Prepaid Cards, Alternative Credit Reporting Benefit Unbanked Americans

The Economist examines the financial industry’s treatment of unbanked and underbanked Americans and, while ticking off a raft of challenges, finds “reasons for hope”. The challenges range from the persistently high cost of the financial products historically available to the unbanked to the newly-erected regulatory hurdles that discourage banks from giving checking accounts to the least desirable customers.

The hopes, on the other hand, are a new phenomenon, which arose as a by-product of the same newly-installed regulatory framework that is otherwise causing banks so much trouble. Even as the Durbin Amendment and CARD Act cost banks billions of dollars in lost annual revenue, they also forced them to develop new products and strategies to make up for the lost income. As a result, new credit-scoring mechanisms have been introduced to help expand the pool of potential borrowers and the quality of prepaid cards has dramatically improved, making the best among them bona fide checking account replacements. So it is fair to say that recent financial regulations have benefited the unbanked more than most other consumer segments.

Who Are the Unbanked?

The Economist cites some data from a recent FDIC report on unbanked and underbanked U.S. households, which we reviewed back in December. According to FDIC’s definition, unbanked households are the ones that lack any kind of deposit account at an insured depository financial institution. Underbanked households, on the other hand, do have bank accounts, but also rely on alternative financial services (AFS), such as prepaid cards and payday loans, to various degrees. Finally, fully banked households are those that have active bank accounts of any kind and have not recently used any of the AFSs included in the survey. Now here are FDIC’s key findings:

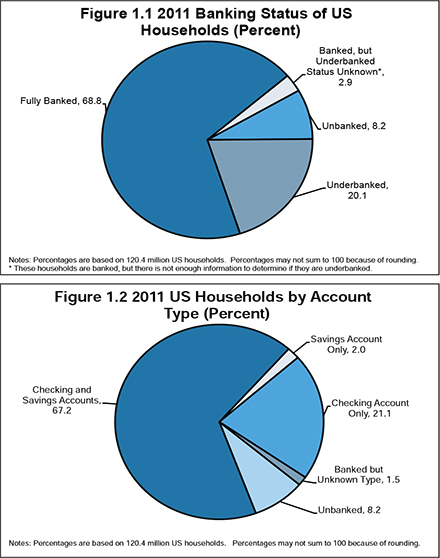

- 8.2 percent of U.S. households are unbanked. That is 10 million households in total, in which live approximately 17 million adults.

- 20.1 percent of U.S. households are underbanked. That is 24 million households with 51 million adults living in them.

- 29.3 percent of households do not have a savings account.

- 10 percent of households do not have a checking account.

- 67.2 percent of households have both checking and savings accounts.

Here are the charts:

Furthermore, as The Economist notes, not all unbanked and underbanked consumers are poor, although most are. A recent study by Javelin, for example, found that, as of June 2011, the income of the average American underbanked consumer was $52,000—lower than the $73,000 average for all of the surveyed consumers, but still an unexpectedly high number.

The Issue with Payday Loans

Payday lending, the author reminds us, has been booming:

When they need credit, the unbanked turn to payday lenders or, if they have a car, to car-title loans secured by their vehicles. Payday lenders say that high volumes—estimated at $29.8 billion for storefront payday lenders and $14.3 billion for online lenders in 2012—demonstrate high demand.

Yet, even as business is thriving, payday lenders are facing increasing regulatory scrutiny and, many would argue, for good reason:

Critics retort that much of that volume comes not from a broad customer base, but from customers taking out additional loans to cover the original debt. A study by the Centre for Financial Services Innovation, a campaign group, found that the average payday customer takes out 11 loans a year; the annual interest rate can exceed 400%.

Lawmakers are taking an increasingly dim view of this: 18 states and the District of Columbia outlaw high-rate payday lending. The nascent Consumer Financial Protection Bureau (CFPB) has held a public hearing on the subject, boosting speculation that the federal government may start regulating payday lending.

The Economist goes on to remind us of the damage recent regulation has done to lenders’ ability to serve low-income Americans, but that is all water under the bridge now. Both more interesting and more relevant to the present topic is the effect the Durbin Amendment and the CARD Act have had on consumer credit reporting and prepaid cards.

‘Reasons for Hope’

The Economist:

For those concerned that their low net worth bars them from the banking system, there are two reasons for hope. The first is that lenders and credit bureaus are starting to use a broader range of data to determine the creditworthiness of prospective borrowers. Many of the unbanked have no credit histories. But data from rent, mobile-phone and utility bills give lenders a way to find lower-risk borrowers.

Alternative consumer credit rating mechanisms were recently examined in some detail in another Economist article and in this blog, so you can visit them for more details. When making his/her case for the second reason for hope, the author brings up a favorite topic of mine:

The second reason for optimism is an increasingly competitive market in pre-paid cards. Once simply reloadable proxies for cash, many of these cards now offer much the same features as bank accounts.

Consider the Bluebird card, a joint venture between Walmart, America’s largest but decidedly downmarket retailer, and American Express, a decidedly upmarket credit-card firm. Among other things, Bluebird offers direct-deposit facilities (including an option where you can take a picture of a pay-cheque with your smartphone) and fee-free sub-accounts (so that a parent can give a child a card with preset spending limits).

I would add that Bluebird is a virtually fee-free card and is built on American Express’ Serve platform, which means that the cardholder is automatically signed up for AmEx’s mobile wallet. Serve enables its users to send and receive money to and from other consumers by email, text and Facebook, make payments at merchants who accept American Express cards and, as you would expect from a mobile wallet, link to credit and debit cards and bank accounts. So Bluebird is better, and cheaper, than most existing checking accounts.

The Takeaway

Whatever the causes, there should be little doubt that now is a better time than ever to be shut out of the traditional financial system in the U.S. Technological developments and regulatory interventions have vastly improved the quality of prepaid cards and have helped promote alternative payment services while making them both more easily accessible and cheaper than ever before. Yet, that does not mean that your credit score is no longer relevant and you shouldn’t care about it. On the contrary, whereas it is now much easier for an unbanked American to be relying on prepaid cards for her day-to-day financial needs, she still needs a good credit score to have a chance of being approved for a mortgage or even an auto loan. So we should take advantage of the new opportunities, but still make good on our old obligations.

Image credit: Eafloe.com.

Alternative Credit is definitely being used for assessing your creditworthiness, and providing access to mainstream financial services. eCredable is a Credit Reporting Agency that uses bill payments for bills like rent, utilities, and insurance to demonstrate your creditworthiness. We rate people on a credit rating scale of A-F. If you earn an A or B, you can qualify for a home loan or auto loan from Churchill Mortgage and RoadLoans. We look up your prior two years of history, so you may have a good enough history today. Membership is free – you only pay for your credit report.