Retailers Pay Higher Fees for PIN Debit Transactions

The interchange fees charged to merchants accepting PIN-based debit transactions are now higher, on average, than before the Durbin Amendment was enacted, according to a recent Federal Reserve report. That is not exactly an unexpected development and is one that we predicted before the interchange limit was enforced, but for a first time we now have specific data to examine.

Now, it should be said that the Fed actually knew that the interchange for this type of transactions would increase after the reform took place. After all, the Fed, which the Durbin Amendment charged with determining the precise make up of the new interchange rate, had previously issued a highly-quoted report, in which the average pre-Durbin PIN debit interchange was calculated to have been lower than the proposed one. Let’s take a look at the new data and see what we can make of them.

Merchants Pay More for Accepting PIN Debit

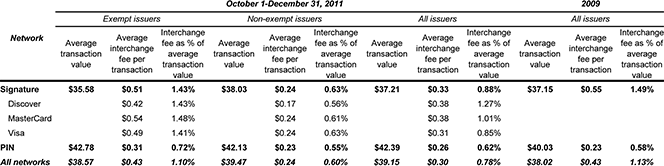

Here is what the Fed is telling us about how the data for the fourth quarter of 2011, which began on the day the interchange reform was enacted, compare to the data for 2009:

The magnitude of the change in interchange fees from 2009 to late 2011 differs materially for signature debit and PIN debit transactions.4 The average interchange fee per signature debit transaction declined substantially (57 percent) for non-exempt issuers and more modestly (8 percent) for exempt issuers. The signature debit interchange fee as a percentage of the average transaction value declined 58 percent for non-exempt issuers and 4 percent for exempt issuers. In contrast, the average interchange fee per PIN debit transaction declined slightly (less than 1 percent) for non-exempt issuers but rose significantly (32 percent) for exempt issuers. The PIN debit interchange fee as a percentage of the average transaction value declined 5 percent for non-exempt issuers and increased 23 percent for exempt issuers.

So, on average, PIN debit is now more expensive for merchants to accept. However, the higher average is entirely caused by the increase in the fees collected by the exempt issuers (financial institutions with assets of less than $10 billion). Here is a more detailed comparison:

Source: The Federal Reserve

Of course, the fee hike is not equally spread among all merchant types. The hardest-hit are the ones selling small-ticket items.

The Gap between Signature and PIN Debit Is Closing

The new Fed Data also reveal that the gap in interchange fees charged for signature and PIN debit transactions has largely been bridged (at least among non-exempted issuers). You can see that in the table above and here is more from the Fed:

The large disparity that existed in 2009 between the average signature debit and PIN debit interchange fees has narrowed substantially. In 2009, the interchange fee per signature debit transaction was, on average, about 2.4 times that for a PIN debit transaction (2.6 times if calculated using the interchange fee as a percentage of the average transaction value). In the fourth quarter of 2011, the difference between the average signature debit and average PIN debit interchange fees received by non-exempt issuers had largely disappeared; the average interchange fee per signature debit transaction was only 2 percent higher than that for PIN debit and 13 percent higher if calculated using the interchange fee as a percentage of the average transaction value. The difference between signature debit and PIN debit interchange fees was larger for exempt issuers but still much smaller than in 2009. The average interchange fee per signature debit transaction for exempt issuers in the fourth quarter of 2011 was 66 percent higher than the average interchange fee per PIN debit transaction (and 100 percent higher if calculated using the interchange fee as a percentage of the average transaction value).

It is quite something to see just how much more the non-exempted banks are collecting in debit interchange fees.

The Takeaway

So now we have some concrete data on the Durbin Amendment’s immediate effects on the debit interchange fee averages. These are as expected. Even as the retailers are paying higher fees for accepting PIN debit transactions, their overall interchange burden has decreased rather significantly.

Unfortunately, also as expected are the effects the interchange reform has had on the overall cost of consumer banking. The issuers had to find new revenue sources to make up for the lost interchange revenue and they have. A recent NY Times report, for example, tells us that about a third of all U.S. banks still offer free checking accounts, whereas three years ago almost all of them did. Moreover, we are told, “having stepped gingerly into the waters of monthly fees with relatively modest charges, the biggest banks are beginning to increase their rates.” At the end, the issuers will manage to find ways to recoup their losses and we will all be picking up the tab.

Image credit: Quizzle.com.