The State of Mobile Payments in the U.S.

The FDIC has recently published an overview of the current mobile payments landscape in the U.S. In it, the authors have reviewed the various technologies powering the most widely talked about m-payments platforms, examined the legal framework and evaluated the risks that could turn the whole thing upside down.

As others have done before them, the FDIC guys have placed the near-field communication technology (NFC) at the heart of their report, even as it is yet to be proved that this particular approach to mobile payments offers the best way forward. Somewhat perplexingly, the authors have seen no need to even mention the direct credit card acceptance branch of the new industry, which, led by Square, has achieved by far the best results so far. Still, I thought I should share the report’s main points with you, as the authors have done a nice job in the areas they have looked at. So here it is.

The Mobile Payments Market

There are many definitions of mobile payments and here is the FDIC’s:

Generally, mobile payments1 are defined as the use of a mobile device—commonly, but not exclusively, a smartphone or tablet computer—to initiate a transfer of funds to people or businesses.

I like this one — it is precisely the all-inclusive type of a definition that we need for such a widespread industry. Then the authors proceed to give us some of the most recent m-payments statistics:

More than 87 percent of the U.S. population now has a mobile phone,2 and more than half of those mobile phones are smartphones.3 Nearly one-third of mobile phone users in 2012 have reported using mobile devices to make a purchase. Consumers spent over $20 billion using a mobile browser or application during the year.

…

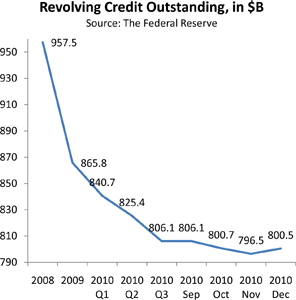

At least six NFC-equipped cell phones are for sale in the United States,6 and 50 percent of smartphones could be NFC-equipped by 2014.7 Projections for U.S. smartphone and global NFC-ready POS market penetration are shown in Chart 1.

Mobile Payments Technologies

It is unlikely that any one m-payments technology will become dominant in the near term, the FDIC report argues, adding that

Retail merchants do not know which mobile payments technologies consumers will find preferable, creating little immediate incentive for investment in new POS terminals that can accept mobile payments. Similarly, consumers have little interest in acquiring the capability to make mobile payments until merchants accept them, or additional incentives are offered making it worthwhile for consumers to try a new form of payment.

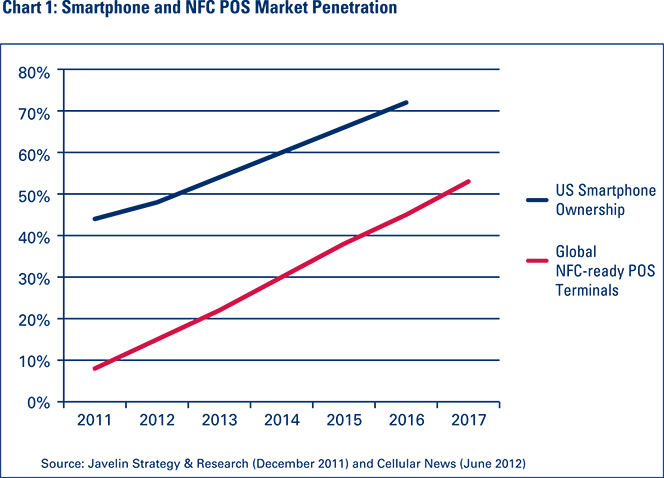

Then the authors proceed to tell us that the following technologies are “increasing in popularity”:

Mobile Payments Risk

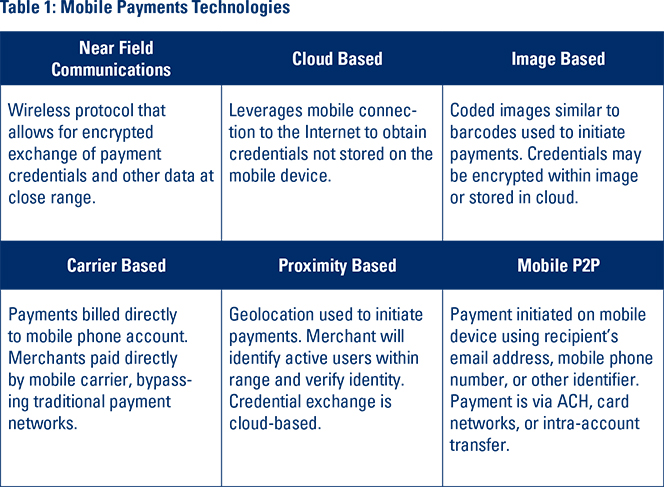

“Mobile payments present the same types of risks to financial institutions associated with many traditional banking-related products”, the authors tell us, adding that the new technologies bring some unique challenges:

[U]nlike most banking products that allow institutions to control much of the interaction, mobile payments require the coordinated and secure exchange of payment information among several unrelated entities. Making matters more challenging is that much of the innovation in the mobile payments marketplace is driven by entrepreneurial companies that may not be familiar with supervisory expectations that apply to banks and their service providers.

Here are the specific areas of concern identified by the authors:

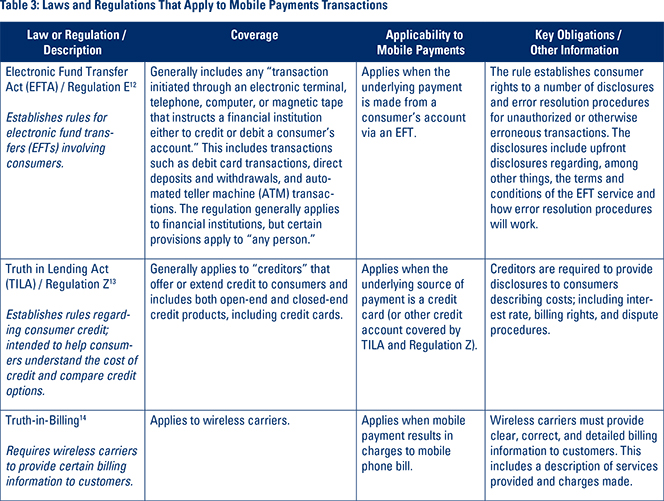

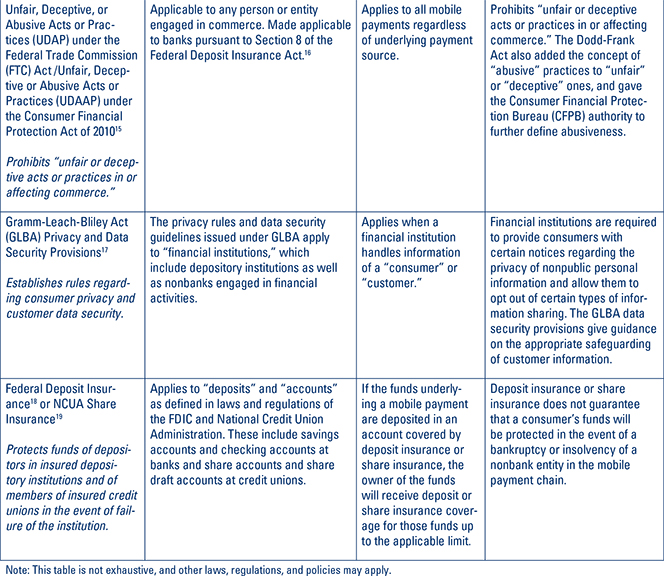

Legal and Supervisory Framework

Finally, noting that there are “no federal laws or regulations [that] specifically govern mobile payments”, the FDIC report gives us a lengthy list of laws and regulations that nevertheless apply to mobile payments:

The Takeaway

The FDIC report concludes by noting that, even as “[m]obile payments are poised to become an important part of the payments landscape,… it is unclear when they will achieve popular acceptance and what forms they will take”. Yet, that lack of clarity doesn’t prevent the authors from agreeing with the prediction of the “majority of industry observers” that “a limited number of mobile payments models will exist in the marketplace”. We shall see.

Image credit: Wikimedia Commons.