Dissecting $1T in Student Debt, Again

Few things can be relied on to catch people’s attention as safely as big, round numbers. Yes, they have to be both big and round, otherwise the effect may be lost on the intended audience. Which is why, when talking about money, say $250 million, a commentator who wants to leave a stronger impression on his readers is more likely to talk about a quarter of a million dollars. It just sounds more!

Which brings me to the student debt total. For more than a year, pundits have been writing ominous headlines about the U.S. student debt approaching $1 trillion. Of course, by itself this cool, round number tells you little about why this is a problem, but you can only get the message across if your piece gets read. And the “$1 trillion” number gives you as good a chance of achieving this goal as anything. So now that I’ve caught your attention, let me proceed to my main task.

Student Debt by the Numbers

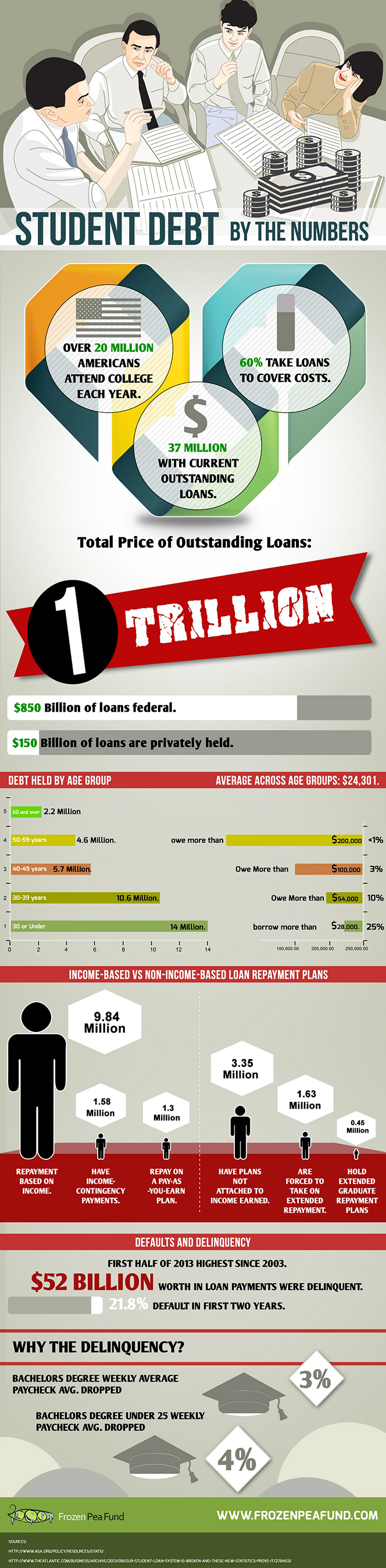

A new infographic produced by the Frozen Pea Fund reports that 60 percent of the more than 20 million Americans who attend college each year take out loans to cover their costs. As a result, there are 37 million Americans with outstanding student loans today. According to the authors’ calculation (their sources are the American Student Assistance and The Atlantic), the total amount of outstanding educational loans is between $902 billion and $1 trillion, with about $864 billion in federal loans and $150 billion in private ones.

It should come as no surprise that most of the student loan debtors are 30 years of age or younger, but quite a few older Americans owe student debt as well. Here is the age distribution:

- 30 or under — 14 million debtors.

- 30 – 39 — 10.6 million.

- 40 – 49 — 5.7 million.

- 50 – 59 — 4.6 million.

- 60 and over — 2.2 million.

The average debtor owes $24,301 in student debt, the authors tell us, however a large proportion of the debtor population owes substantially more:

- 10 percent of all debtors owe more than $54,000.

- 3 percent owe more than $100,000.

- Less than one percent owe more than $200,000.

When it comes to debt repayment arrangements, 9.84 million borrowers’ payments are tied to their income. Another 1.58 million debtors have agreed to income-contingency payment plans and 1.3 million are repaying their student debt on a pay-as-you-earn basis. On the other hand, 3.35 million borrowers’ plans are not linked to their income and 1.63 million have signed on to extended repayment plans.

Delinquency and default rates are rapidly deteriorating, we are reminded, reaching in the first half of 2013 the highest levels recorded since 2003. Overall, $52 billion are delinquent and an astonishing 21.8 percent of borrowers are defaulting within their first two years of leaving school, we are told.

The authors list falling average earnings as the main cause of rising delinquencies, presumably in addition to historically-high unemployment and underemployment rates. The average weekly paycheck of workers with a Bachelor’s Degree has fallen by 3 percent and for those under 25 years of age the drop has been 4 percent. Now, we are not told how exactly the authors have made this calculation, but those of you who want to know may dig into their sources. If you do find out, please let the rest of us know.

Now here is the infographic.

Image credit: Flickr / Bob Jagendorf.