How MasterCard Processes 74B Transactions a Year

The payment card networks have existed for more than five decades, Susan Herbst-Murphy from the Federal Reserve Bank of Philadelphia reminds us in a newly-published paper. During that time, through seven recessions and all kinds of other economic, political, and social tribulations, they have never failed to settle transactions, she notes. MasterCard, the author tells us, reports that its processing system is available 99.9 percent of the time. For its part, Visa claims that its own network was available 100 percent of the time for 18 consecutive peak seasons. Such an impressive record of dependability has doubtless played a key part in the growth of these payment networks and their expansion over the years into debit and prepaid cards, to go along with the original credit card product, Herbst-Murphy concludes.

And the volumes that are being transacted are staggering. In 2010, U.S. electronic payment exchanges handled $3.8 trillion of remittals from consumers to merchants. Another $616 billion in commercial payments was settled through the payment card systems that year. To get a better understanding of interbank clearing and settlement in the U.S., the Philadelphia Fed’s Payment Cards Center has met with executives of MasterCard — the second-biggest U.S. payment card network — and in her paper Herbst-Murphy shares with us what she learned. I will give you what I believe is the gist of her paper and encourage you to read the whole thing.

Authorizing 74 Billion Transactions a Year

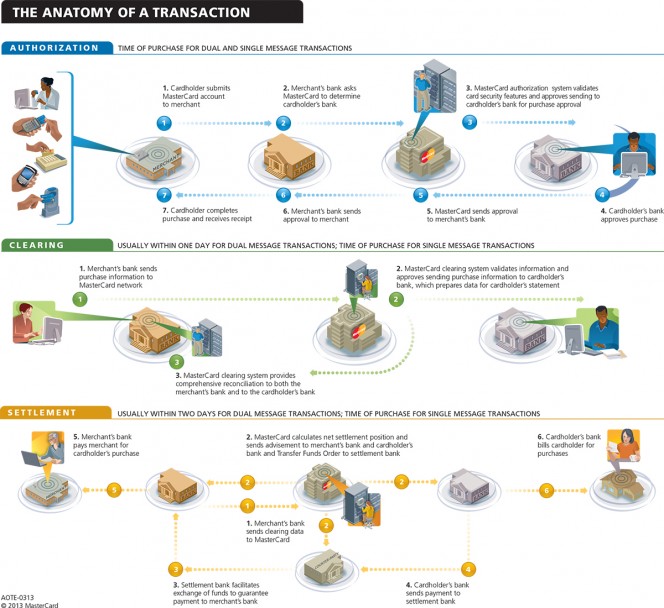

Here is the author’s detailed description of the card payment authorization process, which is the first stage of the transaction cycle:

It happens in seconds and it happens more than 74 billion times a year: The selling party to a transaction transmits a customer’s payment card information electronically into an interconnected global architecture designed to communicate information for a specific transaction from the seller to the buyer’s?á financial institution.1 When a customer’s payment card information is electronically exchanged between the selling party (referred to in a payment card transaction as a merchant) and the buyer’s financial institution (referred to in a payment card transaction as the cardholder’s issuer), a process of automated tests and decisions begins, starting with authentication of card validity. Another step in the process verifies that the account is open, is in good standing, and has the available buying power for the amount of the purchase. Anti-fraud controls are applied at various steps along the route. The results of all these tests and decisions are returned to the merchant. Electronic records of the exchange (called an authorization) are created within the merchant’s system and also at the cardholder’s bank.

All in less time than it takes to read this sentence.

In 2012, we learn, MasterCard handled more than 160 million transactions per hour with an average network response time of 130 milliseconds.

Each card transaction that is successfully authorized in the manner described above is completed when the seller’s (merchant’s) bank account is credited with, and the buyer’s (cardholder’s) account is debited for, the amount of the purchase. This exchange of transaction information and money between buyers and sellers is achieved through the interbank clearing and settlement of card transactions.

Clearing Card Transactions

Clearing is the exchange of transaction-related data, which provide the verification for the money debited from issuers — the banks that service cardholders — and credited to acquirers — the banks that provide card services to merchants. The banks also use the clearing data to update their customers’ accounts with the relevant transaction information and for their own account management purposes.

From the thousands of acquiring banks, which use its payment network, representing millions of merchants throughout the world, MasterCard receives many millions of electronic drafts for clearing each processing day. The network then identifies the issuing banks for these drafts and organizes the electronic reports to be transmitted to each respective issuer. These reports contain all the details that the issuer needs to conduct its activities, including posting transactions to its cardholder accounts and facilitating disputes on behalf of its cardholders, as well as enabling it to calculate the total dollar amount it owes to the acquirer of each transaction.

To give us a sense of what it takes to ensure that transaction data are cleared reliably on such a scale, MasterCard tells us that its “primary data center in St. Louis houses 595 miles of copper infrastructure, 508 miles of fiber-optic cable, three miles of cable trays, and enough backup power capacity to support a town with 10,000 homes”.

Settlement of Card Transactions

Once the data are exchanged between the various transaction participants, MasterCard’s network facilitates the actual exchange of money between them. This process is known as settlement. During settlement, all the customer activity of a bank that is a member of the MasterCard network, both credits and debits, is summed up and the net amount is transferred in a lump sum into that bank’s account, in the case of an acquirer, or from the member bank’s account, in the case of an issuer.

For issuing banks, most of their cardholders’ activity falls into the debit category — they are making purchases for which their bank will pay into settlement on the cardholders’ behalf. But some cardholder transactions, most prominently merchandise returns, fall into the credit category, for which the issuer is paid from settlement. ATM cash disbursements to cardholders from other banks would also be accounted for as credits to an issuer’s daily settlement amount. MasterCard subtracts the total of the debits from the value of the credits, and the net remaining amount is collected from the issuer through settlement.

For acquiring banks, most of their merchants’ activity falls into the credit category — they generate an incoming flow of funds through the settlement process. But refund and return transactions create debits to the merchants (and credits to the cardholders, as explained in the previous paragraph). These debits are deducted from the total of funds owed to the acquirer, and the net amount is deposited into the acquiring bank’s account during settlement.

Also during the settlement process the interchange fees are collected from the acquirers and credited to the issuers for all sales transactions. However, for cash advances, cash withdrawals, credits and returns, the interchange flows in the opposite direction and the issuer pays interchange fees to the acquirer.

Following settlement, the issuing and acquiring banks proceed to post the appropriate debits and credits to their cardholder and merchant customer accounts.

The figure below (click on image for a larger size) offers a graphic illustration of the authorization, clearing, and settlement stages of MasterCard’s dual-message transactions — the company’s credit and signature-authenticated debit transactions (PIN-based transactions are known as single-message transactions).

Image credit: Wikimedia Commons.