Who Pays for Debit Card Fraud?

The Federal Reserve has recently released its biennial report on the volume and value, interchange fee revenue, processing costs and fraud losses related to debit card transactions in 2011. The headline news to come out of it is that the Fed has decided not to make any changes to the debit interchange fees, which retail groups were hoping would go even lower than they are now. Back in 2011, acting on a mandate from Congress, the Fed capped the debit interchange fees — the amount card issuers can collect as fees from transactions involving their debit cards — at 0.05 percent of the purchase amount plus $0.21 per transaction plus an additional $0.01 per transaction if the issuer has implemented certain fraud prevention standards. That limit — which only applied to issuers with consolidated assets of $10 billion or more — slashed the average interchange fee amount from about $0.44 to $0.23 per debit transaction — a 45-percent reduction.

But I wanted to touch on another issue covered in the Fed’s report, which has not received much attention — debit card fraud. We learn that debit fraud has declined from 2009 to 2011 for all types of transactions, excluding prepaid, which technically are not debit transactions, but are included in the Fed’s report anyway. Furthermore, we learn that most of the losses are borne by the issuers, whereas the cardholders’ losses are negligible. Let’s take a look at the numbers.

Debit Card Fraud Down

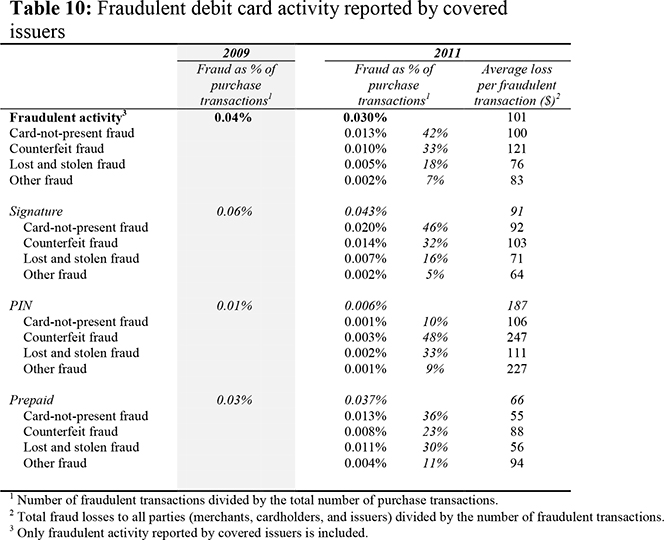

The Fed estimates that debit card fraud losses to all parties (merchants, cardholders, and issuers) amounted to $1.38 billion in 2011. About $1.13 billion of these losses resulted from signature debit card transactions, $204 million resulted from PIN debit transactions and $51 million resulted from prepaid card transactions. The average loss was approximately 8 basis points per debit card transaction, down slightly from 2009. Among covered issuers, the overall incidence of fraudulent debit card transactions fell from 0.04 percent of all purchase transactions in 2009 to 0.03 percent in 2011. Card-not-present fraud was the most common type of debit card fraud, accounting for 42 percent of fraudulent transactions, followed by counterfeit fraud — 32 percent. There were significant differences in the overall incidence and distribution of fraud by type among signature, PIN, and prepaid transactions, as the following chart illustrates.

As you see, from 2009 to 2011 fraud incidence declined significantly both in signature transactions (by 28.3 percent) and in PIN debit ones (by 40 percent). As expected, fraud incidence was much lower among PIN transactions than it was among signature (by a factor of more than seven) and prepaid transactions signature (by a factor of more than six). Card-not-present fraud was found to be the most common type of fraudulent signature transaction (accounting for 46 percent of all fraudulent signature transactions) and counterfeit fraud was the most common type of fraudulent PIN transaction (constituting 48 percent of all fraudulent PIN debit transactions). Lost and stolen fraud occurred more often in PIN transactions (representing 33 percent of all PIN-based fraud) than in signature ones (accounting for 16 percent of signature fraud).

On a per-fraudulent-transaction basis, fraud losses averaged $101 in 2011. The average loss for PIN transactions ($187) was more than twice as high as the average for signature fraud ($91), and almost three times as high as the prepaid loss average ($66).

Card Issuers Bear 60% of Debit Fraud Losses

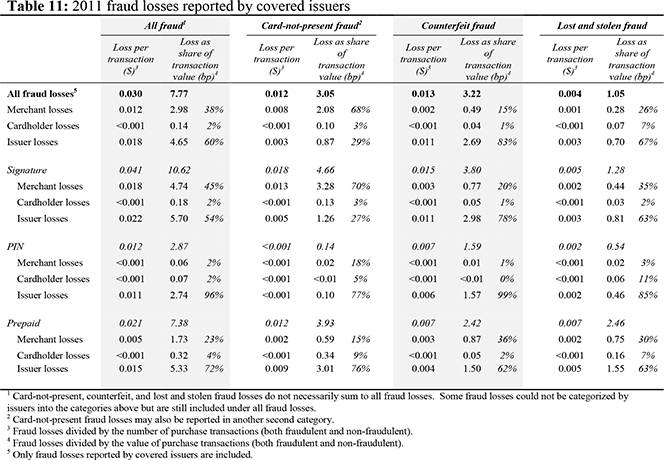

The fraud losses reported in 2011 were shared primarily between the card issuers and the merchants, with 60 percent of the losses borne by the issuers and 38 percent borne by the merchants. The remaining 2 percent were borne by the cardholders. This breakout was roughly in line with what was reported in 2009. However, the distribution of fraud losses among issuers, merchants, and cardholders varied widely based on the authentication method used in a debit card transaction. Whereas issuers bore nearly all (96 percent) of the fraud losses associated with PIN debit card transactions, they bore 72 percent of prepaid fraud and 54 percent of signature debit losses. Here is a table with the full distribution.

As you can see, merchants bore a higher share of the fraud losses in card-not-present transactions than in card-present ones. So, while they absorbed 70 percent of all signature debit card fraud losses for card-not-present transactions, the merchants only bore 20 percent of the signature counterfeit fraud losses and 35 percent of the signature lost and stolen fraud losses. And whereas merchants only absorbed 18 percent of all PIN card-not-present fraud losses, there are very few card-not-present PIN transactions. On the other hand, issuers bore most of the losses resulting from fraudulent card-present transactions.

Overall, the issuers’ fraud losses in 2011, as a share of the total transaction value, was 4.65 basis points, the Fed tells us. Issuer fraud losses from signature debit transactions averaged 5.7 basis points, more than twice as high as the average for PIN transactions — 2.74 basis points. Average prepaid losses were 5.33 basis points per transaction.

The Takeaway

Now, it has to be said that, although cardholders bear very little of the losses resulting from debit card fraud, they can still have their money tied up for the duration of the investigation. Remember that in a debit transaction the sales amount is debited to your bank account practically right at the time the transaction takes place. Incidentally, this is an area where credit card use offers an advantage in that credit cardholders are not charged for any disputed amount until the investigation is complete. So this is a consideration to be taken into account when deciding what type of card to be used for purchases.

Image credit: Lifelock.com.

Don’t give these thugs a chance to skim your details, use RFID protected Wallets to stay safe . My suggestion Mani Wonders brand.