The Kids Are Alright, Credit Card Edition

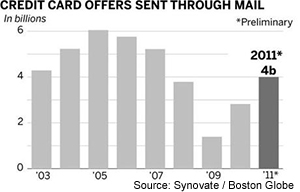

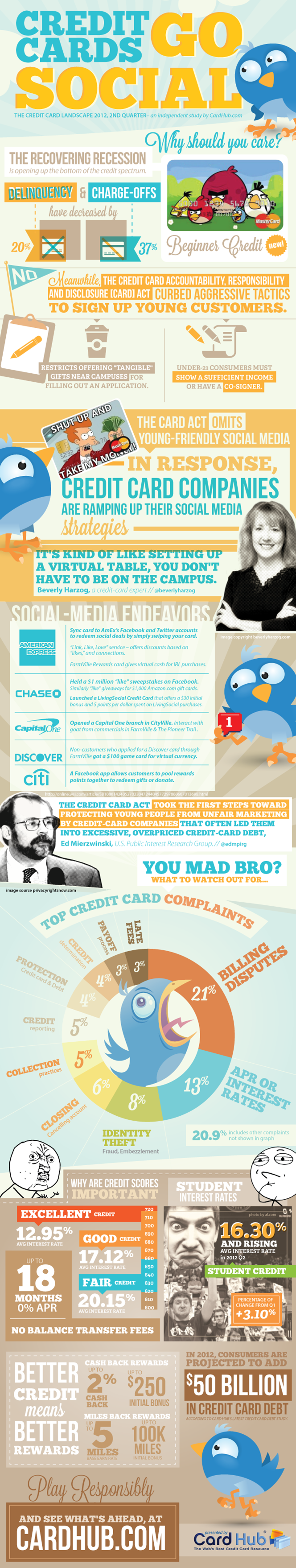

I came across a couple of infographics this morning on the ever-popular topic of college kids, credit cards, and finances in general. They are both fun and visually well done and also seem to be making contradictory arguments, although, on closer inspection, that is only true on the surface. The first one, by Card Hub, is yet another take on everyone’s favorite subject of the inability of the CARD Act of 2009 to put an end to the depredations of card issuers on college kids and the evils that credit cards hold for youngsters. Credit card companies may now be banished from campus, we are warned, but they’ve learned to use social media as a Trojan horse: “it’s kind of like setting up a virtual table, you don’t have to be on the campus”. Tolerate it at your own peril!

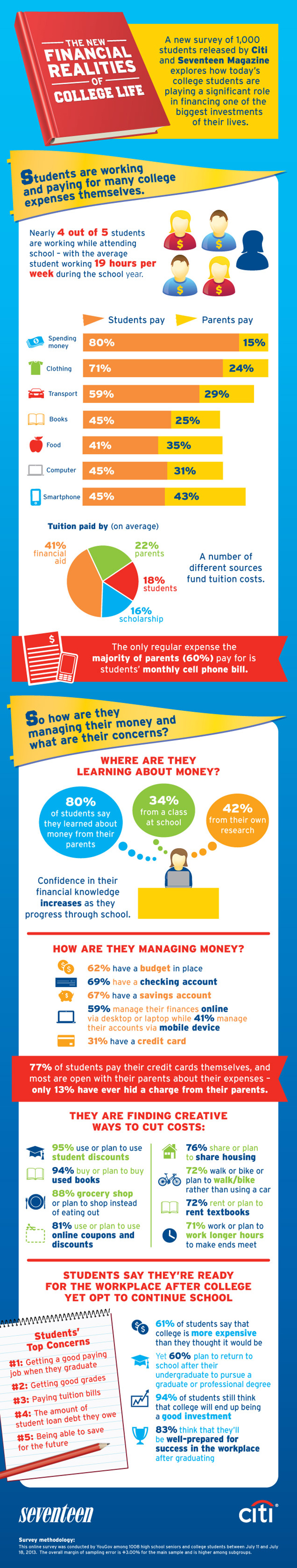

The other infographic, however, presents the findings of a recent survey by Citi and Seventeen magazine, which paints a starkly different picture: rather than being na?»ve victims in dire need of protection, “students are taking control of their finances by working their way through school, using their own money to fund their college expenses, and finding creative ways to cut costs”. And that is not the first study to reach the same conclusion. As we reported on this blog a couple of weeks ago, three economists from the Federal Reserve Bank of Richmond recently found that youngsters under the age of 21 were far less likely to be late on their credit card payments or to default on them than older borrowers. They were also found to be less likely to get themselves into a credit card trouble than same-age peers who entered the credit card market later. So the kids are alright and are perfectly able to take care of themselves.

Social Media: Card Issuers’ Trojan Horse

As Card Hub reminds us, the CARD Act of 2009 revoked the issuers’ on-campus access. In one fell swoop, the infamous credit card tables became a thing of the past. However, in the infographic below, the Card Hub guys are warning us that, “in response, credit card companies are ramping up their social media strategies“, proceeding to list several prominent examples, some of which we’ve previously analyzed on our blog. Now, that can’t be a good thing, can it?

So what’s wrong with this presentation? Well, to begin with, the CARD Act went further than what even the Card Hub guys are acknowledging, much further. To put an end to the card companies’ “predatory practices”, on or off college campuses, the legislators ruled that, once the new law went into effect, no one younger than 21 could be issued a credit card unless he or she had a cosigner or provided financial information “indicating an independent means of repaying any obligation arising from the proposed extension of credit”. So how well has the new arrangement been serving the youngsters? Well, here is what the Richmond Fed paper had to say on the subject:

We interpret these results as indicating that some young individuals choose to enter the credit card market to establish a credit record and thus facilitate the transition to homeownership. Our findings contrast with the view that young individuals get credit cards early primarily as a response to aggressive advertising to this demographic group.

…

We find that, conditional on the length of the credit history, individuals who enter the credit card market early have a lower probability of experiencing serious delinquency later in life. In summary, we find no compelling evidence that young borrowers are bad borrowers.

That is Fed speak for “the CARD Act’s under-21 provision is doing a lot of harm to young borrowers, even as it is producing no discernible benefit.” And the study by Citi and Seventeen magazine lends even more support to that view.

College Kids Are Managing Finances Just Fine

The majority of students — four out of five — work during the school year, we learn, with the average student clocking 19 hours per week. The earnings are used to pay for some college expenses like food, books and transportation, and for splitting with parents the cost on the rest. Here are all the more important findings:

Note that 80 percent of the students say that they learn about money from their parents, which shouldn’t come as a huge surprise, but also no fewer than 42 percent say that they learn about it from their own research and 62 percent have set a budget for themselves. And as the infographic says, “confidence in their financial knowledge increases as they progress through school”. Most impressive of all, however, is the list of creative ways to cut costs, which includes things like walking or biking, rather than using a car (selected by 72 percent of the respondents), renting or planning to rent textbooks (72 percent), grocery shopping, rather than eating out (88 percent), etc.

The Takeaway

So, once again, far from being easily lured into financial traps, college-aged Americans are perfectly able to make sound decisions about money. It is true that nicely done infographics about devious practices employed by credit card companies make for attention-grabbing headlines, but they miss the point and help no one. Study after study has shown that, when left alone, college kids are managing their finances every bit as good as, or better than, older consumers. The only thing that a more difficult access to credit achieves is making it harder for young borrowers to build their credit histories, which, in turn, ensures that they get less advantageous loan terms than they otherwise would and postpones the day when they become eligible for a mortgage. How is that helping?

Image credit: Wikimedia Commons.