Interchange Fees: How Much Do U.S. Merchants Pay?

As regular readers know well, one of this blogger’s most frequently voiced complaints is about the difficulties of explaining to merchants how the interchange-plus pricing structure works. It is by far the best pricing plan for credit and (especially) debit card acceptance available to both U.S. and international businesses, but its inherent unpredictability puts merchants off. On the face of it, it’s all quite simple: for each card payment you accept, your fee is the sum of your processor’s mark-up and the interchange fee, charged by the card issuer. But here is the issue: whereas the mark-up is fixed and known in advance, the interchange fee is not and it can vary quite widely. And so the inevitable question follows: “What is the highest interchange fee I am likely to pay?” At that point I know that I’m fighting a losing battle.

Well, not anymore. The answer to the above question, of course, is that what matters is not the highest possible interchange rate, but its average. Until recently, the problem was that I couldn’t point a merchant to a reliable source of data, where she could easily see what other businesses were paying in interchange fees. Now, however, Fumiko Hayashi and Emily Cuddy from the Federal Reserve Bank of Kansas City have done a lot of work to compile the relevant data for us. As a result, we now have the averages for credit and debit card interchange fees in the U.S., going as far back as the mid-1990s. Compare that work to the interchange tables published biennially by Visa, MasterCard and Discover (American Express does not charge interchange fees separately from processing fees) and you’ll understand what I have been up against. Now I can simply point a merchant to these charts and move on. Here are the most interesting ones among them.

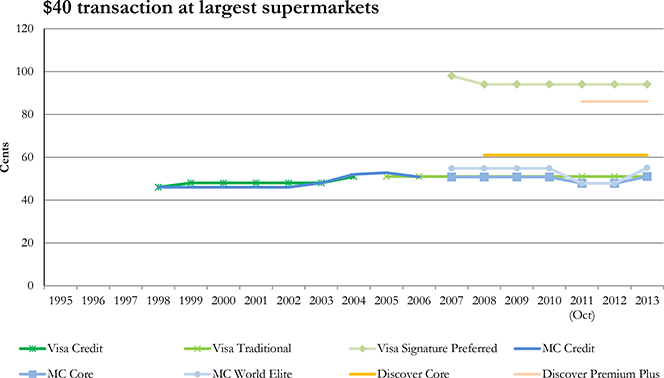

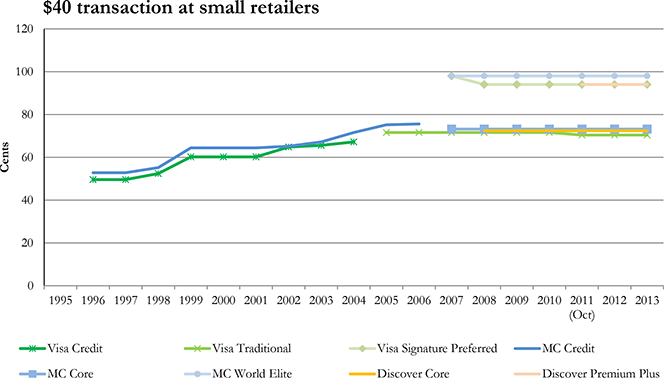

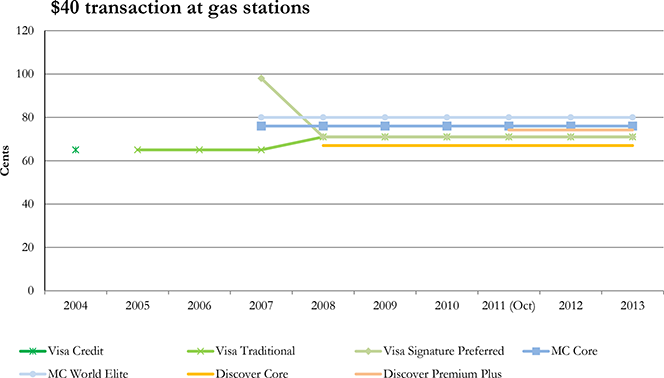

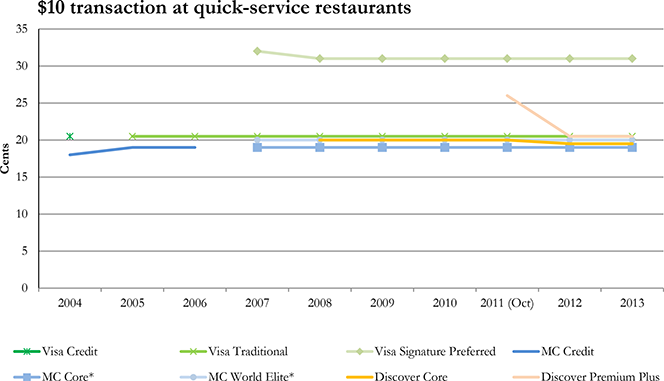

Credit Card Interchange Fees

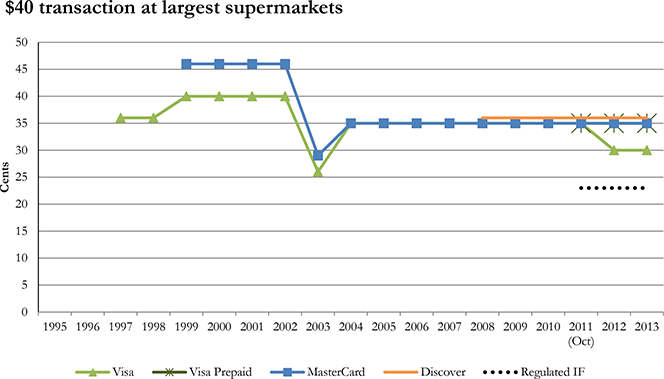

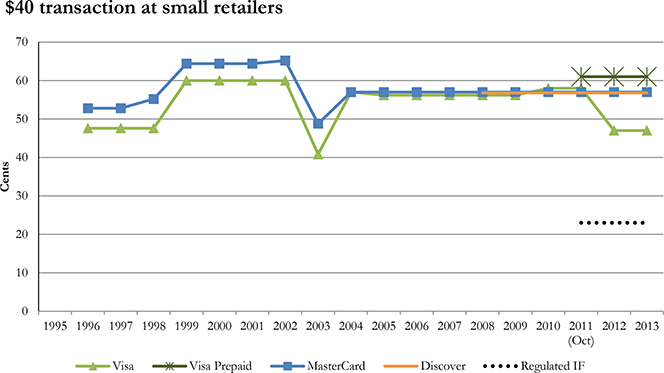

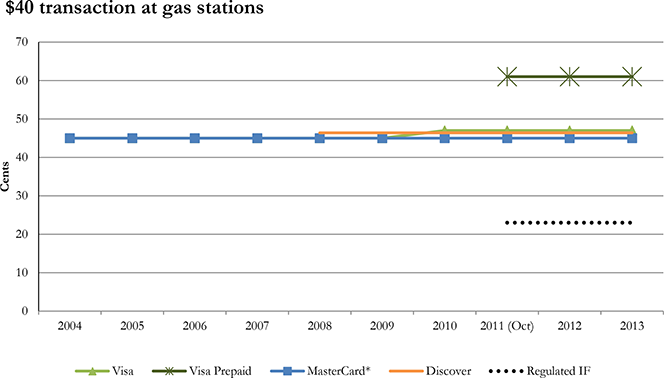

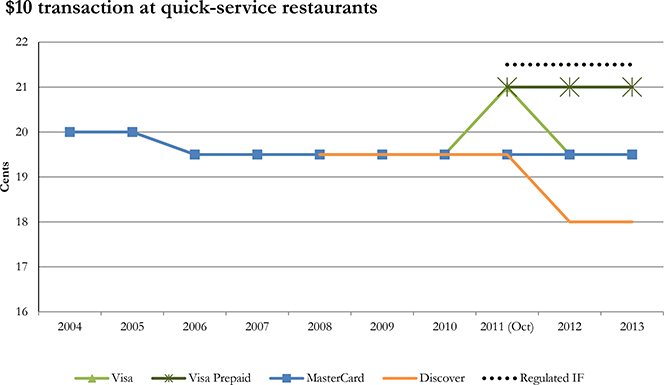

Let’s begin by taking a look at the credit card averages. Here is how much a $40 transaction has cost different types of merchants over the years.

Here are the charts for supermarkets; first the small ones:

And here is the chart for the largest supermarkets:

Now here are the charts for retailers; first the small ones:

And here is the chart for the largest retailers:

Here is the chart for the gas stations:

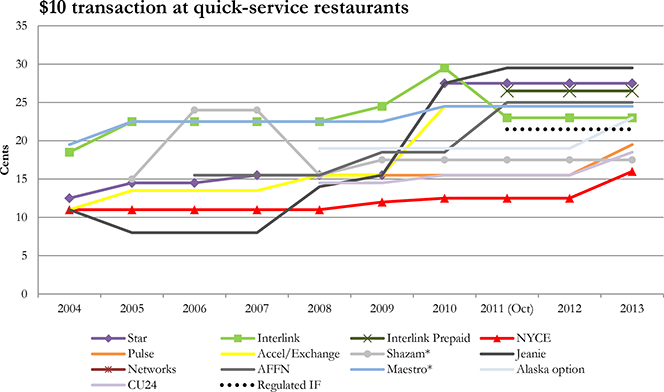

Finally, here is how much a $10 transaction has historically cost quick-service restaurants:

Note: * indicates products with tiered interchange fees. The base rates are shown.

Signature Debit Card Interchange Fees

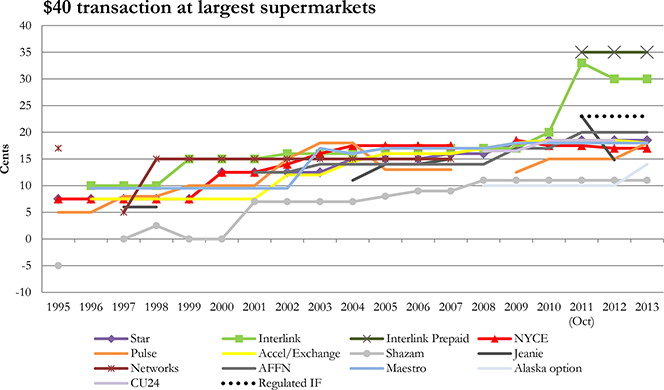

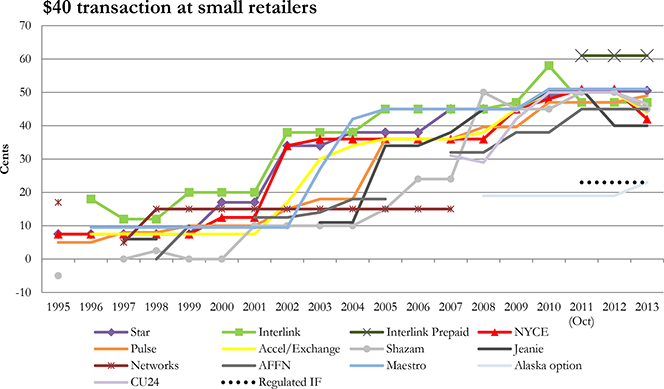

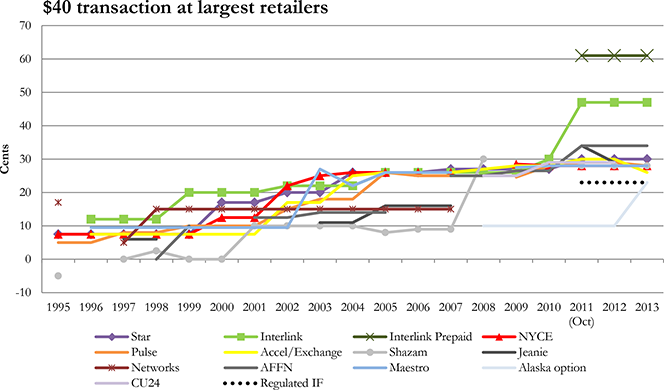

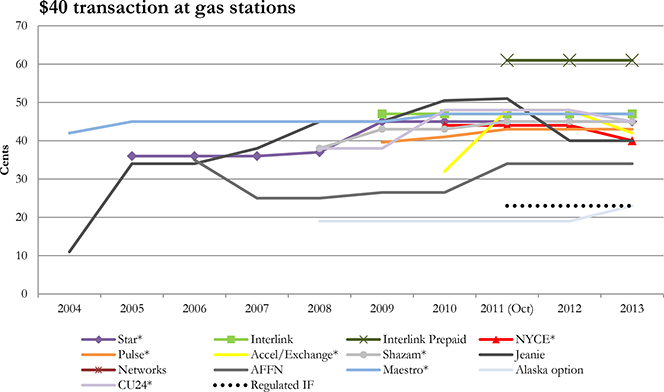

Now let’s take a look at the averages for signature-based debit transactions. Here is how much a $40 transaction has cost merchants over the years. Note that exempted interchange fees are shown from October 2011 to 2013.

Again, we start with the charts for supermarkets; first the small ones:

And here is the chart for the largest supermarkets:

Now here are the charts for retailers; first the small ones:

And here is the chart for the largest retailers:

Here is the chart for the gas stations:

Finally, here is how much a $10 signature debit transaction has historically cost quick-service restaurants:

PIN Debit Card Interchange Fees

Now let’s take a look at the averages for PIN-based debit transactions. Here is how much a $40 transaction has cost merchants over the years. Again, note that exempted interchange fees are shown from October 2011 to 2013.

Once again, we start with the charts for supermarkets; first the small ones:

And here is the chart for the largest supermarkets:

Now here are the charts for retailers; first the small ones:

And here is the chart for the largest retailers:

Here is the chart for the gas stations:

Finally, here is how much a $10 PIN debit transaction has historically cost quick-service restaurants:

For those of you who are interested, the authors also offer some comparative charts, as well as averages for the two major types of credit cards — consumer and commercial.

The Takeaway

So the charts above should be the first point of reference for anyone who is trying to decide whether or not interchange-plus is the right type of pricing structure for her business. Now that you have the averages, broad as they may be, all you have to do is add the mark-up that your prospective processor is proposing and compare the sum to the tier rates you currently have. Better yet, calculate the weighted average of your tiered rates and compare the resulting rate to the interchange-plus one under consideration. That’s about as simple as it gets.

Image credit: Flickr / vonKinder.