The State of the Student Loan Debt

A am a bit late on this one, but thought that I should write about it anyway, even though the data are a bit old—the lessons are nevertheless valid. A recent paper by three economists from the Federal Reserve Bank of Kansas City gives us an overview of the current state of student loan debt in the U.S. And the picture it paints is not a pretty one. Even as the total outstanding U.S. consumer debt has been continually decreasing since reaching its peak in the third quarter of 2008, the student debt total has been increasing all along, and at a much higher rate. Needless to say, that increase has been occurring at a time of stagnant wages and high unemployment, which, in turn, has led to high and rising delinquency and charge-off rates.

This one is just the latest of a string of studies, which clearly indicate that the growth of student debt in the U.S. is out of control and that it is leading to the inflation of a new debt bubble. Something needs to be done to bring that growth rate back in line with the wage growth or the bubble will eventually burst, with unquantifiable, but surely negative, consequences for the economy. Let’s take a look at the Kansas City Fed paper.

Student Loan Debt up by $540 Billion in 7 Years

Here is what the paper tells us:

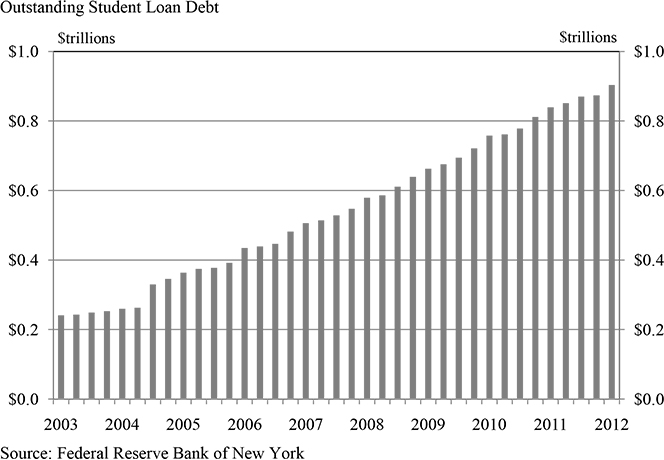

Student loan debt has increased dramatically over the last several years, from about $364 billion in the first quarter of 2005 to $904 billion in the first quarter of 2012, a rate of growth of 13.9 percent annually (compounded) (Figure 2). 9 By comparison, total outstanding revolving debt, which includes and is largely made up of credit card debt (but excludes revolving mortgage debt), was $866 billion in the first quarter of 2012 (seasonally adjusted). 10 While student loan debt has been rising at a rapid pace, total U.S. outstanding debt has fallen by over $1.5 trillion since reaching its peak in the third quarter of 2008. 1

And here is the chart:

The Average Student Loan Borrower Owes $24,218

Here is the breakdown:

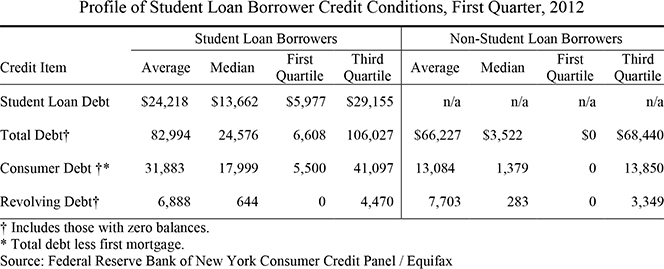

The median borrower holding student loan debt in the first quarter of 2012 owed $13,662 in student loan debt (Table 2). 13 The average amount of student loan debt across all consumers with student loan debt was $24,218. The difference in average and median reflects the existence of borrowers at the top of the distribution with especially large amounts of student loan debt. Over 3 percent borrowers have six-figure student loan debt, and 0.5 percent have debt over $200,000. 14 25 percent of borrowers held more than $29,155 in student loan debt in the first quarter of 2012, while another 25 percent held less than $5,977 in student loan debt. 15

And here is the table:

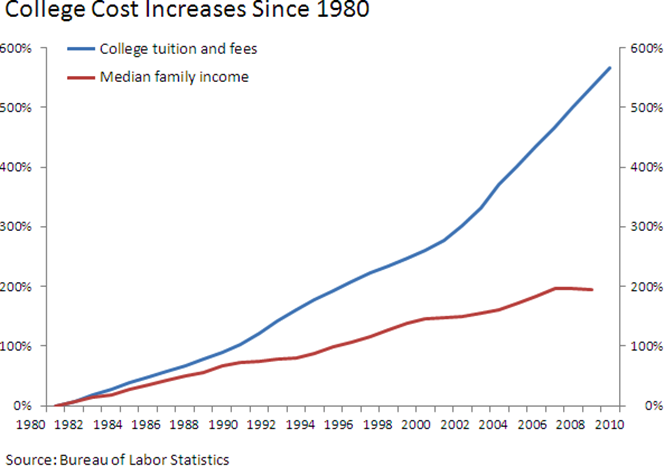

And there is a good reason for the rise in student debt: college cost has skyrocketed:

10.6% of Student Debt Is Delinquent

And that is not all:

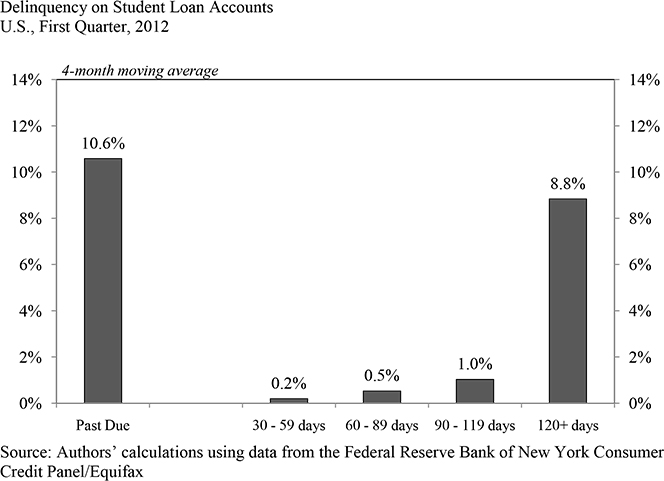

In the first quarter of 2012, the latest date at which data are available, about 10.6 percent?á of student loan accounts were at least 30 days past due (Figure 5). 28 The large majority of these delinquent loans were over 120 days past due (8.8 percent). These figures may understate the problem of delinquency, however, because those in deferment or forbearance are included in the numbers of loans outstanding, but are not included in the number of loans currently past due.

And here is the chart:

It is worth pointing out that even at their post-Lehman height, credit card delinquencies were much lower than the current level of the student debt delinquencies. According to the St. Louis Fed, that height – 6.74 percent – was reached in the first quarter of 2009.

Defaulted Student Loan Borrowers Face ‘Serious Consequences’

Here is what we learn:

Delinquencies on student loan payments, especially when resulting in a default, have serious consequences for the borrower. If a loan goes into default, the entire unpaid amount of the loan immediately becomes due. Defaulted borrowers may be sued, tax refunds may be intercepted, and / or wages may be garnished. The defaulted borrower is responsible for paying collection fees, costs, court costs, and attorney fees. Defaulted borrowers also can be denied a professional license. Eligibility for future loan deferments is withdrawn, as well as eligibility for other federal student aid under federal benefit programs. Finally, student loan delinquencies are reported to the major credit bureaus. An often overlooked aspect of individual student debt problems is the psychological burden it imposes on delinquent borrowers.

As I said, it is not a pretty picture.

The Takeaway

Unfortunately, it is not at all clear what needs to be done to reverse, or at least slow down, the student debt explosion. The report’s authors stop short of offering specific policy suggestions, contenting themselves with stating the obvious: the “clear message is that student loans present problems for some borrowers.” However, I find the following statement a bit too sanguine:

At the same time, the analysis suggests that student loans do not yet impose a significant burden on society from their fiscal impact.

I would point out that home mortgages also did not “impose a significant burden on society from their fiscal impact” until the bubble burst and government spending went through the roof in support of an economy in free fall. The sooner we deal with the student debt issue, the better.

Image credit: Wikimedia Commons.

Congress needs to do more than “revisit its system for ensuring that students who take on debt have a fighting chance to pay it back.” They need to fix the dysfunctional and iniquitous “American Exceptional” system of higher education that requires so many young people to take on a lifetime debt burden to obtain what is a de facto requirement for any job that allows a decent life.

It is an inexcusable shame that the United States is the only “developed” nation in which students face what is effectively indentured servitude. (The shame is second only to being the only country whose citizens face bankruptcy from medical bills even if they pay exorbitant premiums for adequate insurance.) And to compound the shame, lenders bought a law preventing student loan debt from being relieved with bankruptcy regardless of circumstances, even as corporations (including those headed by Donald Trump) receive Wall Street plaudits for using bankruptcy as a strategic tool to create shareholder value by ridding themselves of creditors, unions, and employees.

Addressing the problem of lender abuse is ignoring the more fundamental problem of ensuring that qualified students receive the necessary education to contribute their full potential to society. Other countries regard providing that education as an investment in the public good. The United States regards higher education as an industry that can profit from excessive tuition. That’s a disgrace!