Americans Pile up Some Credit Card Debt for a Change

In a rare break from the post-Lehman trend, Americans racked up quite a bit of credit card debt in October, we learn from the Federal Reserve’s latest consumer credit data release. Although we shouldn’t rush to make too much from a single month’s worth of data, I think it is nonetheless reasonable to expect that, if the credit card debt total rose by a good margin in October, it would do much of the same during the holiday shopping months that follow. Of course, there have been a few other similar (and bigger) spikes since 2010, but all of them have been quickly reversed in the subsequent months. So it’s too early to tell what the fate of this uptick will be.

What didn’t change this month was the relentless increase of the non-credit-card portion of the total and, most particularly, its auto and student loan components. Car sales have been helped by the ongoing recovery in the housing and stock markets and by improving employment data. However, student debt just keeps on growing, seemingly unaffected by other trends in the economy. Now, it is true that the amount of outstanding federal student loans, which make up the bulk of the overall total, has slowed down considerably this year, and that is good news, considering the relentless explosion it had undergone over the past decade. However, the inflation of the student debt bubble has inevitably led to a huge and ongoing rise in charge-off and delinquency rates, whose end is nowhere in sight. And anyway, the growth of federal student debt seems to once again be gathering speed.

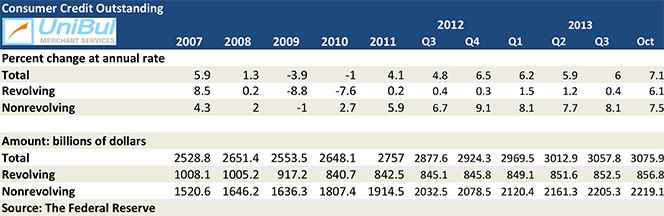

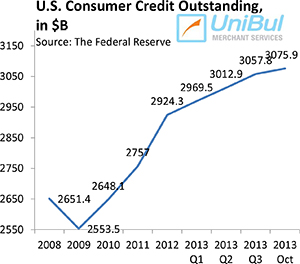

In all, Americans added to the total amount of outstanding consumer debt for yet another month in October and, once again, that gain was larger than anticipated. This was also the 26th consecutive monthly increase. The total expanded by $18.2 billion, following an upwardly revised $16.3 billion gain in September. Now let’s take a closer look at the latest Fed data.

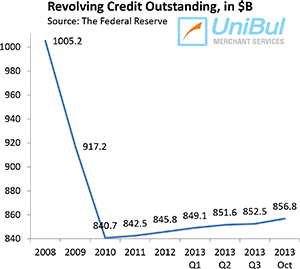

Credit Card Debt up by 6.1% in October

The total consumer revolving credit in the U.S., which is almost exclusively comprised of outstanding credit card balances, rose in October at a seasonally adjusted annual rate of 6.1 percent, or $4.3 billion, from the previous month’s level, after a downwardly revised 0.3-percent decline in September. As you can see in the chart to the right, the credit card debt total in the U.S. went into a free fall in the aftermath of the financial meltdown in September 2008 and the process went on uninterruptedly until the end of 2010. Since then, it has bounced up and down, but has remained virtually unchanged.

The total consumer revolving credit in the U.S., which is almost exclusively comprised of outstanding credit card balances, rose in October at a seasonally adjusted annual rate of 6.1 percent, or $4.3 billion, from the previous month’s level, after a downwardly revised 0.3-percent decline in September. As you can see in the chart to the right, the credit card debt total in the U.S. went into a free fall in the aftermath of the financial meltdown in September 2008 and the process went on uninterruptedly until the end of 2010. Since then, it has bounced up and down, but has remained virtually unchanged.

The total for October — $856.8 billion — is just 1.9 percent, or $16.1 billion, above the total reported at the end of 2010 ($840.7 billion) — at the height of the credit card debt deleveraging process. Furthermore, the current total is lower by 14.8 percent, or $148.4 billion, than the all-time record-high of $1,005.2 billion recorded at the end of 2008.

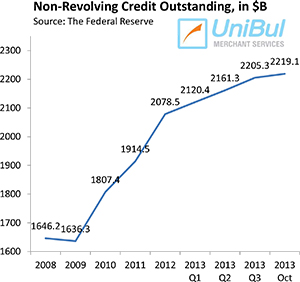

Non-Revolving Consumer Credit up by 7.5%

The non-revolving component of the U.S. consumer debt total, a mixture of student loans, auto loans and loans for mobile homes, boats and trailers, but not including home mortgages and loans for other real estate-backed assets, continued to expand, in keeping with another long-standing trend. The Federal Reserve reported a $13.8 billion — or 7.5 percent — increase in October from September’s level, bringing the total up to $2,219.1 billion. That followed an upwardly revised 9.1 percent ($16.5 billion) increase in September.

The non-revolving component of the U.S. consumer debt total, a mixture of student loans, auto loans and loans for mobile homes, boats and trailers, but not including home mortgages and loans for other real estate-backed assets, continued to expand, in keeping with another long-standing trend. The Federal Reserve reported a $13.8 billion — or 7.5 percent — increase in October from September’s level, bringing the total up to $2,219.1 billion. That followed an upwardly revised 9.1 percent ($16.5 billion) increase in September.

As you can see in the chart to the right, the non-revolving portion of the total consumer debt didn’t fall nearly as precipitously as the revolving one in the wake of Lehman’s collapse and then it was much quicker to recover the lost ground.

Overall, with the lone exception of August 2011 when it fell by 5.2 percent, the non-revolving debt total has increased in every month since July 2010. The figure for October of this year was higher by 37.2 percent, or $601.7 billion, than the pre-crisis peak of $1,617.4 billion, measured more than five years ago, in July of 2008.

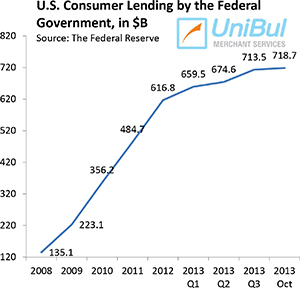

Student, Auto Loans Up Once Again

After a period of moderate growth from February through July, the federal student loan total rose substantially in the following two months. The Fed data tell us that lending to consumers by the federal government — which is mostly made up of educational loans — rose by $5.2 billion in October to $718.7 billion, following a downwardly revised $12.8 billion spike in September and an even bigger $22.5 billion increase in August. The biggest increase this year occurred in January when that total grew by $25.9 billion. Overall, since the end of 2008, when it stood at only $135.1 billion, the total of outstanding federal government loans to American consumers has skyrocketed by an astonishing 432 percent, or $583.6 billion.

After a period of moderate growth from February through July, the federal student loan total rose substantially in the following two months. The Fed data tell us that lending to consumers by the federal government — which is mostly made up of educational loans — rose by $5.2 billion in October to $718.7 billion, following a downwardly revised $12.8 billion spike in September and an even bigger $22.5 billion increase in August. The biggest increase this year occurred in January when that total grew by $25.9 billion. Overall, since the end of 2008, when it stood at only $135.1 billion, the total of outstanding federal government loans to American consumers has skyrocketed by an astonishing 432 percent, or $583.6 billion.

Propelled by low interest rates, cars and trucks continued to sell very well in October, at an annualized rate of 16.3 million after a 15.2 million rate in September — the strongest gain since 2007, according to Bloomberg. Bloomberg also tells us that each of the three big American automakers either handily exceeded (Chrysler and Ford) or matched (GM) the average estimates for the month.

Overall Consumer Credit up by 7.1%

The total amount of outstanding U.S. consumer credit — the sum of the revolving and non-revolving components — rose by 7.1 percent, or $18.2 billion, to $3,075.9 billion in October. The numbers for September were revised upwards, for a gain of 6.4 percent or $16.3 billion.

The total amount of outstanding U.S. consumer credit — the sum of the revolving and non-revolving components — rose by 7.1 percent, or $18.2 billion, to $3,075.9 billion in October. The numbers for September were revised upwards, for a gain of 6.4 percent or $16.3 billion.

The new total is larger by $488.4 billion, or 18.9 percent, than the pre-Lehman record-high of $2,587.5 billion, measured, once again, in July 2008. Almost the entire gain is the result of the rise in non-revolving credit, as the revolving portion has remained virtually during the period.

The Takeaway

So it looks quite likely that we may have already seen the end of the post-crisis debt deleveraging process. We saw strong indications of that in the latest quarterly report on household debt from the NY Fed. Yet, looking at the latest data on credit card delinquencies and charge-offs, it looks just as likely that Americans are still very reluctant to take on more credit card debt and increases like the one in October may be no more than aberrations. See, both the credit card charge-off and delinquency rates have just set new record-lows.

The credit card delinquency rate in the U.S. fell in October by three basis points to 1.25 percent — a 26.5-percent annual drop — according to Fitch Ratings. At the same time, charge-offs fell by 14 basis points to 2.98 percent — the first time ever the index fell below the three-percent threshold and 28.4 percent below the level of a year before. Moreover, Fitch’s monthly payment rate (MPR) — the share of Americans’ total credit card debt they pay at the end of each month — rose to 26.55 percent, a record-high and an 18-percent annual increase. So yes, Americans are still very reluctant to roll credit card debt over from one month to the next and as long as they remain in such a mood, delinquencies and charge-offs will not be an issue.

Image credit: Flickr / Josh Kenzer.