The Problem with Cash and the Rise of the Digital Dollar

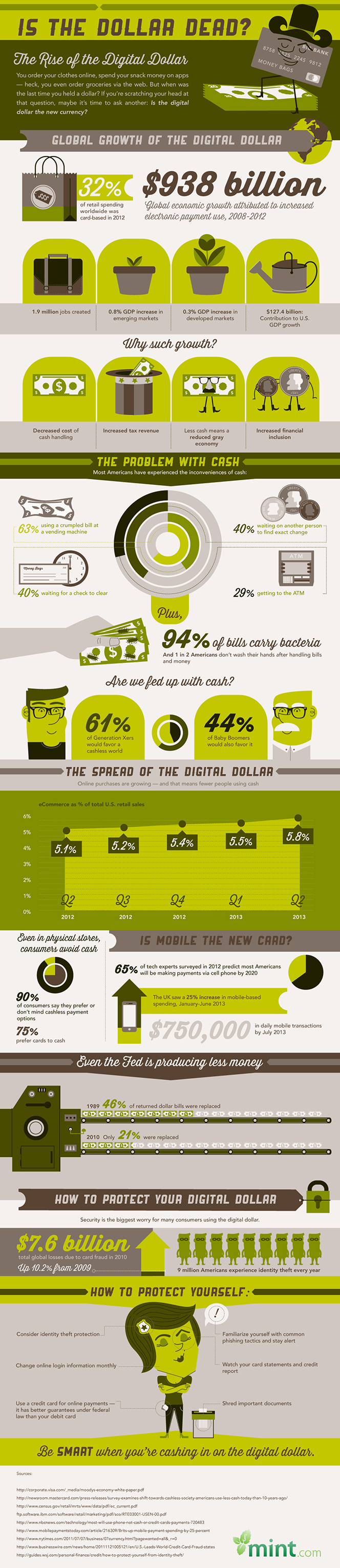

You can buy anything online or through apps these days, even groceries, but when was the last time you held a paper dollar in your hand, asks Mint.com in a new infographic. Is the digital dollar the new currency? Well, the shift away from paper money and toward the virtual variety has been an ongoing process for many decades now and it has been quite clear for a long time that the greenback’s days are numbered. And the furious proliferation of mobile wallets in recent years has further sped up the transition.

Mint.com’s infographic tracks the rise of the digital dollar and visualizes some top-line statistics about its impact on the broader economy. Some of the numbers are eye-popping, other stats are dubious, but in the eyes of consumers virtual money’s advantages clearly outweigh its shortcomings. There is a lot that can be said on the subject and no infographic, however detailed, can hope to cover the whole story, but I thought I’d show you this one and let you draw your own conclusions.

The Rise of the Digital Dollar

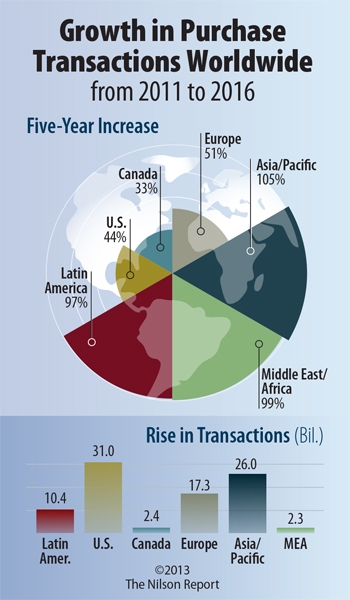

In 2012, close to a third — 32 percent — of all retail spending worldwide was card-based, we are reminded. Moreover, going forward, the process is likely to accelerate. As shown in the charts below, The Nilson Report — a newsletter, which provides news and statistics about the payment industry — projects a spike in the growth rate of card transactions for the period 2011 – 2016.

Close to a trillion dollars of global economic growth has been attributed to the increase of electronic payment use in the period 2008 – 2012, Mint.com tells us in its own graph. Some trivial inconveniences are listed as reasons why cash is being replaced, but I think the major ones have been left out. Most conspicuously, you just can’t use cash to pay online, so the continual growth of e-commerce by itself would be sufficient to keep driving down the share of cash transactions.

Moreover, most of us wouldn’t carry large sums of cash around, lest we lose it or have it stolen from us. After all, we could use a credit card just about anywhere cash is accepted and get rewarded for doing so in the form of cash-back, airline points or something similar. In other words, an item which would cost us $100 in cash could cost us $98 if paid for by credit card. Moreover, whereas your credit card could also get lost or stolen, you are not held liable for unauthorized purchases — if someone fraudulently uses your credit card, the issuer and merchant split the losses. In stark contrast, if you lose a $100-bill, no one else bears the liability but you: you lose $100 — it’s as simple as that. And anyway, does anyone like filling his pocket with loose change?

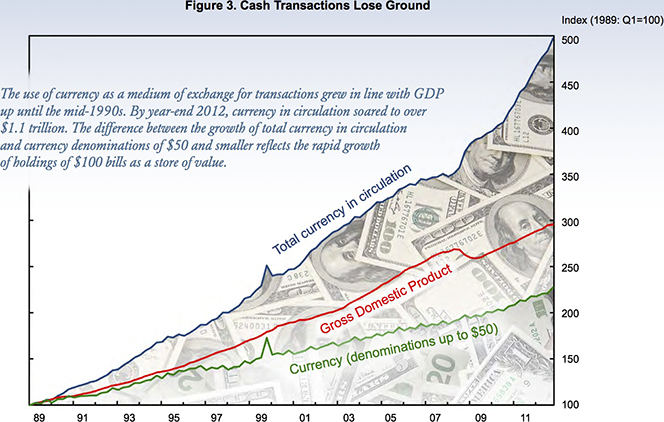

Now, it is true that the total amount of currency in circulation in the U.S. has been rising at an accelerating rate, even as the use of cash for transactional purposes has been declining. Tellingly, however, the growth has been entirely the result of the rapid growth of holdings of $100-bills, whereas the growth rates of smaller denominations have lagged the growth rate of the GDP, as seen below (source).

The extra currency is unlikely to be used for everyday payments — how often do you use $100-bills at the checkout? What then? Well, here is how Paul Krugman explained it:

The motives for holding cash, especially in the form of $100 bills, have been around for a long time; in large part it’s about evading taxes, and the law in general. (Latin American drug lords hoard high-denomination dollar currency; Russian beeznessmen do the same with big euro notes).

For the time being at least, you can’t store digital dollars under your mattress. But if someone could figure out how to do that, the victory of the digital dollar over its greenback counterpart would be complete.

Now here is Mint.com’s infographic:

Image credit: Flickr / Ze Moo.

The problem with Bitcoin is since there is no central authority, who guarantees authenticity, and how are you protected against devaluation and/or re-issuance? I trust the US dollar, the Swiss Franc, the British Pound, The Australian dollar, and the various Scandinavian currencies (The Euro, not as much).

To me, Bitcoin is right on the same level as Iraqi dinar and Zimababwe dollar…..

The banks have been creating this false sense of money for years and it seems to work well at convincing people it’s real. I believe we should go back to the barter system to keeps people honest… Just saying.