Credit Cards Are Getting Cheaper

Americans are paying less to use credit cards, as consumer behavior is changing and the risk profile of open credit lines is shifting away from high-risk accounts, we learn from a newly-released report from the American Bankers Association. ABA’s Credit Card Market Monitor looks into the availability, price, and usage patterns of credit cards and also examines how they compare to other types of consumer loans.

The authors report two key findings:

1. The availability of credit card lines of credit continues to lag behind pre-recession levels.

2. Interest charges are declining as a share of outstanding credit card balances.

Let’s take a look at the report.

Availability, Cost of Credit Cards Decline

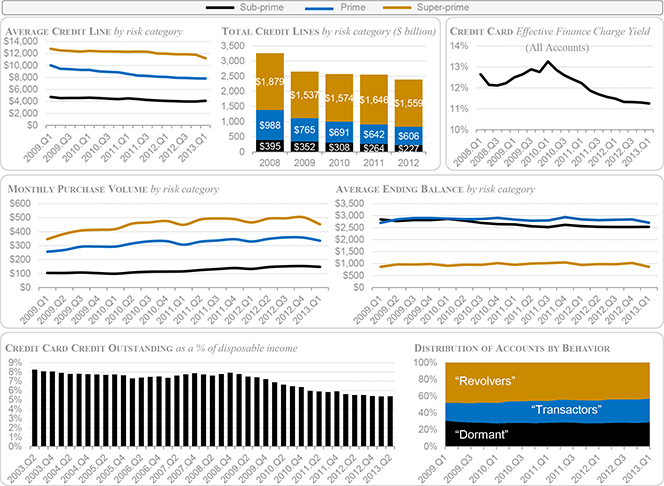

The aggregate volume of credit card lines of credit decreased sharply during the financial crisis and subsequent recession, falling by nearly 19 percent in 2009. However, total credit lines have continued to fall even following the recession’s end. Whereas super-prime credit lines has fluctuated (increasing in 2010 and 2011, but decreasing in 2012), sub-prime and prime credit lines have fallen in all three years.

Yet, even as its availability has declined, the cost of credit for cardholders has also fallen. As a share of their outstanding credit card balances, American cardholders are paying less in interest charges. To measure the cost of credit, the report uses the Effective Finance Charge Yield, which is the interest charged to accounts, calculated as a share of outstanding credit balances. The EFCY declined from 12.65 percent in the first quarter of 2008 to 11.25 percent in the first quarter of 2013. The authors attribute the decrease to changing consumer and industry behavior, such as:

- Fewer cardholders are rolling balances from one month to the next.

- Revolving unpaid balances have become smaller, on average.

- Changing risk profiles in bank portfolios, with a shift away from high-risk accounts.

- Money market rates and rates of interest on deposit accounts have remained low.

Here are a few charts to visualize ABA’s findings:

Credit Card Debt Falls More than Other Forms of Credit

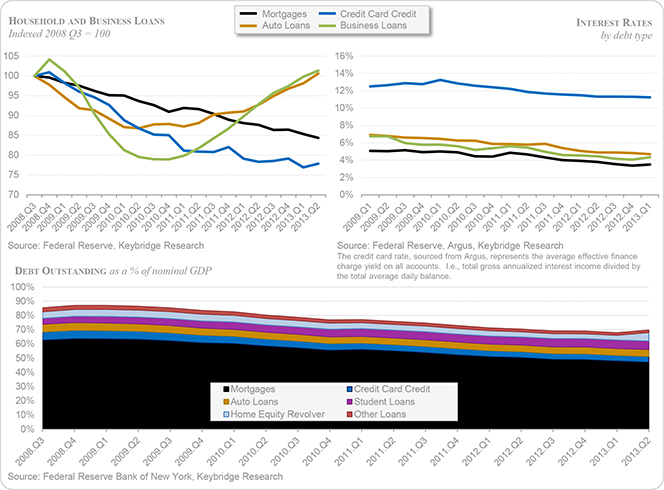

Since the 2008-09 financial crisis, the total of outstanding credit card balances has decreased more than any other major form of credit, including mortgages, reaching a 10-year low as a share of GDP. Yet, the cost of most other types of credit has fallen even more than the cost of credit cards.

- From the third quarter of 2008 to the second one of 2013, business loans and auto loans recovered to exceed their pre-recession levels, but mortgage debt is down by 16 percent and credit card balances have fallen by 22 percent.

- The totals of outstanding business and auto loans started to recover in early 2011 and over the past 2 years they have increased by 28.4 percent and 14.5 percent, respectively. During the same period, however, outstanding mortgages and credit card balances have declined by 7.2 percent and 8.4 percent, respectively.

- Interest rates on all major types of credit have fallen since the peak of the financial crisis. However, the cost of most other forms of credit has decreased by a greater amount than the interest on credit card debt. For example, from the first quarter of 2009 to the first quarter of 2013, the cost of credit card debt, measured by the Effective Finance Charge Yield, fell by 10 percent. During the same period, however, the annual interest rate on auto loans, mortgages, and business loans declined by 32 percent, 31 percent and 36 percent, respectively.

- Outstanding credit card balances continue to fall as a share of GDP. After peaking at 6.0 percent in the last quarter of 2008, the share was down to 4.0 percent at the end of the second quarter of 2013, a 10-year low.

Here are the charts visualizing these dynamics:

The Takeaway

ABA’s report leaves me thinking about the comparative cost of the different types of consumer credit. Here is a question for you: why has interest on credit card debt fallen much less than that of other types of debt in the aftermath of the financial crisis, even though the total amount of outstanding credit card balances has decreased much more steeply? I guess I’ll take a look at the issue in a future post.

Image credit: Flickr / Josh Kenzer.