Is The Chinese Credit Card Market Worth Fighting For?

The China Economic Review gives us an interesting account of the latest troubles a big U.S. credit card company is having in what will soon become the world’s biggest credit card market. As some of you will have noted, earlier this month the Chinese central bank had stopped MasterCard from issuing yuan-denominated credit cards in the country, which the company was doing through a partnership with a local payments firm. The Chinese authorities did that even though a year ago the World Trade Organization (WTO), acting on a U.S. complaint, ruled that China is discriminating against foreign providers of credit and debit card payments by maintaining a monopoly on payment cards denominated in renminbi (yuan), which breaks the organization’s rules.

Yet, as the CER reports, MasterCard has kept silent about the decision, even though, as the author says, “MasterCard would have found solid support in raising a loud complaint”, if the company had chosen to do so. Moreover, we are reminded, neither Visa nor MasterCard has “fought overly hard to gain access to the market despite the WTO’s support”. Why have the two biggest U.S. credit card associations been so passive in China? Well, the CER suggests that there isn’t really all that much to be won in fighting the central bank’s decision, whether the WTO ruling supports you or not, which is probably true. But there is more to it than that.

The Wonders of Monopoly

At the heart of the aforementioned U.S. complaint with the WTO was the monopolistic status of China UnionPay — the Chinese credit card champion. Similarly to Visa and MasterCard, UnionPay was created in 2002 as an association that is jointly owned by its member banks — more than 80 of them, as the CER says. Crucially, since its inception, UnionPay has been the sole processor of all renminbi-denominated transactions, which allowed it to grow at a break-neck pace.

Just recently, citing official statistics from the People’s Bank of China — the central bank — China Daily told us that in 2012 alone, Chinese banks had issued a total of 331 million credit cards, exceeding the number of newly-issued debit cards. That was a 16 percent increase over 2011’s total and as a result a quarter of Chinese consumers now have credit cards, a 19 percent growth from the previous year’s total. The total number of bank cards issued by Chinese banks at the end of 2012 was 3.5 billion, up from 2.95 billion at the end of 2011 — an increase of 18.6 percent.

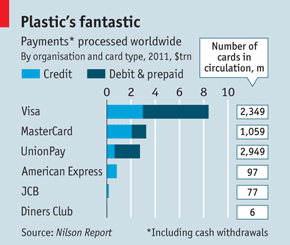

Moreover, in 2012 the number of card transactions rose by 46 percent and ATM withdrawals increased by 26 percent, China Daily told us citing statistics from China UnionPay. The chart to the right was produced by The Economist, using data from the Nilson Report — a payment industry newsletter — to illustrate the global balance of power in 2011. Considering its growth rate, UnionPay may already have more bank cards in circulation than Visa and MasterCard combined.

Moreover, in 2012 the number of card transactions rose by 46 percent and ATM withdrawals increased by 26 percent, China Daily told us citing statistics from China UnionPay. The chart to the right was produced by The Economist, using data from the Nilson Report — a payment industry newsletter — to illustrate the global balance of power in 2011. Considering its growth rate, UnionPay may already have more bank cards in circulation than Visa and MasterCard combined.

Furthermore, UnionPay may surpass Visa’s processing volume within as few as 3 – 4 years. In 2012, the average volume of bank card transactions in China was 5,894 yuan ($957.8) per person, up 6.6 percent from 2011 level. The average transaction value was 2,312 yuan ($375.7), down 2.6 percent. And all this volume is processed by UnionPay!

A Tough Market

As the CER notes, there are only two foreign banks that are allowed to issue credit cards in China. One of them is actually based in Hong Kong and the other one is Citigroup. We don’t know how well Citi is doing in China, but the CER tells us that the Hong Kong issuer has “lost millions of yuan annually” on its Chinese operation. It is a tough market to compete in:

Compared to the US market, far fewer Chinese card holders rollover their debt, a major driver of global industry revenue in which cardholders pay off credit card debt on another card. The Chinese government also fixes annual interest on cards at 18%, leaving little room for banks to compete by lowering the rates. Instead, banks hawk items such as designer bag and Starbucks coupons at potential customers to get their cards in wallets and purses.

Moreover, tough as it is, the market is already dominated by UnionPay and, as the author says:

After 10 years of UnionPay’s unfettered growth, MasterCard and Visa may however find there’s little room in the market left for the international firms, with or without a rule change.

There is more:

Foreign payment companies would find striking substantial deals with Chinese banks difficult, because domestic firms, namely UnionPay, will continue to be favored for convenience. Given the expanding reach of UnionPay, there are few reasons why China’s banks would opt for a foreign brand. Even Chinese consumers believe that holding foreign cards is just too much trouble.

Of course, perceptions can change, but UnionPay certainly has taken a huge lead on its rivals and that lead only keeps growing.

The Takeaway

So here is how the author sees the current and near-future state of affairs:

China would also do well to follow its WTO commitments, however unlikely that seems. After all, China’s monopoly building is done, and UnionPay’s grip on the market is ironclad.

For the foreseeable future, getting a cut of UnionPay’s cut might be all that transaction processors can hope for. There’s not much to be won in the fight to issue foreign credit cards in the mainland. Perhaps that plain and simple fact accounted for MasterCard’s silence this month.

I agree with most of that. However, I wish that the U.S. government officials who were basking in the glory of last year’s WTO decision had said something about China’s flouting it, even though their complaints would have probably fallen on deaf ears.

Image credit: Flickr / Richard Bao.