Why Math Rules and the End of Square’s Flat-Rate Pricing

I was going through my news feed this morning, checking on the latest goings-on in the payments industry, which is how my work days usually begin, and wasn’t seeing anything special. So I switched my attention to social media and somehow ended up on Square’s Facebook page, which I don’t believe I’d done in at least a year. And that’s when I got really lucky.

See, it turns out that Square, the much-praised (including on this blog) mobile payments company, had done away with its extremely merchant-friendly flat-monthly-fee pricing model (I’ll remind you how it works in a bit) and its clients were, understandably, very, very unhappy with the decision. And the merchants were letting Square know exactly how they felt about it. I couldn’t believe that I would have missed such big news, but went to the “News” section of Square’s website to learn more about it and promptly found absolutely nothing. Getting slightly puzzled, I then googled “Square flat pricing” (without the quotation marks for a greater reach) and again found precisely nothing about a discontinuation of the flat-fee option. Unperturbed, I dug deeper and narrowed my search to “News”. That’s when I finally found what I was looking for. “Square Discontinues Monthly Flat-Rate Plan” declared the top headline, but, disturbingly, there were only three reports on the matter. Compare that to the hoopla that surrounded the launch of the flat-fee pricing.

I’ve rarely criticized Square, for they’ve done a marvelous job of bringing credit card acceptance to the masses and their product is truly outstanding — the company was the first one to give even the smallest of merchants free access to payment processing tools, which before Square only large merchants could afford. Unsurprisingly, merchants responded by signing up for Square in their hundreds of thousands. However, the way the processor has been handling the discontinuation of its flat-fee model is deplorable and its merchants have every right to be as unhappy as they are. Let’s take a look into the issue.

Square’s Flat Monthly Fee

Let’s begin by reviewing how the processor’s pricing plan in question works. Back in August of last year, Square introduced a flat-fee monthly plan, under which merchants would pay $275 per month and zero percent per swiped transaction for payment amounts under $400 and for a monthly sales volume of up to $21,000 (about $250,000 annually). If a merchant who’d signed up for the plan accepted a swiped payment for an amount greater than $400, it would be processed at the standard rate of 2.75 percent, as would all swiped transactions over the monthly limit of $21,000. All key-entered payments, irrespective of the transaction amount or monthly volume, would still be processed at 3.50 percent plus $0.15 per transaction.

Now, assuming that the average sales amount was lower than $400, at $275 per month, the flat-monthly-fee plan made perfect sense for all Square merchants, which were processing more than $10,000 in swiped transactions, on a monthly basis, but not for merchants processing less than that. So, if you were a Square user and your monthly processing volume was greater than $10,000, switching to the monthly plan would have saved you money, and, in some cases, a lot of it. For example, if you had switched to the flat-monthly-fee pricing plan and accepted $20,000-worth of swiped transactions over the course of the next full month, you would have been charged twice less in processing fees than you would have paid if you had stuck to the pay-as-you-go arrangement. So, unsurprisingly, merchants liked the offer. And now they are angry.

The Math Doesn’t Add Up

The worst part of the whole thing is that Square had buried the announcement of the discontinuation deep within its website, evidently hoping that it would fly under the radar and life would just go on as normal. But the announcement itself is quite something on its own right — here it is:

We launched a monthly flat rate to offer flexibility in pricing for larger businesses. Over the past year we heard from many of our customers that caps and limits in the program were inhibiting growth–at a certain point, rates went back up the more you sold. So, effective February 1, 2014, we’re replacing the Square monthly pricing program with one low per-swipe rate for your business.

We want our pricing to be simple: no more limits or complicated monthly caps at all. Just one low, flat per-swipe rate for your business.

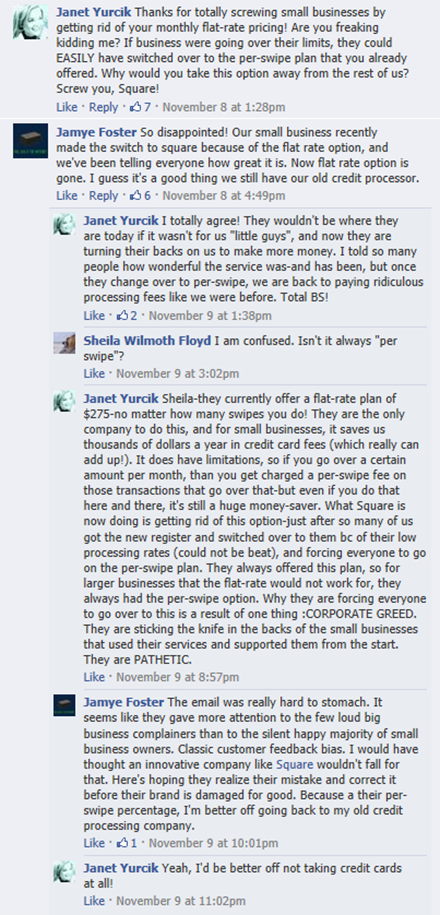

OK, by all accounts, Jack Dorsey is a very smart man, and his board is full of impressive personalities (Larry Summers, Vinod Khosla, David Viniar, etc.). But just how stupid does he think the rest of us are? How could you say that the “caps and limits in the [flat monthly fee] program were inhibiting growth”? On the contrary, regardless of how big your volumes were, you’d be saving big on your first $21,000 or so in monthly card sales and then pay the standard fee on your additional sales. How does that inhibit your growth? It saves you money! Unsurprisingly, Square’s merchants are having none of it. Here is what they are telling their processor on its own Facebook page:

I wish I saw the email, which Square had sent to its merchants to break the news to them. I suspect it would have been similar to the announcement on the processor’s website, but even if it were better — after all, it could get no worse — it couldn’t possibly hope to prevent the outrage. And the company fully deserves it — they created a pricing plan, which left them with very little room for profits and now they’ve come to regret it. But rather than state the real reason for discontinuing it — the math doesn’t add up — they are giving us all this nonsense — and their merchants are calling them on it.

The Takeaway

So Square has handled the matter in an appallingly bad manner. It is true that, whatever approach they might have chosen, the Square guys would still have taken a lot of flak from their merchants, but they still could and should have done better. And this is not the first time the company has been less than straightforward with us.

Regular readers may remember that, very early in the start-up’s existence, Jack Dorsey was railing against the credit card industry’s “misleading practices”, even as he was employing some of them. Then, in August of last year, Square and Starbucks made a huge announcement, in which they made it sound as though Square would start processing all of the coffee chain’s card transactions. Now it looks as though that was merely a publicity stunt on the part of both companies. So viewed in the light of previous events, the flat-monthly-fee venture could be seen as just another piece of the company’s marketing strategy. Only that this time it blew up in their faces.

Image credit: Square.

Just in case you haven’t seen it here is the very offensive letter that Square sent. The reason that they give businesses they give for the change is that it is too confusing for them to get something for free so instead they will just charge you for everything because that will be easier for you.

SQH,

Thanks for posting the letter! I hadn’t seen it, but it’s as bad as the company’s announcement on their website: “caps and limits in the program were inhibiting growth”, etc. I guess it would have been funny, if it hadn’t negatively affected so many merchants.