Crediting the Holiday Season

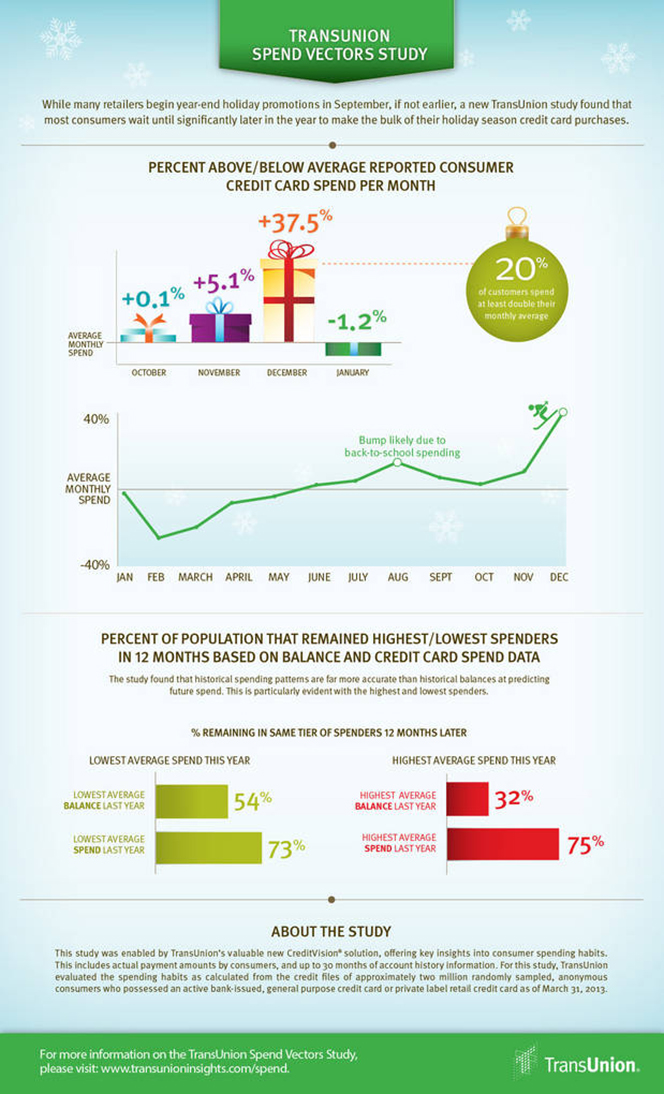

As everyone else, I’ve always known that credit card spending in the U.S. is highest during the holiday season, but I’ve never really looked into detailed data on the precise characteristics of the seasonal peak. Well, this morning I finally had a chance to fill this gap in my knowledge when I came across a TransUnion study on the subject. It confirms the anecdotal evidence and adds some interesting facts.

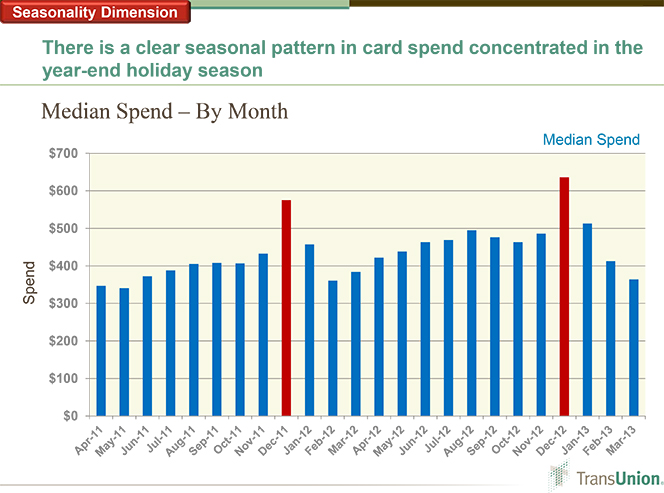

I guess my biggest surprise was to learn that credit card spending remains fairly flat until December — in fact it dips a bit following the back-to-school shopping period in August. Yet, as the study notes, many retailers begin their year-end holiday promotions as early as in September. I’ve always found this policy somewhat puzzling and now I find my skepticism justified. Let’s take a look at TransUnion’s findings.

Waiting for the last Minute

TransUnion finds that most Americans wait until December, before they start using their credit card for holiday season purchases. Whereas consumer spending reported for November is 5 percent higher than that for a typical month, this total is only the third-highest for the year and is considerably lower than the spending levels reported for December. The second-highest spending month for the year turns out to be August, when consumer spending is 7 percent higher than average, which the authors explain with the “back-to-school” shopping season.

|

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

|

-1.2% |

-21.9% |

-17.0% |

-8.8% |

-5.3% |

0.1% |

1.4% |

7.0% |

2.9% |

0.1% |

5.1% |

37.5% |

One month clearly stands out from the rest.

Credit Card Spending Explodes in December

Looking at the data, it is clear to me that the holiday shopping season consists of a single month — December. Here are TransUnion’s main findings:

1. The median card spending in December is 35-40 percent higher than the annual median. The chart below shows the median monthly consumer card spending:

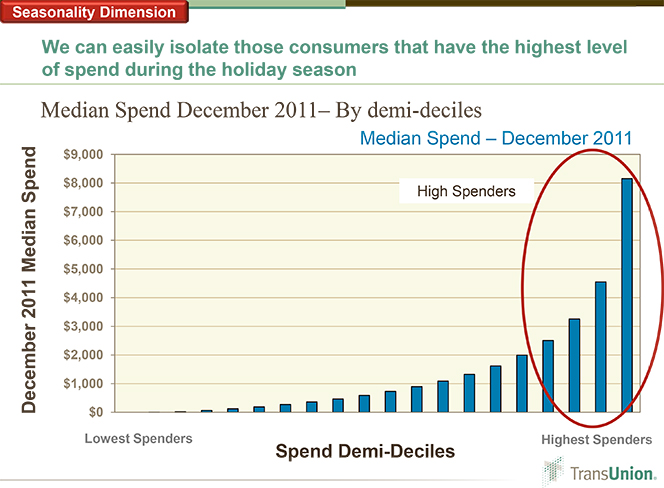

2. A fifth of consumers spend at least twice as much in December on their cards as they do on average throughout the year. Furthermore, the top 5 percent of the highest spenders spent more than $8,000 in December 2011 — more than twice the average of the next three demi-deciles, as seen in the chart below.

3. 60 percent of consumers in the top 20 percent of holiday spending in a given year will be in the same top bracket the following year.

|

% Remaining in that tier of SPENDERS 12 Months Later |

% Remaining in that tier of SPENDERS 12 Months Later |

||

|

Lowest Average BALANCE Last Year |

54% |

Lowest Average SPEND Last Year |

73% |

|

Highest Average BALANCE Last Year |

32% |

Highest Average SPEND Last Year |

75% |

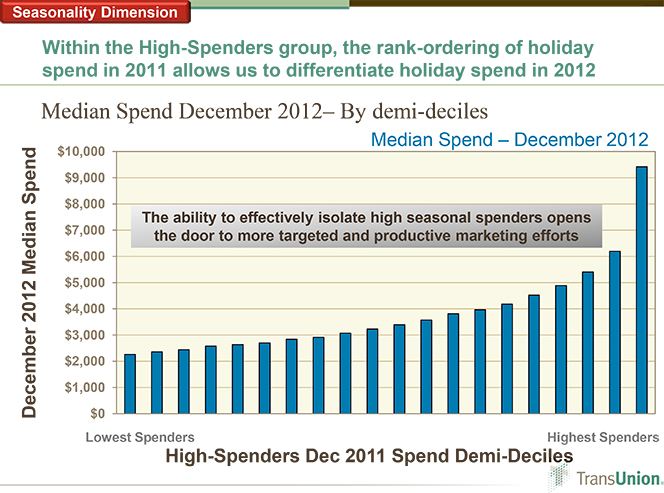

4. Among high-spending consumers, the level of holiday card spending in a given year perfectly rank-orders the level of holiday card spending observed in the following year. This means that, when TransUnion segmented the highest spenders of 2011 into 20 groups based on their reported December spending, each of these groups continued to rank their holiday spending in the same order in the following year.

The Takeaway

So TransUnion’s study tells us that, whether retailers choose to recognize it or not, there is really only one holiday shopping month — December. Furthermore, we learn that the very same consumers who spent the most in the previous year are likely to be the highest spenders again this year. Here is how Ezra Becker, vice president of research and consulting in TransUnion’s financial services business unit, interprets his study’s findings:

This finding suggests there is a three in four chance that the same individuals who spend either the most or least on their credit cards will remain the same the following year. Financial institutions, who had previously only been able to observe their own portfolios for spend information, can now use these data to better market their products to consumers. As a result, consumers utilizing credit cards may receive better interest rates, better credit lines or more rewards from lenders — in other words, a better fit of products to their needs.

In other words, the more you spend, the better credit card terms you’d be likely to get.

Finally, here is the infographic TransUnion has produced to go along with the study:

Image credit: Flickr / Wonderlane.