Eventbrite Shows Us how to Become a Square

I would never have guessed it, but it now seems very probable that sometime soon we will have just as many different types of Square-like credit card acceptance platforms as we now do point-of-sale (POS) terminals. But the launch of such a service by Eventbrite — a website that enables users to plan events and sell tickets for them — has opened my eyes to the possibility.

And it does make sense. Eventbrite could just let its customers take payments through Square, PayPal Here or some other service provider, but doing so would deprive it from the transaction fees that payment processors collect. And these fees are not to be ignored. Of course, the company gives a different reason for its decision to build a proprietary payment service — that doing so allows it to capture customer data that the Squares of the world would not otherwise have made available — but that assertion doesn’t hold any water. Let’s take a look at what Eventbrite has done.

Eventbrite At The Door

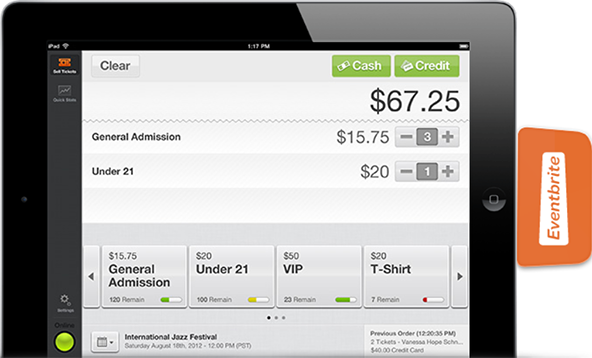

So At the Door, as the new payment acceptance service is called, is available exclusively for Eventbrite users. It is designed for iPads and it requires that users first download the free At the Door app and buy the card reader (it costs $10, but the money is later refunded) that plugs into the tablet’s charging dock. An optional printer can be added for about $300.

The At the Door event set-up process is not in any way different from the standard Eventbrite set-up procedure and users can still collect customer payments online. The difference, as the name implies, is that At the Door now makes it possible to collect card payments on location.

Eventbrite charges a flat 3 percent fee for At the Door credit and debit card payments. I wasn’t able to find any other pricing details, so I don’t know if there is a higher non-qualified fee for key-entered payments, which is what all Square-like service providers do. What is known is that the processing fee is in addition to the 2.5 percent plus $0.99 per-ticket fee charged by Eventbrite.

At the Door vs. Square

At the Door is a slick card acceptance tool that will surely be put to good use by any iPad-armed Eventbrite user who ever needs to sell tickets on location. Last-minute attendees will also love the convenience of being able to pay their ticket by a credit card.

And yet, useful as it is, At the Door could never compete with Square and PayPal Here on its payment acceptance merits alone. And Tamara Mendelsohn, Eventbrite’s VP of marketing, has been more than a bit disingenuous when she told the New York Times that her company chose to build At the Door, because

[T]hird-party payments companies like Square do not make available the data they capture about the people who are buying those tickets at the door.

In reality, Square Register does provide its users with plenty of customer data and much better reporting capabilities than what At the Door seems to offer and it costs less to boot. And everyone can see that on Square’s website:

Find out which of your customers are loyal to your business based on how often they visit or how much they spend. Reward your Regulars with special discounts and a personalized experience.

I really wish that the NYT had challenged Mendelsohn’s assertion.

The fact is that Eventbrite has gone into the POS card acceptance business with the goal of collecting some extra revenue. Yes, At the Door is a neat way to take cards, but then anything looks neat on an iPad. And anyway, as I said, there are cheaper and more powerful ways to do that.

The Takeaway

But there is a bigger lesson to be learned from the At the Door launch than the knowledge that one service provider’s executive has made a less-than-accurate statement about a competitor. I do have to reiterate, though, that Mendelsohn’s statement is rather exceptional in its disregard for the facts. It would’ve been OK if she had said that At the Door gives Eventbrite users a better way to collect customer information than anything currently available. I don’t think it would have been a correct statement, but it would have left room for interpretation. But to say that no other processor makes available to its users the data captured about their customers is simply incorrect.

Still, what the story teaches us is that certain B2B service providers, whose platforms incorporate some type of a third-party payment acceptance solution, can quite easily turn into a Square or PayPal Here, under the right circumstances. Such businesses don’t necessarily have to be all that big, but they do need to be well-placed. And the potential reward is well worth the effort.

Image credit: Eventbrite.

Hi UniBul Team and Readers-

Thank you so much for taking a look at our At The Door Card Reader launch–we’re very excited about it, and we’re glad that it’s sparking conversation. We really appreciate the thoughtful post, and I want to respond on two points:

1. To celebrate the launch, we are waiving all service fees on purchases made through At The Door. That means that the only cost associated with transactions will be the 3% credit card processing cost.

2. This conversation around data is a complex one, so I want to try to add some clarity. At Eventbrite, one of our main priorities is arming event organizers with data about their attendees–this makes it easier for them to make staffing and marketing decisions for future events. Because Square does not offer an open API, we could not build an integration with our app that supports these capabilities. So yes, Square does support data collection, but without an open API, we can’t sync that data with an organizer’s Eventbrite account, to give them a comprehensive look at ticket sales (both before the event and at the event). Hopefully, they will offer an open API soon, at which point we’ll definitely explore an integration.

Thanks again for sharing the news of our launch!

Vanessa

Sr PR Manager at Eventbrite

Hello Vanessa,

Thanks for the detailed reply and I do appreciate your explanation of the data availability issue. I’m sure that your customers will love your new lower fees and will reward you by using At the Door more often than the other checkout alternatives that you support, which would now cost them considerably more. Best of luck with your new service!