The Durbin Amendment One Year On: A Disaster Revealed

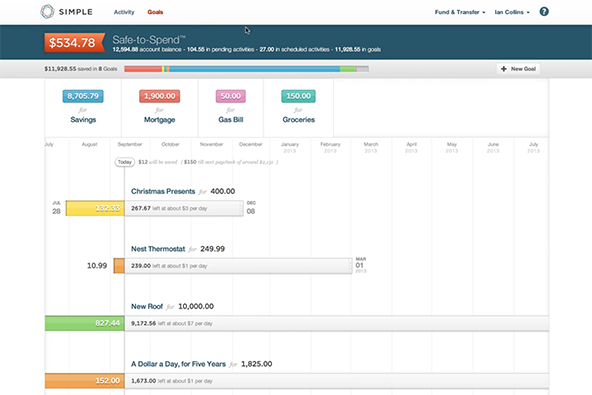

Regular readers know very well what we at UniBul think about the Durbin Amendment, which famously directed the Federal Reserve to ensure that debit interchange fees — the fees credit card issuers collect from each processed transaction involving one of their cards — were “reasonable and proportional”. The Fed responded by placing an upper limit of about $0.24 on the amount card issuers could charge merchants for each debit transaction they processed — a 45 percent reduction from the pre-reform average of $0.44. We warned before, during and after the new rule took place that the new regime would ultimately hurt consumers whose interests it was supposed to protect. Sure enough, that is precisely what is happening and we’ve written many, many, many posts on the Durbin Amendment’s side effects (and, by the way, some merchants have also been negatively affected) to document the damage.

It’s been a while since we’ve last visited the subject and I thought that the amendment’s first anniversary was the perfect time to do it. As it happens, the good people at The Financial Services Roundtable have done all the heavy lifting for me and have compiled an extensive list of the legislation’s “achievements”. So let me do some copying and pasting for you.

The Durbin Amendment One Year On: A Disaster Revealed

Here is what The Financial Services Roundtable has found:

FACT: The Durbin Amendment, a provision of the Dodd-Frank Act, directed the Federal Reserve to set price controls on debit interchange fees, (what retailers pay to accept debit cards at the register).

FACT: On October 1, 2011, the Durbin Amendment went into effect, capping debit interchange fees at 50% their previous levels.

– A diverse group of independent voices spoke out against the rule because of its negative impact on consumers, including the NAACP, National Education Association, Hispanic Chamber of Commerce, Americans for Prosperity, Consumer Federation of America, Black Chamber of Commerce, Redstate, National Taxpayers Union, and National Community Reinvestment Coalition.

FACT: One year later, the Durbin Amendment has resulted in significant savings for retailers.

– $9.4 billion was transferred from financial institutions to merchants, according to a Card Hub study.

– The average savings per merchant was $260.24 for every $100,000 of signature debit and credit card volume processed, according to a Heartland Payment Systems Survey.

– Washington DC merchants received the highest average savings of $333.94, according to a Heartland Payment Systems Survey.

FACT: However, as economists and academics predicted, retailers have not passed along the full savings to consumers.

– 41% of merchants report they do not intend to pass on lower debit card costs to consumers, according to a DRF Survey.

– 72% of consumers believe retailers will not pass on savings, according to an Ipsos Survey.

– Retail prices actually have increased 1.5% since the passage of the Durbin Amendment, according to the Electronic Payments Coalition.

FACT: Instead, consumers have experienced higher banking costs, as financial institutions seek to recoup lost revenue.

– 54% of institutions are looking to re-structure or terminate rewards programs due to Durbin, according to Pulse Network’s 2011 Debit Issuance Study.

– 60% more noninterest checking accounts carry fees and balance requirements than they did in 2010, according to a Bankrate Checking Account Survey.

– 30% of banks already have terminated their debit reward programs, according to a Bankrate Checking Account Survey.

– Elimination of fee incomes through Durbin and limitations of overdraft fees are hurting community banks. Noninterest income helps provide many banking products and services for consumers, according to Ignacio Urrabazo, Commerce Bank President and CEO.

– The Durbin Amendment will cause some of the smaller institutions to cease offering deb[i]t cards to their consumers, according to Cliff McCauley, Senior Executive VP of Frost Bank.

– Banks and credit unions will pass on much of the reduction in interchange fees to consumers and small businesses in the form of higher fees or reduced services, according to Drs. David S. Evans, Robert E. Litan, and Richard Schmalensee.

So there it is. I will leave you to make your own conclusions.

Image credit: Log-analyzer.net.