Why Are Retailers still Taking Your Credit and Debit Cards?

The Washington Post’s Lydia DePillis has written what surely must be the worst piece on a topic related to credit and debit cards published in a major media outlet in the past year, and maybe more. And to attain the achievement, she has had to overcome an incredibly strong field of contenders. I know, I read dozens of articles on the subject every day. What makes DePillis’ piece shine is that, even as the author repeats a number of garden-variety fallacies, with which we are regularly dealing on this blog, she also manages to squeeze in her short post a few absurdities no one had thought of before.

The first one is DePillis’ claim that Square, “Paypal’s mobile system, Google’s Wallet, Groupon’s Breadcrumb, and a few smaller players… all transfer money through the Automated Clearing House”. Incredibly, she has linked “Automated Clearing House” to its Wikipedia page. I hope for her sake that the author didn’t actually read what Wikipedia had to say about ACH, because if she did, she would have read that “credit card payments are handled by separate networks”. And if DePillis had read that, and still claimed that the above-mentioned companies were transferring money through ACH, well, I don’t know what her defense would have been, for all of these companies facilitate card payments and only PayPal also facilitates payments through bank accounts. There are a couple of other such jewels, but the one that stands out the most is the assertion that, if only the merchants adopted one of these alternatives, or Square, or Dwolla, the interchange fees, which “are such a burden on merchants”, would promptly go the way of the dodo. “[W]hy are they still paying them”, DePillis wonders. Why, indeed?

Square, Google Wallet, PayPal and Interchange Fees, Redux

OK, let’s begin our little exercise by examining the relation, or lack thereof, between the interchange fees on credit and debit cards and the fees charged by the U.S. companies mentioned in DePillis’ piece. Regarding M-Pesa, I will only say that everyone who believes, as the author does, that the Kenyan money transfer company “charges a small fee for each transaction”, should review the actual charges.

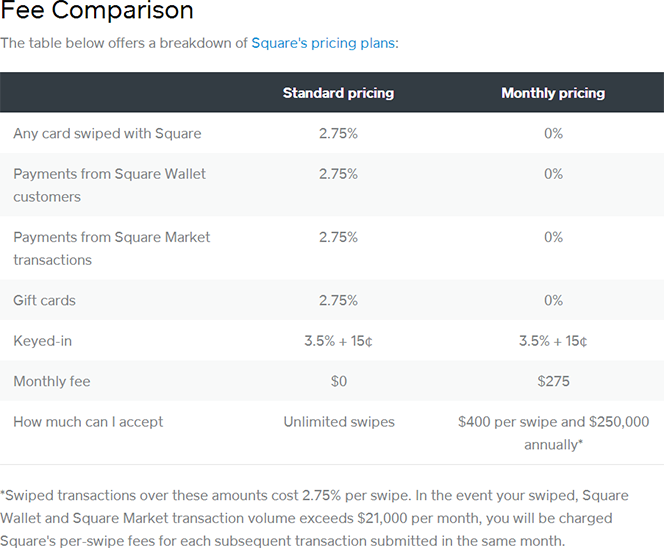

Now let’s turn our attention to Square, Groupon’s Breadcrumb, Google Wallet and PayPal. As I already mentioned, the first three companies on this list facilitate exclusively card payments and about 55 percent of the transactions processed by PayPal are card-based. Every time one of these firms processes a card transaction on behalf of one of its merchants, the processor is charged a fee that is payable to the issuer of the card used for payment in that transaction. That fee is called interchange and there is no escaping it. That being the case, how exactly are these companies offering merchants “a bunch of different ways to evade the system”, as DePillis claims? In fact, the author helpfully links to Square’s pricing page, which shows that the company is charging fees that are much higher than the average interchange. Here is the breakdown:

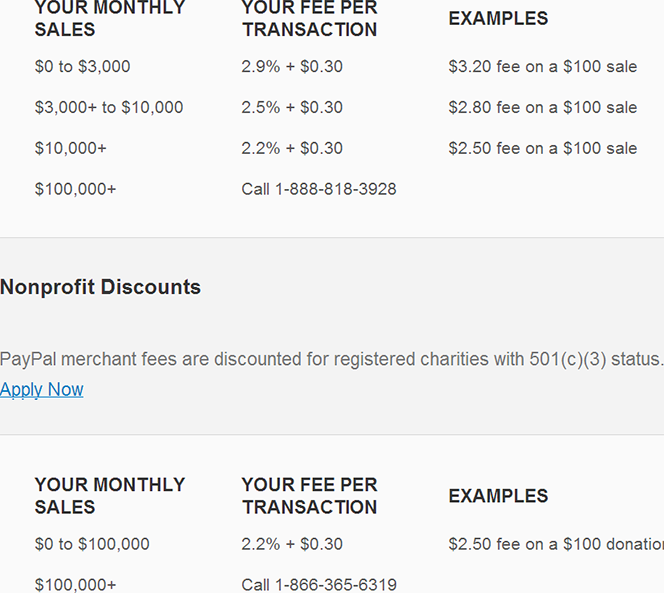

The same is true for PayPal. Here is this processor’s pricing structure:

Then the author quotes someone as saying that “Google… charges no fees at all for its Wallet service–the data itself are valuable enough”. Except, that is not true. Google tells us that “the transaction processing and other fees for the Service will be as set forth on the Fee Schedule”. Now, we don’t know what this “Fee Schedule” is, but the biggest U.S. payment processor tells us that its merchants will “pay card-present rates” for transactions made via Google Wallet, and these are higher than interchange. I think that the author is confused, because so far Google has been content to just pass the interchange fees on to the issuers of the cards that can be stored in its digital wallet, creating a huge money sinkhole in the process. However, even though Google isn’t collecting any processing fees, the merchants are still paying them.

How about Dwolla?

And then there is Dwolla — a frequent topic of disagreement between this blogger and many of his readers. As the author says (correctly, for once), Dwolla charges 25?ó for transactions over $10 and nothing for transactions under $10. Then again, Dwolla does not facilitate card transactions, but transfers between bank accounts, which are in fact cheaper and subject to the ACH rules.

And yet, for all of Dwolla’s cheapness, the vast majority of merchants stubbornly refuse to ditch their credit card processors and switch to Dwolla, willingly choosing to keep paying these outrageous interchange fees, and more. How can they be so stupid? Well, what DePillis fails to understand, and she is far from alone here, is that merchants keep accepting credit and debit cards, because that is what their customers want to use for payment, for many reasons having to do with getting rewards, convenience, access to credit, etc. If one merchant stops taking cards, a good chunk of its customer base will defect to a competitor. Moreover, the rise of mobile wallets and other forms of digital payments will not mean the death of credit cards. On the contrary, the vast majority of these new payment platforms merely transform the old-fashioned rectangular piece of plastic into a digital version of it. However, the substance — getting access to a line of credit extended by a financial institution — remains unchanged. Is this truly that difficult of an idea to grasp?

The Takeaway

So no, the interchange fees are not going away anytime soon and will be around for as long as payment cards are used for payment. A far more plausible alternative is offered by MarketWatch.com’s Charles Passy, who suggests that the federal court ruling, which told the Federal Reserve to lower the cap on interchange fees even further may be the end of debit cards: why would the banks want to issue debit cards if they make no money out of them? But for as long as payment cards are around, the retailers will be taking them.

Image credit: Flickr / GuySie.