Student Debt Quickly Turns into a Major Problem

That is the inescapable takeaway from the latest Household Debt and Credit quarterly report, issued by the Federal Reserve Bank of New York. The growth of the overall volume of outstanding student loans in the U.S. over the past decade has been staggering and that is hardly surprising, considering that college costs have been rising at an accelerating rate, even throughout the Great Recession. The unavoidable outcome of these developments, which the NY Fed’s data show is already taking place, is that Americans can no longer keep up with their student loan repayments and the delinquency rate of this debt category is now increasing at a faster pace than even the one of the home mortgages at the height of the financial crisis.

Outstanding credit card balances and auto loans also rose in the third quarter of 2012, albeit more modestly than the student debt total, however the overall level of consumer indebtedness fell for yet another quarter, the report tells us. It was the fourteenth such decrease in the past fifteen quarters. The ongoing debt deleveraging trend is driven by the continual decline in real estate-related debt. Yet, if the student debt issue is not resolved, we will soon find ourselves dealing with yet another huge consumer debt crisis, even as the overall indebtedness keeps falling. Let’s take a closer look at the NY Fed’s numbers.

U.S. Consumer Debt Down by $74B

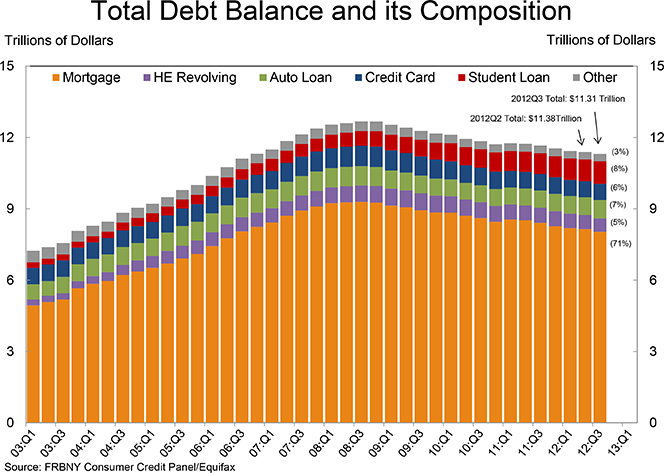

The NY Fed report’s headline news is that the aggregate indebtedness of U.S. households at the end of September 2012 was $11.31 trillion. That is $74 billion (0.7 percent) lower than the corresponding total at the end of the previous quarter. The new total is lower by 10.8 percent, or $1.37 trillion, than the peak of $12.68 trillion recorded in the third quarter of 2008, at the end of which the collapse of Lehman Brothers paved the way for the Great Recession. The fall is due exclusively to the drop in mortgage balances — a 1.5 percent decrease from the level recorded in 2012 Q2 — which now stand at $8.03 trillion.

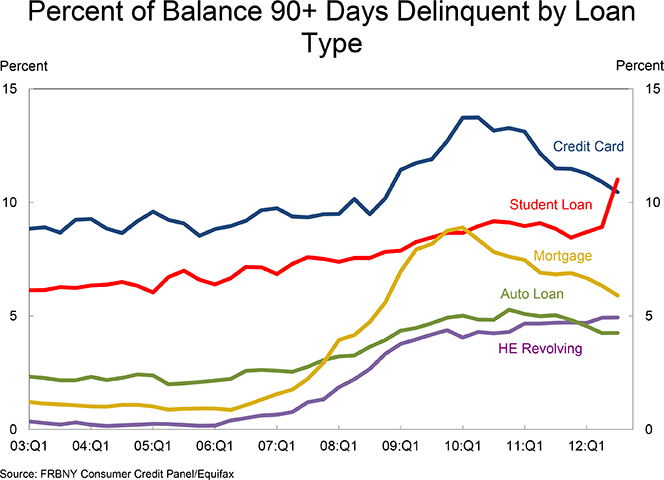

The overall delinquency rate also improved in 2012 Q3, the NY Fed tells us. As of the end of September, 8.9 percent of all outstanding consumer debt — $1.01 trillion in total — was delinquent, down from 9 percent in 2012 Q2 and 9.3 percent in 2012 Q1. Just under three-quarters — $740 billion — of that total was “seriously delinquent” — at least 90 days late, we learn. As you can see in the chart below, whereas the delinquency rates of credit cards and home mortgages have been steadily declining since reaching a peak in early 2010, following a short-lived improvement, student loan delinquencies are quickly approaching stratospheric levels.

Credit Card Debt Down, Student Loans Up

Now let’s look at the credit cards and student loan numbers.

Credit Cards

- Aggregate credit card limits were down by $9 billion — 0.3 percent — from the previous quarter.

- The number of open credit card accounts fell slightly to 382 million, 23 percent below the 2008 Q2 peak of 496 million.

- Outstanding credit card balances rose by $2 billion to $674 billion, 22.1 percent below the 2008 Q4 peak of $866 billion.

- Credit card delinquencies — 10.45 percent — were down from 10.9 percent in 2012 Q2 and are at their lowest level since Q4 2008.

Student Loans

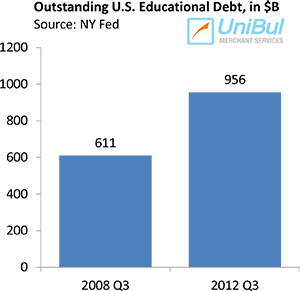

- Student loan debt rose by $42 billion to $956 billion. We are told that $23 billion of this total is new debt and the remaining $19 billion is attributed to previously defaulted student loans that have now appeared on the affected consumers’ credit reports.

- Since the peak in household debt in 2008 Q3, the student debt total has risen by $345 billion — an increase of 56.5 percent — while the other forms of debt have fallen by a combined $1.4 trillion.

- The student loan delinquency rate rose for the third consecutive quarter. The share of student loan balances delinquent by 90 or more days jumped to 11 percent from 8.9 percent in 2012 Q2. For perspective, the highest delinquency level previously reached was 9.17 percent in 2010 Q3.

As I and many others have been pointing out, it’s been an astonishing turnaround.?á Only four years ago, the student debt total was lower by more than a quarter — 28.8 percent — than the credit card total. By 2012 Q3, the roles had been completely reversed and the student debt total was bigger by more than a quarter — 29.5 percent.

The Takeaway

In a sense, the latest NY Fed quarterly report doesn’t tell us anything we didn’t already know. It confirms that American consumers are still very much in a debt-deleveraging mode and are careful to make their mortgage and credit card payments on time. And that is all very well. However, we are also seeing a continuation of the sharp increase in both the student debt total and the associated delinquency rate. To state the obvious, these trends are unsustainable and, if left unaddressed, the quickly inflating student debt bubble will inevitably pop. When that happens the damage could be huge.

The obvious short-term solution would be to help distressed student loan borrowers — especially those who can’t find a job — to stay current on their loans by restructuring them. However, the long-term issue — the skyrocketing college costs — is much more difficult to solve, as it is hard to see how these costs can be contained in a globalized higher-education system, in which the U.S. is the undisputed leader and the destination of choice for many foreign students.

Image credit: PBS.org.

“a globalized higher-education system, in which the U.S. is the undisputed leader and the destination of choice for many foreign students.”

I would disagree with that assessment, on several counts.

– At the undergraduate level studying in your home country is much more cost effective, especially if you look at worldwide university rankings. UK, Europe and HK/China have world class universities. Sure many aspire to come to Harvard or MIT as undergrads, but that is minuscule.

The graduate school is a different matter as the funding cycle from DARPA/DOE/NSF etc. creates a virtuous circle with incredible amount of research and value in the system. Here we are in fact undisputed.

The real problem is that the undergraduate college system is unsustainable at current tuitions. Of course student debt is also a bubble that will pop if not addressed as you correctly point out.

My niece recently started college and was faced with making decisions about which loans to go with to finance her education. While looking for loans my Brother-in-law was speaking with one of the lenders and even mentioned how some of the loan options looked like the variable rate loans that created problems for the mortgage industry. The lender didn?ÇÖt deny the similarity of the two industries lending practices.

The student loan market is an area of growing concern in our industry and one that needs to be addressed sooner rather than later. Financial institutions need to carefully evaluate the quality of their loan underwriting in the student lending space. If we return to a banking culture of providing quality products to consumers we can help prevent collapses similar to what happened in the housing market.

As a professor this is scary. As a Business professor, I find these trends terrifying. MY guess is that we will have a student loan bailout within 4 years.

-Dr. Gerdes