The Digital Future of Retail Banking

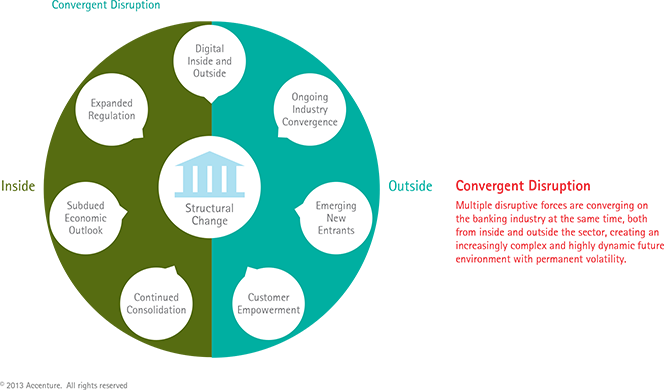

Last week I touched on the subject of how the future of virtual banking is being shaped and what it might look like when the market matures. My suggestion, based in part on a newly released paper by Accenture — a big consultancy — was that it will be shaped in no small part by mergers between the traditional, retail-based banking players and their digital-only start-up rivals that are popping up all over the place. In fact, these mergers, as The Economist article to which I also referred in my post pointed out, have already begun.

If present trends hold long enough, which at this early stage is anyone’s guess, the most probable outcome may be that, once the dust has settled a few years hence, the old-fashioned players will have bought up their start-up challengers and incorporated the most promising virtual banking technologies into their traditional offerings. As of yet, no PayPal-like digital banking champion seems to have made an appearance.

But I thought I’d delve a bit deeper into the Accenture paper, as it gives us some valuable insights into the challenges faced by both the established banking players and the aspiring industry “disruptors”. Furthermore, it offers a look into the way consumers view the present state of affairs and their preferences for its future. So let’s get to it.

Retail Banking’s Digital Challenge

New digital rivals and digitally-minded customers are presenting retail banks with huge challenges, Accenture reminds us. Yet, for now at least, most of them are still going about their business as usual, either unable or unwilling to offer what their customers actually want. These banks, we are told, tend to manage their various networks — including the digital channels — separately, rather than as an integrated platform, covering all aspects of their retail operation.

For now, the banks are able to get away with that, mostly because their customers are seeing no better alternatives or are considering switching to a competitor to be too much of a hassle. The researchers see this as a confirmation that the right offering and approach can induce customers to switch. And such new offerings may already be available.

Different Strengths, Different Focus

The industry newcomers are taking full advantage of their digital-only models to “deliver the speed, convenience and low-cost personalized service that today’s customers increasingly seek”, Accenture tells us.

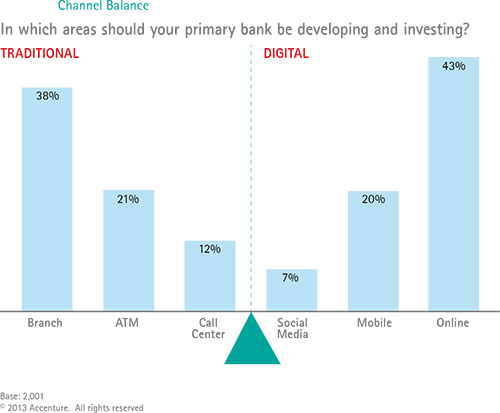

However, the incumbents have a rather big advantage of their own: their extensive branch networks that customers still value and are likely to do so for a long time to come. Yet, the researchers tell us, retail banks cannot afford to ignore the message that is being delivered rather forcefully by their virtual competitors: “winning with digital in the future will be all about winning more satisfied and loyal customers with trusted, transparent and compelling offerings”. To the researchers, that entails “becoming an integral part of customers’ lives: an agile, ubiquitous presence, wherever those customers may be”. And here is what consumers have to say on the matter:

A Tenuous Relationship

Traditional banks’ future customer relationships are at risk: consumers still want their branches, but they also want more and better online offerings. Moreover, many of the offerings that keep them with their traditional providers, such as good online services and low fees, are also available from alternative providers, which in fact often do those things better and are easy enough to switch to.

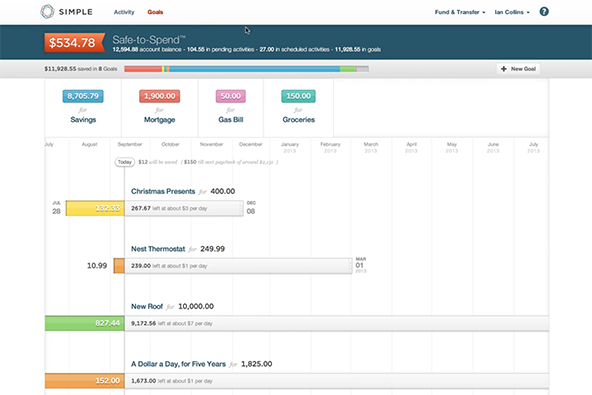

If traditional banks don’t build trust and transparency with better offerings, Accenture warns, they risk losing their customers. In fact, the researchers point out, that is already happening, as illustrated by the success of American Express and Walmart’s excellent Bluebird prepaid card and the digital banking start-up Simple, which was the focus of the aforementioned Economist article.

Talking to a Person

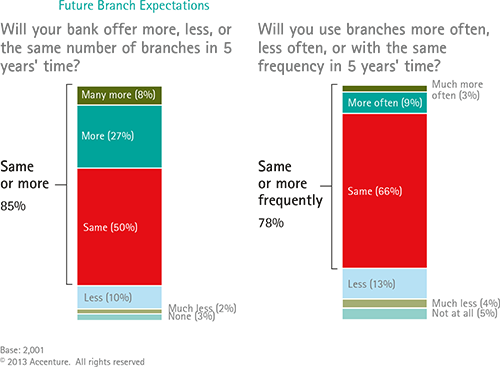

Physical branches, as already mentioned, are a significant strategic asset for retail banks and that is likely to remain the case for quite some time. More than three-quarters (78 percent) of Accenture’s respondents expect to be visiting their bank branch just as frequently, or even more so, five years from now.

Consumers’ love affair with bank branches seems to be rooted in their preference (expressed by 66 percent of respondents) to “talk to a person”, rather than buying a banking product online. Reinforcing that result, two-thirds of respondents also say that they consider a branch closure to be more than a minor inconvenience and for close to half of them that would be a sufficient reason to switch banks.

So, for now, the branch remains the preeminent banking channel. Yet, though consumers still prefer branches to websites, the margin is already narrow — 41 percent to 35 percent. It is reasonable to expect that, in the not-too-distant future, digital banking will push branches into second place.

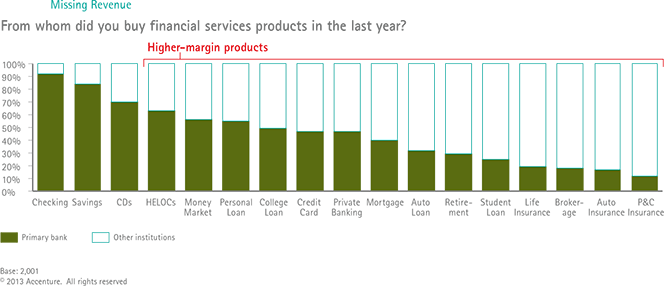

The Cross-Selling Challenge

Retail banks need to work much harder at cross-selling higher-value products, the researchers declare. They already have plenty of information about their customers, but are not yet good at making sense of it.

Consumers, on the other hand, are taking full advantage of the more and better information on products and pricing now available and are actively shopping around. More than half of the respondents (53 percent) have chosen a provider other than their primary bank for credit cards, 60 percent have done so for their home mortgages, 68 percent for auto loans and 82 percent for brokerage accounts.

The Digital Arrival

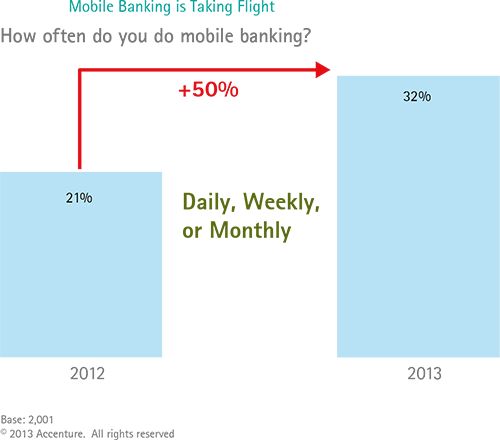

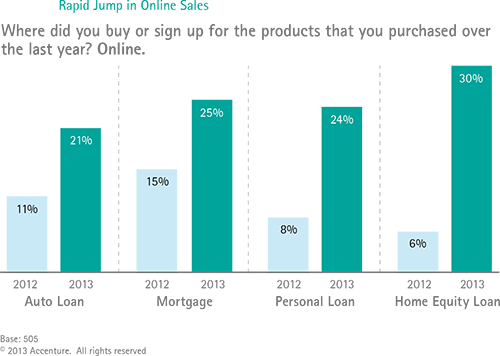

Physical branches may still be very important, but consumers see online banking as the most important area for banks to invest in and develop, we are told. Four-fifths of Accenture’s survey respondents are using this channel at least once a month.

Moreover, mobile banking usage has increased by close to 50 percent since 2012, with nearly a third of customers active at least once a month. The various digital channels are enabling consumers to interact with their banks more frequently than ever before.

Even as bank branches experienced a decline in their sales of higher margin products, the web-based channels saw triple-digit growth in several such categories, we learn. One of these channels, in particular — mobile — has soared in usage in the past year, almost overtaking the ATM in its perceived importance to consumers.

Most consumers feel that social networks and financial activities should be kept separate, though some already see benefits in blending the two. Over a third (38 percent), for example, would like to be able to locate branches via social media and 30 percent would use them to access customer services. Twenty-nine percent are interested in finding financial education material via social media and 26 percent would want to receive bill pay reminders.

The Takeaway

The researchers suggest a “way forward” for traditional banks, which involves a combination of enabling the digital model and revamping the branches. I think the former suggestion has been accepted by everyone quite some time ago. Regarding the branch reform, the report tells us that some of the largest U.S. banks are already experimenting with “more open and flexible branch formats that give customers multiple options, 24 / 7, and that could, in addition, lower the banks’ own cost to build by 33 percent and their cost to operate by 25 percent”. I expect that we’ll see much more of that in the coming years.

Image credit: Simple.