Grocery Stores, ATMs Top Locations for Credit and Debit Card Fraud

Other prime spots for payment card fraud include gas stations, restaurants and online stores, we learn from new data released by FICO, the maker of the most widely used consumer credit score model in the U.S. While fraud losses have increased during the period covered by the study, they remain low by historical standards, we are told.

As traditionally has been the case, card-not-present fraud has accounted for most of the losses, however new technologies have enabled criminals to make inroads into card-present territory where fraud is costlier on a per-transaction basis, we learn. Even though payment card fraud losses are absorbed by the card issuers and the merchants, cardholders can be greatly inconvenienced when dealing with the consequences, so it’s in everyone’s interest to help keep them low. Let’s see what FICO has to tell us.

1% of U.S. Credit and Debit Cards Affected by Fraud

That is what Doug Clare, vice president of Product Management at FICO, tells us, adding that the criminals are adapting to changing consumer behavior:

More online shopping has created a shift towards more online fraud, which is proving to be a popular, relatively safe and anonymous means for fraudsters to exploit any weakness in fraud systems. Consumers and issuers should remain diligent when using cards for point of sale and ATM transactions.

Overall, during the period covered by the study — from January 2010 to September 2011 — FICO has found that card-not-present fraud — fraudulent transactions completed on e-commerce websites, over the phone and in mail order sales — have increased at twice the rate of counterfeit card losses. However, there has been an increase in skimming, where a card reading device is installed into an ATM or a self-checkout terminal, which has enabled criminals to collect more sensitive payment-related data. These data are then used to produce counterfeit cards, which, in turn, are used in fraudulent card-present transactions.

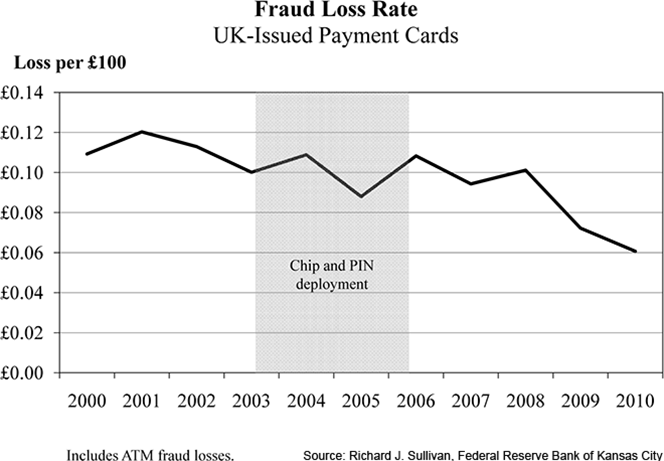

The upcoming adoption of the EMV (smart card) technology is expected to have a positive effect on card-present fraud levels, as it did in the U.K. Here is what took place in Britain, following the EMV adoption (source):

The top three locations for debit card fraud were ATMs, grocery stores and self-service gas stations, whereas the top categories for credit card fraud were grocery stores, restaurants and e-commerce websites.

Who Loses from Payment Card Fraud?

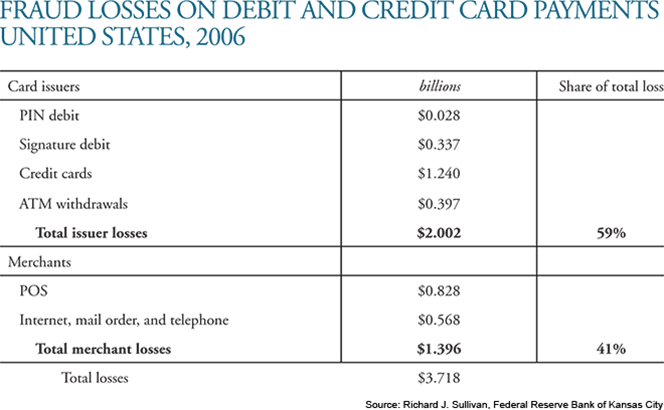

We’ve written on this subject before, but let me just give you the data. Kansas City Fed economist Richard J. Sullivan has done the math for us and has found that in 2006 U.S. card issuers have absorbed 59 percent of all card fraud losses, with the remaining 41 percent belonging to the merchants. Here is the full breakdown (source):

As you can see, cardholders have suffered no fraud-related losses. In 2006 credit card fraud has comprised 61.9 percent of the issuers’ losses, ATM withdrawals have added 19.8 percent, signature debit transactions have accounted for 16.8 percent, and the remaining less than two percent have belonged to PIN debit payments.

The Takeaway

So the FICO data show that losses from payment card fraud in the U.S., as a share of total transactions, are low, which is good news. However, in absolute terms, these are still very big numbers and so there is room for improvement. The decisions by Visa and MasterCard to make it mandatory for all U.S. payment processors to ensure support for the EMV technology by April 1, 2013, will make some difference and help push card-present fraud levels further down. However, we are unlikely to see anything like a full-scale replacement of the mag-stripes with chips anytime soon. Still, that is a step in the right direction.

Image credit: Whatsnextretail.com.