Leave Payday Lenders Alone

The first headline that jumped out at me as soon as I started going through my news feed this morning was Washington Post‘s “Payday loans suck up billions in fees in states where they’re unregulated”. The author — Niraj Chokshi — had indulged in the seemingly always-fashionable bashing of payday lenders and I would not have paid it much notice, if it weren’t for a report which had actually prompted that outburst. And, by the way, am I the only one who is struggling to figure out why commentators engage in the same type of rhetoric over and over again — don’t people get tired of this stuff, at some point?

Anyway, the report responsible for unleashing Chokshi’s creativity is written by the Center for Responsible Lending’s Susanna Montezemolo and is appropriately titled “Payday Lending Abuses and Predatory Practices”. It is full of the usual tripe, replete with the colorful use of language that we’ve come to expect from the payday bashers by now. I can’t help but think that, if the number of metaphors per page falls below a certain ratio, such a paper will not be published (if anyone knows what that ratio is, please let the rest of us know). Here is a good one for you, prominently positioned right at the start of the report. “[p]ayday loans create a debt treadmill that makes struggling families worse off than they were before they received a payday loan”.

Yet, for all their glamor, such reports invariably fail to address what surely must be the most important question: what is the alternative to payday loans for the consumers who use them? Keep in mind that these are predominantly unbanked consumers, meaning that they are shut out of the traditional financial system. But let’s take a look at the latest.

The Beatings Will Continue Until Morale Improves

I won’t bore you too much with Montezemolo exercise, but let me just give you the five payday lending practices she has identified to “contribute to the creation of a debt treadmill for borrowers” (the author does seem to like her treadmill):

- Lack of underwriting for affordability. The payday lending business model depends on borrowers’ inability to afford their loan and their subsequent need to borrow—paying more fees—multiple times.

- High fees. Payday lenders typically charge the maximum possible rate allowed in a state. As a result, the annual percentage rate (APR) on payday loans is often 400% or higher.

- Short-term due date. Most borrowers cannot repay their payday loan principal within a two-week period—let alone the principal plus a fee. In fact, some payday lenders offer a “free” first payday loan with no fee,2 knowing that borrowers who cannot afford to repay the principal in two weeks will incur many repeat borrowings and fees in subsequent pay periods.

- Single balloon payment. The entire payday loan balance typically is due in one lump sum; combined with the short-term due date, this single-payment feature makes payday loans especially difficult to repay.

- Collateral in the form of a post-dated check or access to a bank account. The consequence of not repaying a payday loan is that the check used as collateral will be deposited or ACH transaction debited, which puts lenders “first in line” to be paid (rather than being “just another bill”).3 Because the payday loan is tied to the borrower’s payday, the lender can be reasonably sure the check will clear. Most borrowers will simply run out of money to cover their expenses before the end of the month, often taking out more payday loans (and paying more fees) to pay for the expenses.

As I said, nothing new here, just the usual stuff. But what is Montezemolo proposing as a way of halting this infernal treadmill of hers? Well, nothing unusual on that front, either. The author’s main proposal is to enact a 36-percent limit on payday loans’ annual percentage rate (APR) of interest and she wants it done both on federal and state levels. Other than that, Montezemolo contents herself with engaging in nebulous talk about more regulation. For example she urges states to “vigorously enforce their laws against unlicensed lenders and… work in partnership with federal regulators to address attempts at subterfuge”. The remainder of her “Policy Recommendations” is mostly about appealing to an assorted array of abbreviated governmental bodies to “use their enforcement authority against payday lenders to address violations of law”. You get the picture.

But how likely is it that anyone would be left to serve the payday borrowers if Montezemolo’s recommendations were accepted and payday lenders were forced out of business?

Leave Payday Lenders Alone

Whereas Montezemolo is completely silent on the topic of alternatives to payday lenders, The Washington Post’s Chokshi has at least considered the issue:

But limiting interest on payday loans isn’t enough, says Signe-Mary McKernan, an economist and senior fellow with the Urban Institute, a nonpartisan think tank. High-risk borrowers still need access to loans, she says, so states should encourage mainstream alternatives. A few years ago, for example, the Federal Deposit Insurance Corp. sought to do just that with its Small-Dollar Loan Pilot Program.

Well, the analysis here at least is correct, even as the recommended solution is unrealistic. Here is a question for you: have you heard of the FDIC’s Small-Dollar Loan Pilot Program? Well then, let me tell you something about it. The FDIC tells us that, “[s]ince the pilot began, participating banks made more than 34,400 small-dollar loans with a principal balance of $40.2 million”. To put these numbers into perspective for you, one of UniBul’s payday lending clients does more than 180,000 loans every month and the volume is quite a bit higher as well! The point is that, if lending to high-risk borrowers at low interest rates were profitable, the traditional lenders would be doing it. But it is not, due to high default rates, which is why interest needs to be higher.

The Takeaway

We’ve written quite a bit about payday loans lately and much of our attention has been focused on new-age, online-only, lenders like BillFloat, Lending Club, Prosper and Wonga, which have all benefited in a huge way from the crisis of 2008. The financial meltdown forced traditional lenders to retreat, excluding all but the most creditworthy of consumers from loan consideration. But if you go to any one of these newcomers’ websites, you will learn that even they lend only to reasonably creditworthy borrowers.

See, the fact is that payday lenders serve a large consumer group, which no one else wants to deal with. And they should be allowed to continue doing their business. If the government, or anyone else for that matter, can come up with a business model that makes lending to high-risk borrowers at low interest rates a viable business proposition, the resulting competition will do the job of forcing payday lenders out of business just fine. But if you can’t devise such an alternative, don’t prevent the lenders from doing their job.

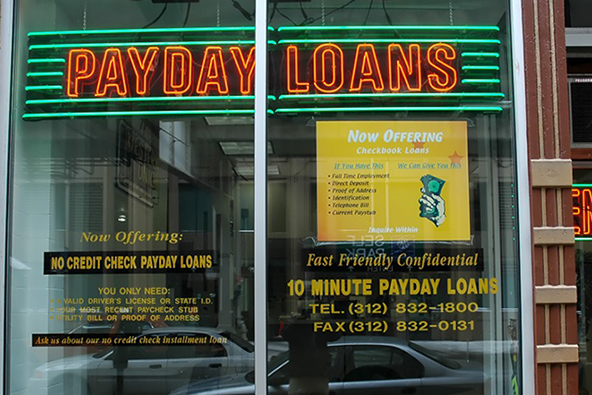

Image credit: Wikimedia Commons.