Young Americans Have Fewer Credit Cards, but Bigger Problems Managing Them

Experian — one of our three major credit reporting agencies — has analyzed the debt management behavior of four generational age groups in the U.S. and has found that the youngest among them (the Millennials) have the lowest average credit score and worst credit habits. Youngsters, we learn, have fewer credit cards and less debt, on average, than older Americans, but they use a much greater share of the credit limit available to them and are much more likely to be late paying their credit card bills. Naturally, then, the upshot is that the youngest generation has by far the lowest credit score average.

Now, the first thing to note is that Millennials would have had lower-than-average credit scores, even if they managed debt every bit as well as members of the older generations. To begin with, credit history is a major component of the credit score algorithm (the longer, the better) and is beyond anyone’s control. Then there is the revolving utilization ratio — another score’s component — which is also certain to be worse by default for Millennials than for older generations. The reason is that borrowers with shorter credit histories get credit cards with lower limits than those with longer files and so, the same amount of spending would translate into very different utilization ratios.

However, Millennials have scored the highest late payments average and that is their biggest problem: yes, delinquencies may be higher among youngsters, because they are less likely to be employed, but they should still be doing a better job at paying their bills on time, as this is an error, which will haunt them for a long time to come. Now let’s take a look at Experian’s findings.

A Credit Tale of Four Generations

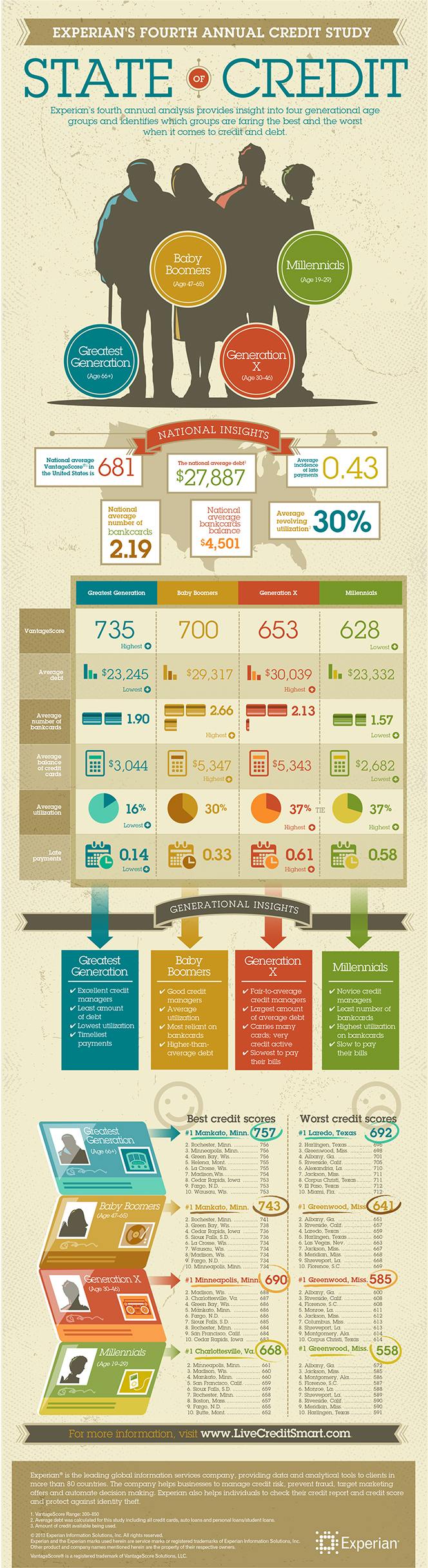

Let’s begin with the national averages. The study finds that the average debt in the United States is $27,887, the average number of bankcards is 2.19, the balance on those bankcards is $4,501, the revolving utilization ratio is 30 percent, the incidence of late payments is 0.43 and the VantageScore is 681 based on a range from 300-850. The thing that immediately jumps out at me here is the very high utilization ratio: even after all the post-Lehman deleveraging, that ratio is still at a level considered as borderline unacceptable by FICO, the nation’s biggest provider of consumer credit cores, which recommends that we keep it at around 20 percent.

Now let’s focus on the generational differences. Experian segments the U.S. population into four generational groups: the Greatest Generation (ages 66 and older), Baby Boomers (ages 47 to 65), Generation X (ages 30 to 46) and Millennials (ages 19 to 29) and examines their credit scores, the number of credit cards they have, how much they are spending on those cards and the occurrence of late payments. Here is what they find for each group:

1. Greatest Generation. This generation has the lowest average debt ($23,245), the lowest utilization ratio (16 percent), the lowest incidence of late payments (0.14) and the second-lowest bankcard balances ($3,044), which translates into by far the best average credit score (735).

2. Baby Boomers. At 2.66 per person, this generation has by far the most bank cards of all four age groups and it relies heavily on them, racking up the highest average balance ($5,347). Moreover, at 30 percent, this group’s average utilization ratio is almost twice as high as the Great Generation’s and the incidence of late payments is more than twice as high. Add to that the much higher average debt load ($29,317) and one is left wondering how it is possible that their average credit score (700) would be so close to the leading group’s.

3. Generation X. At $30,039, this group has the highest average debt. Moreover, Generation X-ers had the highest utilization ratio (37 percent) and the highest incidence of late payments (0.61) and the second-highest average bank card balance ($5,343). All that resulted in a VantageScore of 653 — the second-worst among the four age groups and 28 points lower than the national average.

4. Millennials. As I already noted, at 37 percent, this group has the highest utilization ratio (shared with Generation X) and it also has the second-highest incidence of late payments (0.58). By most measures, Gen X-ers score worse than Millennials, yet, for reasons already discussed, the latter group has the lowest credit score average.

Here is a snapshot of the generational differences:

|

|

Greatest Generation |

Baby Boomers |

Generation X |

Millennials |

|

Average Debt |

$23,245 |

$29,317 |

$30,039 |

$23,332 |

|

Average number of bank cards |

1.90 |

2.66 |

2.13 |

1.57 |

|

Average balance on bank cards |

$3,044 |

$5,347 |

$5,343 |

$2,682 |

|

Revolving utilization ratio |

16% |

30% |

37% |

37% |

|

Late payments incidence |

0.14 |

0.33 |

0.61 |

0.58 |

|

VantageScore |

735 |

700 |

653 |

628 |

If I had to point to one number that stands out from the rest, I would single out the incredibly low credit score for the Generation X group.

We Are Doing Alright, or Are We?

The study’s authors conclude that, overall, Americans are managing credit quite well:

In summary, the State of Credit for Americans is very healthy overall, with room for improvement for the younger generations. While there are some areas that have commonalities—both positive and negative—across the generations, such as the consistent low credit scores in Greenwood, MS or the high credit scores in Minneapolis, the true common thread is that with positive credit behaviors, the needle can be moved in the right direction.

But I see the data quite differently. Whereas delinquencies are very low by historical standards, the same cannot be said for the utilization ratio. See, we’ve just gone through a huge five-year long debt deleveraging process, during which the total amount of credit card debt fell by 15.7 percent, from $1,005.2 billion at the end of 2008 to $846.9 billion at the end of September of this year, even as the population grew. Yet, even after all this deleveraging, the average revolving credit utilization ratio is 30 percent, which the makers of credit scores consider borderline unacceptable. Moreover, at 37 percent for the two youngest age groups, that ratio is excessively high.

Now, it is true that during the post-Lehman period, the number of active credit cards fell dramatically, from a high of 496.12 million in the second quarter of 2008 to 391.24 million at the end of this year’s third quarter (source) — a fall of 21 percent. That has kept the utilization ratio from falling too low. Yet, the fact remains that younger Americans are excessively reliant on the credit cards they have, which holds their credit scores down and prevents them from getting the most favorable terms on new loans.

The Takeaway

So yes, as Experian says, younger generations should do a better job at managing debt. But can we realistically expect much improvement? After all, there are strong indications that the debt deleveraging process may have run its course. Furthermore, delinquencies have long been at historically-low levels and there are signs that they have reached bottom. I guess a loosening of lenders’ underwriting standards would increase the number of cards in the hands of Americans, which might bring down the utilization ratio, but that would not decrease their debt load and in fact it is more likely to increase it. So it is not easy to see where an improvement might come from.

I leave you with the excellent infographic that comes with Experian’s study.

Image credit: Wikimedia Commons.