Credit Cards Keep Getting Cheaper

And Americans are using them more freely than they have done in years, we learn from the latest Credit Card Market Monitor report from the American Bankers Association. However, there doesn’t appear to be a correlation between these two trends, as Americans are also paying back a greater share of their monthly credit card balances than they ever have, rather than rolling them over from one month to the next and take advantage of the lower cost of credit. That trend, which is now in its sixth year, has in turn led to the lowest credit card delinquency and default rates on record.

Yet, even though by all appearances Americans are managing credit card debt more responsibly than ever (or at least in a very long time), card issuers still seem to not trust them. Why else would they continue to be cutting back their cardholders’ credit lines and be doing so across all risk categories, not sparing even the most creditworthy borrowers, as the ABA reports? Perhaps they are seeing something I don’t? Or perhaps they are expecting American cardholders to revert to type any day now? Well, I don’t know, but to tell the truth, I wouldn’t be at all surprised if the latter possibility did come to pass, even as there is absolutely no indication for it that I can see just now. But let’s take a look at the latest data.

Cost of Credit, Card Lines Decline, Spending Rises

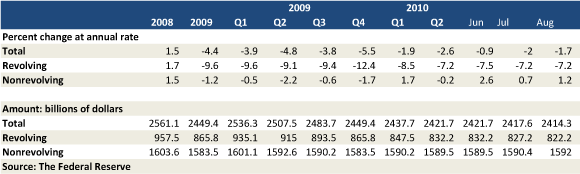

The total volume of available credit card lines of credit declined sharply during the financial crisis and subsequent recession, falling in absolute terms by 18.8 percent from the peak of $2.664 billion at the end of 2008 to $2.163 billion at the end of 2013 Q3, according to the latest New York Fed’s Household Debt and Credit Report. And while this year we’ve seen that total grow slightly, the ABA now tells us that, on a per-borrower basis, the average line of credit continues to decline and is doing so across all risk categories. We learn that, from 2013 Q1 to 2013 Q2, the average credit lines fell again, by:

- 1.5 percent for sub-prime accounts,

- 2.1 percent for prime accounts and

- 0.2 percent for super-prime accounts.

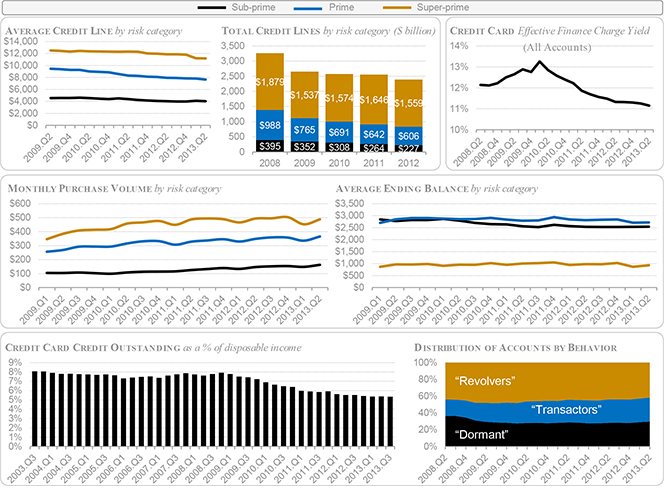

Yet, even as credit is becoming more scarce, its cost to cardholders continues to fall, as you can see in the chart below. As a share of their outstanding credit card balances, Americans are now paying less in interest charges than they have done since well before the financial crisis. To measure the cost of credit, the ABA uses the Effective Finance Charge Yield (EFCY), which is the interest charged to accounts, calculated as a share of outstanding credit balances. The EFCY fell from 12.65 percent in the first quarter of 2008 to 11.25 percent in the first quarter of 2013 and was just above 11 percent at the end of 2013 Q2. This decrease can be attributed to changing consumer and industry behavior, which is clearly illustrated in the data:

- Fewer cardholders are rolling balances from one month to the next. The transactors — cardholders who pay off their monthly balances in full — make up a greater share of all accounts. At the end of 2013 Q2, transactors made up 28.7 percent of all cardholders, up from 19.6 percent in 2008. On the other hand, revolvers — cardholders who carry a balance from one month to the next — have fallen as a share of the total from 44.4 percent of all accounts in 2008 to 41.6 percent in 2013 Q2. The remaining 29.7 percent are dormant accounts, down from 35.9 percent in 2008.

- Among revolvers, outstanding balances have become smaller, on average.

- Issuers have been changing the risk profiles of bank portfolios, shifting away from high-risk accounts.

- Money market rates and interest rates on deposit accounts have remained low.

The ABA also tells us that a significant majority of cardholders use rewards cards, with benefits such as airline miles and cash back. As of 2013 Q2, about 85 percent of super-prime credit card accounts, 75 percent of prime accounts and 57 percent of sub-prime accounts had some kind of a rewards program.

Furthermore, consumers spend significantly more on rewards cards than they do on non-rewards ones. In 2013 Q2, the average monthly spending on non-rewards cards was $166, while the average monthly spending on rewards cards ranged from $409 to $1,245, depending on the type of rewards. Here are a few charts to visualize ABA’s findings:

Card Issuers Love Super-Prime Borrowers

I suspect that few would be surprised by such a statement. Yet, the trend has been both dramatic and unique, for credit standards have actually been easing in most other consumer credit categories. Here are the latest data:

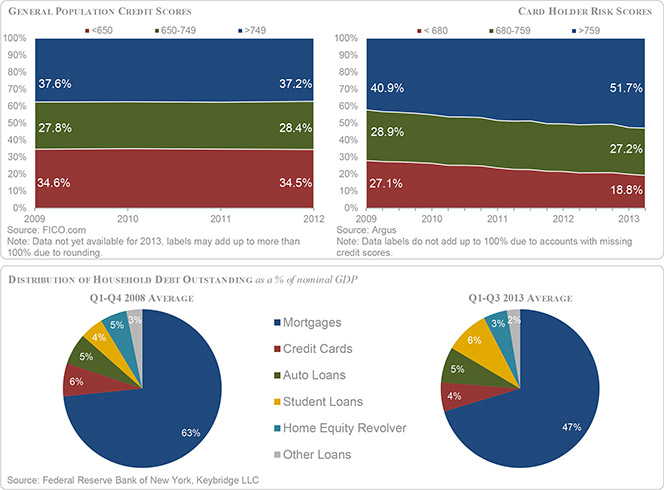

- From the first quarter of 2009 to the second one of 2013, the share of super-prime accounts (defined as having an Argus risk score greater than 759) has increased from 40.9 percent to 51.7 percent. On the other end of the scale, the share of sub-prime (Argus risk score lower than 680) cardholders declined from 27.1 percent to just 18.8 percent. In the middle of the distribution range, the share of prime accounts (680-759 Argus risk score) has remained steady.

- The distribution of risk scores among U.S. consumers has remained relatively steady since the recession, the report tells us. From 2009 to 2012, the share of the riskiest consumers (those with a FICO score lower than 650) has remained virtually flat, falling by a single basis point from 34.6 percent to 34.5 percent. Similarly, the ratio of the lowest-risk consumers (those with a FICO score higher than 749) has declined only slightly — from 37.6 percent to 37.2 percent of all consumers.

- Following five years of deleveraging, consumers are now less indebted, in absolute terms, than they were at the onset of the financial crisis. As the report notes, this trend is even more significant considering that the economy has been growing, albeit slowly, since early 2010. Yet, consumers are still reluctant to start increasing their debt burden.

- The composition of consumer debt has changed quite significantly. In particular, both mortgage and credit card debt have declined, while the student debt total has increased sharply and auto loans have remained steady.

Here are the charts visualizing these dynamics:

The Takeaway

So I guess the question I’m left with is why there has been such a huge shift toward super-prime borrowers on the credit card front and, which is actually the real puzzle, why this trend is still ongoing. After all, all the available data clearly show that Americans are managing credit card debt more responsibly than they have in a very, very long time. Well, here is what Kenneth J. Clayton, executive director of the ABA’s Card Policy Council, has to say on the matter:

We’re still exploring the factors behind the dramatic shift to low-risk accounts in the face of an improving economy and slowly easing credit standards. Regulatory restrictions on banks’ ability to manage risk, the unsecured nature of credit cards and the after-effects of the recession all play a role as banks navigate today’s economic environment.

I think that there should be more to it than that, but I can’t put my finger on it quite yet. If anyone has figured it out, please let the rest of us know.

Image credit: Flickr / StockMonkeys.com (changes have been made to the original image).