U.S. Household Debt Keeps Falling, Delinquencies Improve Sharply

Americans reduced their overall indebtedness for yet another quarter in the second trimester of this year, we learn from the latest Household Debt and Credit quarterly report, issued by the Federal Reserve Bank of New York. It was the seventeenth such decrease in the past eighteen quarters and the total is now substantially below the peak reached on the eve of the financial crisis of 2008. Once again, the decline was primarily driven by a decrease in the housing-related debt.

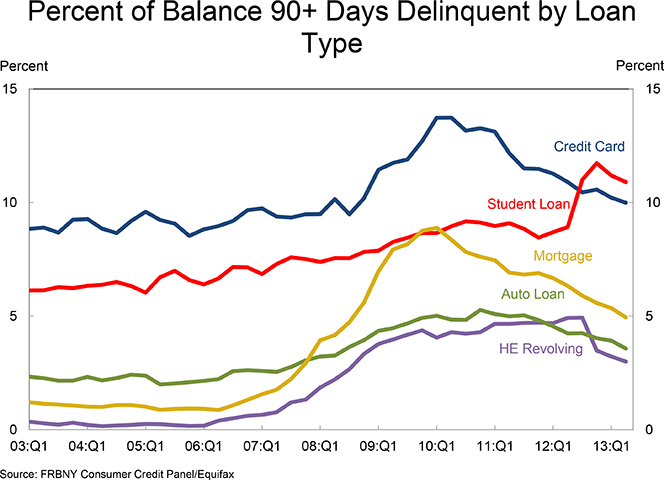

However, the non-housing debt total increased in the period, fueled by gains in auto loan, student loan and credit card balances. Using data from Equifax, one of the three national credit bureaus, the NY Fed reports that the number of consumers with a bankruptcy notation on their credit files fell by a healthy amount for a tenth consecutive quarter. Delinquency rates also decreased considerably in the quarter in all of the categories monitored by the NY Fed, including, surprisingly, the student debt one. Let’s take a closer look at the numbers.

U.S. Consumer Debt Down by $78B

The headline news to come out of the NY Fed report is that the aggregate indebtedness of U.S. households at the end of June 2013 was $11.15 trillion. That is lower by $78 billion (0.7 percent) than the corresponding total at the end of the previous quarter. Furthermore, the new total is lower by $1.53 trillion (12.1 percent), than the all-time high of $12.68 trillion measured in the third quarter of 2008, at the end of which the collapse of Lehman Brothers ushered in the financial crisis and transformed the ongoing downturn into The Great Recession.

The overall delinquency rate also decreased considerably in 2013 Q2, the seventh consecutive quarter of improvement. As of the end of June, 7.6 percent ($845 billion) of all outstanding household debt was in some stage of delinquency, down from 8.1 percent ($909 billion) in 2013 Q1 and from 9.0 percent (1.02 trillion) in 2012 Q1. About three-quarters — $635 billion — of that total was “seriously delinquent”, meaning at least 90 days overdue, down from $678 billion in the previous quarter and from $765 billion a year ago, the NY Fed tells us. As you can see in the chart below, the delinquency rates of all consumer loan types tracked by the NY Fed, including student debt, have declined in the quarter.

Credit Card Debt, Student and Auto Loans Up

And now here are the credit card and student and auto loan numbers.

Credit Cards

- Aggregate credit card limits were up by $27 billion from the previous quarter’s level to $2.8 trillion. That is still down by almost a quarter ($900 billion) from the peak of $3.7 trillion recorded in Q3 2008.

- Available credit was up by $29 billion to $2.133 trillion, but is still down by a quarter from the Q3 2008 high of $2.842 trillion.

- The number of open credit card accounts rose by 5.1 million to 388.9 million, a level that is still 21.6 percent below the 2008 Q2 peak of 496 million.

- Outstanding credit card balances rose by $8 billion to $668 billion, still 22.9 percent below the 2008 Q4 peak of $866 billion.

- Credit card delinquencies fell by 22 basis points to 10.0 percent — the lowest level since Q1 2008.

- The number of new credit inquiries within six months — 159.2 million — was up by just 1.5 million from the previous quarter. For perspective, the all-time high in this category was 244.6 million, recorded in Q3 2006.

Student Loans

- The student debt total rose by $8 billion to $994 billion, up by 63 percent from the $611 billion level of Q3 2008.

- Since the peak of household debt in 2008 Q3, the student debt total has increased by $383 billion, while the other forms of debt have fallen by a combined $1.9 trillion.

- The student loan 90-day delinquency rate fell to 10.9 percent from 11.2 percent in Q1 2013. That is the second quarterly decline, but there are good reasons to expect that the upward trend will resume in the near future, very likely in the current quarter.

Auto Loans

- The auto loan total was up by $20 billion in the quarter to $814 billion, which is just below the all-time high of $818 billion, recorded in Q3 2007. Overall, in the last nine quarters, auto loan debt has increased by $108 billion.

- New auto loan originations increased to $92 billion, again the highest level since Q3 2007.

- The ratio of auto loans delinquent by 90 days or more kept falling, ending the quarter at 3.57 percent, down by 35 basis points from the previous quarter and the lowest showing since Q2 2008 (3.26 percent).

In a blog post, three NY Fed researchers have taken a closer look at the auto loan increase, among other things refuting the proposition that the new growth in auto loan balances may be due to an increase of sub-prime lending. They find that in Q2 2013 about 23 percent of newly-originated auto loan balances were issued to borrowers with credit scores under 620, well below the 25 – 30 percent ratios that have been seen historically. Moreover, in a reversal of a historic trend, there has been a substantial decline in auto debt at age twenty-five, particularly among people with student loans. Only older borrowers are now originating auto loans at levels that meet or exceed their pre-crisis amounts, we are told.

The Takeaway

To me, the biggest surprise in the latest NY Fed report is the fall in the student debt delinquency rate. However, all other available data clearly point to a further deterioration ahead. Other than that, we are seeing a continuation of the post-Lehman consumer debt deleveraging trend, although in this quarter it was driven exclusively by a reduction in the housing debt-related category. More importantly, delinquency rates are falling across the board, as they’ve now done for seven consecutive quarters, which, as one of the NY Fed researchers notes, is an “encouraging sign going forward”.

Image credit: Flickr / msaari.