messaging, the authorization and clearing are done simultaneously and all the information necessary to post a transaction to the cardholder’s account is exchanged during the transaction. Therefore, there is no need to create transaction batches to be entered into clearing at a later point, as it is done with dual-messaging — only monetary settlement is required.

Single-message transactions have only one cut-off time each day, in contrast to the multiple ones available for dual-message ones. This cut-off time is the same for all participants and is non-negotiable. At cut-off, MasterCard calculates the total monetary positions for all of its banks for that day’s single-message transactions. These include both PIN-based sales transactions and ATM transactions that take place at “foreign” ATMs — when a cardholder has used an ATM that is not operated by her card’s issuer. The ATM category includes withdrawals made with debit cards, as well as cash advances made with credit cards.

MasterCard’s Settlement

MasterCard uses only one settlement window for both dual- and single-message transactions and settlement is done on an aggregate net basis. So all of each bank’s credits and debits are summed up and the net amount is either credited in a lump sum to the client bank’s account, in the case of an acquirer, or debited from the bank’s account, in the case of an issuer.

For issuers, most of their customers’ activity is in the debit category — cardholders are making purchases for which the issuer will pay into settlement on their behalf. But some transactions, in particular merchandise returns, fall into the credit category. The issuer may also have made ATM cash disbursements to other banks’ cardholders and these will also be credited to the issuer’s settlement amount. MasterCard calculates the total of the debits, deducts the total of the credits and the net remaining amount is collected from the issuer through settlement.

For acquirers, most of their merchants’ activity is in the credit category, but merchants also conduct transactions, such as the aforementioned refunds, which create debits. These debits are subtracted from the total of funds owed to the acquirer and the net amount is deposited into the bank’s account through settlement.

But things are made more complicated by another activity which creates a debit position for the acquirer (and its merchant) and a credit for the issuer (and its cardholder) — the chargeback. Chargebacks typically occur when a cardholder disputes a successfully completed transaction, which is then reversed. Of course, chargebacks are complicated, there are time limits, allowable reasons for dispute, etc., but these need not concern us here — we’ve dealt with chargebacks elsewhere and at length.

MasterCard plays an intermediary role in the processing of chargebacks and is the final arbiter as to their validity. If the chargeback is resolved in the merchant’s favor, no settlement activity takes place, as nothing changes from transaction processing standpoint. If, on the other hand, the chargeback is resolved in the cardholder’s favor, MasterCard will debit the transaction amount from the acquirer’s net settlement and credit it to the issuer’s net settlement.

Finally, it is also during settlement that the interchange fees are collected from acquirers and credited to issuers for sales transactions. For cash advances, withdrawals, credits and returns, the interchange flow is reversed and the issuer pays interchange fees to the acquirer.

Interchange fees are established by MasterCard and vary depending on a number of factors, such as the type of card used, the merchant category, the type of transaction, the merchant’s sales channel and the fraud rates associated with the merchant and its category. All these data are captured as a transaction is authorized and sent on for clearing, during which MasterCard assesses its appropriate interchange fee. This amount is then added to or deducted from the bank’s net settlement amount.

All of the activity just outlined is conducted before the settlement cut-off time, at which time MasterCard sends notifications of these amounts to each of its client bank. Banks with a net debit position are notified of the amounts they need to remit to MasterCard’s clearing account and banks with a net credit position are informed of the amounts that will be deposited to their settlement accounts. Most credits and debits are processed within an hour after cut-off.

Once funds are settled between issuers and acquirers, these banks proceed to post the appropriate debits and credits to their own customers’ (cardholders and merchants, respectively) accounts. The electronic reports provided by MasterCard during clearing are used by its banks for facilitating the detailed entries into the individual customer accounts each processing day.

The Takeaway

So this is how MasterCard’s payment processing network facilitates more than 74 billion card transactions each year. And the company tells us that tests have showed that its system can handle much larger volumes: more than 24,000 transactions per second “with no degradation in quality or security”. So they have room to spare!

And here is MasterCard’s own representation of the company’s card transaction process (click on the image for a larger view):

Image credit: YouTube / MasterCard.

hi,

how is does merchant/cardholders bank reconcile(daily) in instances where the bank recieves two advisments for settlement usd (840) and kes (404),

im not sure if this is adequate information please help

Hi, In the anatomy of the transaction, in the settlement flow diagram, what is the settlement bank? Can you give an example?