Why Owners of AmEx’s Black Card Love Hyundai

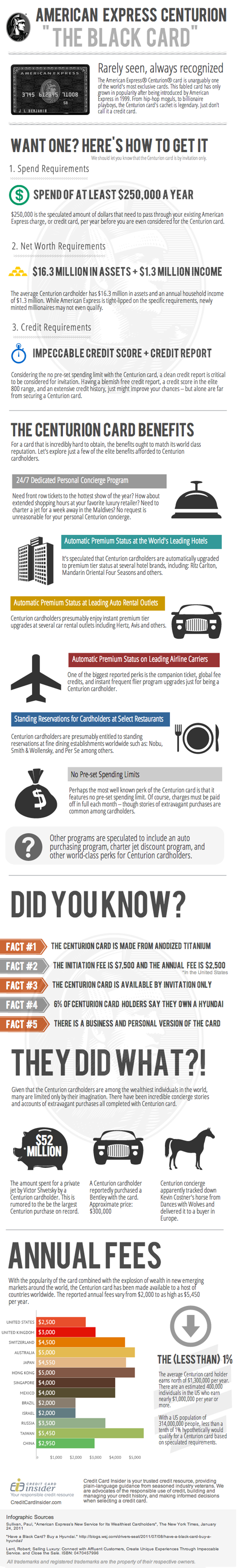

Browsing through my daily newsfeed this morning, I came across a couple of seemingly unrelated, but nevertheless intimately connected infographics. The first one — about American Express’ Centurion “Black” card for the super rich — was full of juicy factoids about things like the highest sales amount ever charged on such a card ($52 million for a private jet, if you must know), the sale of Kevin Costner’s horse from Dances with Wolves to a Centurion cardholder, etc. The other infographic offered an illustrated answer to the much more mundane question of how a credit card transaction was processed from start to finish. Now, what could these two pieces of visual art possibly have in common?

Well, to me at least, the connection was immediately obvious. See, it turns out that Black cardholders are disproportionately likely to be owners of Hyundai. How do you explain that? Why would a person whose household’s annual income is about $1.3 million and who is evidently more than willing to pay a one-time sign-up fee of $7,500 and then a fee of several thousand dollars every year buy a lowly Hyundai which, though admittedly highly dependable, nevertheless brings with it a host of unwelcome side effects. At the very least, the guy risks being mercilessly mocked by his country club buddies every time they see him drive the thing. But, once you think about it for a moment, you quickly understand what’s going on: by buying a Hyundai, the Black cardholder is testing the reliability of his card. I mean, you wouldn’t want to start charging hundreds of thousands on a card, before you are certain it actually works as advertised, would you? So you spend $20,000 – $30,000 on a test transaction, wait for a few days, make sure everything is in order and move on to buy a Bentley.

So I thought I’d help the Black card guys out by offering them a detailed presentation of the credit card transaction process. First, though, I just have to take a closer look at the card in question.

By Invitation Only

Being rich is not enough to get you a Black card, not by itself, Credit Card Insider tells us. This piece of plastic (excuse me, the card is actually made of “anodized titanium”) is only available by invitation, which, the authors have calculated, could be extended to less than one percent of U.S. residents. You get invited to pay $7,500 and commit to charge at least $250,000 per year on your new account. If you live in the U.S., you will also be charged a $2,500 annual fee, but if you live in Taiwan, that fee will be $5,450.

What do you get in return? Well, the authors tell us that American Express is “secretive about most of the details”, but a quick Google search brought up this list of “Advantages of the Centurion Card” for cardholders living in Switzerland. As you see, these advantages include things like Centurion Travel Service, which “books your trips, flights, hotels and much more” and Centurion Concierge Service, which “books tables, tickets as well as spa and shopping appointments”. Furthermore, the Centurion Villas service promises “[t]he most beautiful and most coveted villas worldwide”. The Fine Dining service gives you “[r]eservation of tables in the best restaurants in the world”. The Private Jets and Helicopters feature pledges “[e]xtras and discounts at selected partner companies who offer everything from helicopters to 747 jets”. The list goes on, but you get the picture.

Oh, and there is no pre-set spending limit (here is the Centurion Cardmember Agreement for the U.S.). Now on to cars. The Wall Street Journal has done the hard work for us:

6 percent of Black cardholders say they have a Hyundai in the garage. That’s tied with Bentley and Audi. Others on the list: BMW is tops with 22%; then Mercedes with 21%; Porsche with 15%; Lexus, 11%; Ferrari, 8%; and Acura, 7%. That puts a lot of interesting brands below it.

Needless to say, Hyundai’s U.S. boss has been more than willing to share this piece of data with everyone who would listen.

Without further ado, here is the infographic:

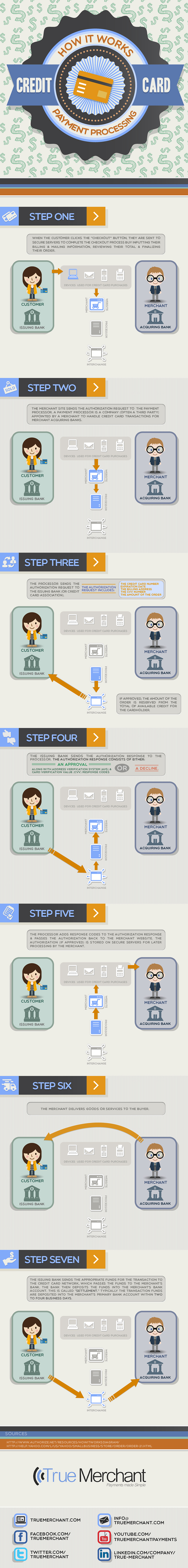

How a Card Transaction Is Processed

Now, as promised, here is the infographic, courtesy True Merchant, showing in great detail the sequence of stages through which a credit card transaction passes, before a sale is completed. Keep in mind that the process below applies to Visa and MasterCard transactions where we have a card issuer and a merchant acquirer, which are separate entities. For example, a Visa card may be issued by Chase, but the transaction may be “acquired” by Bank of America. So in our example, on behalf of its cardholder, Chase would credit, through Visa’s payment system, BofA’s account with the transaction amount. BofA would then transfer that amount into the bank account of the merchant, which accepted Chase’s card for payment.

However, in American Express’ case things are much simpler. See, AmEx serves as both the issuer of its customers’ cards and the acquirer of its merchants’ transactions. Of course, these transactions would still need to be authorized, typically through a third-party payment processor, but you can immediately see how less complicated the process would become.

The Takeaway

Now, I wonder whether a mere infographic would be sufficient to convince the Black card guys that they have nothing to fear when using their newly-obtained pieces of anodized titanium rectangles. I fully expect that, upon approval, a good number of them would keep buying Hyundais to test the reliability of AmEx’s payment system, before moving on to getting the stuff they actually want. Needless to say, that would keep the Korean auto maker’s executives happy. But a more important question arises: what happens to all the Hyundais they buy? Well, I don’t know for certain, but I suspect that a Hyundai may just make for a perfect gift for a poor cousin. And, in any case, who would worry about such a trifling amount?

Image credit: American Express.

Nope. They are BUYING THEM FOR THEIR KIDS AND GRANDKIDS.

They are NOT buying “test transaction” Hyundaes. No need. They can go online (or CALL) Amex and ask if the card will accept a $225k Bentley. Besides, how does a $22k transaction test a $225k purchase?

And these people have MONEY. They don’t buy, and register, and pay taxes on, and insure, and take delivery of, and assume risk for, and then DISCARD a hunk of metal.

If they wanted to use a transaction (instead of a phone call or page visit), they can test a $22k transaction on a luxury item like a cheap (for them vacation) or a designer dress with accessories. Easy to rack up $22k like nothin’ on that stuff. And that is something they WANT to KEEP, unlike a Hyundae.

But, again, they don’t even need to do THAT. They can quickly phone-check the amount before purchasing. I’m sure that $52m private jet purchase was checked by phone before the purchase was made.

I can make this test-check as easily as THIS with my Amex Gold and Platinum cards (I have both).

Right on the Amex site, in big letters, on the MAIN PAGE, is this obvious link:

“Check Spending Ability”

Clicking it takes you to a very simple page which says this:

To verify if upcoming charges on this Card will be approved:

1. Select the transaction type

– General Purchase

– Cash

2. Enter the expected purchase amount

– Enter Dollar Amount

And POOF, you get an instant answer on whether it will take that amount.

You can do 2 or 3 requests, and no more. This prevents you from creeping up to find your secret limit.

(Obviously there is one. Duh. Saying it’s not pre-set is just another way of saying it’s a secret calculation the computer makes based on your most recent history plus your long-term history. It’s still there, waiting to be calculated. Once it’s calculated on your first request, it isn’t going to change on the next 2 pulls.)

SO, NO, THEY ARE NOT TESTING THEIR LIMITS ON SOMETHING WITH INVOLVED PAPERWORK THAT WEIGHS 3,000 LBS AND CARRIES WITH IT PESKY EXTRA COSTS AND RISKS, AND TAKES UP SPACE.

They are buying Hundaes for their kids because the car is cheap (kids wreck cars) but they are well-rated for safety with lots of airbags and very good structure, and some Hundae’s even are relatively luxurious. They have all the toys and leather and feel tight and solid and handle well. They’re maybe $37k or more, and have more cool stuff than a typical Toyota Camry.

There you have it. Kids and Grandkids need cars.

Dad/Grandpa is rich.

He wants points on his Centurion card.

He buys the kid a car for what is very little money to him.

He is the hero.

The kid/grandkid gets a car they like, maybe even one of those little shatboxes with booming stereos Hundae makes…

Simple story. Simpler reasoning.

Occam’s Razor. Simplest explanation.

Now you know why.