Americans Look for, Get More New Credit Cards

Even as the debt deleveraging process in the U.S. was still in full swing in the fourth quarter of last year, Americans were looking for, and getting approved for, more new credit card accounts, according to the latest Household Debt and Credit quarterly report, issued by the Federal Reserve Bank of New York (FRBNY). The aggregate credit limits rose in step with the increase of new accounts, however both numbers are still well below the peaks reached in 2008.

The fall in aggregate consumer debt, the twelfth such occurrence in the past thirteen quarters, was once again driven by the continuing decrease in real estate-related debt, as well as the ongoing decline in delinquency, bankruptcy and foreclosure rates, the FRBNY report tells us. The trouble, however, is that the fall in the overall delinquency rate seems to be slowing and stabilizing at a level that is significantly higher than the pre-crisis one.

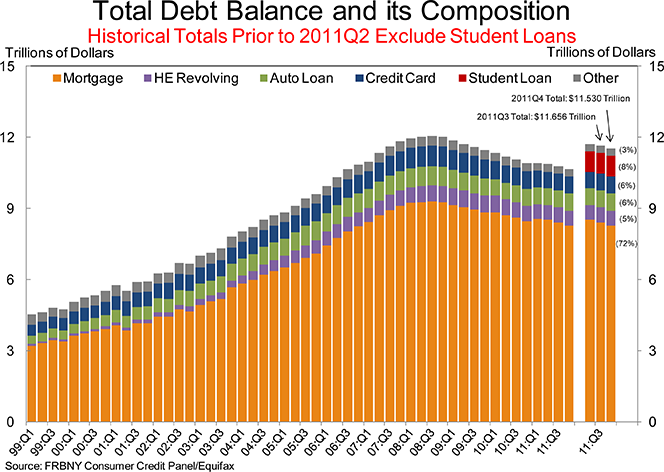

U.S. Consumer Debt Down 1.1%

The headline news to come out of the FRBNY report is that the overall indebtedness of U.S. households at the end of December 2012 was $11.53 trillion. That is $126 billion (1.1 percent) lower than the $11.66 trillion total measured at the end of the third quarter. Excluding student loans, which were not tracked by the NY Fed prior to 2011 Q2, the new total is 11.6 percent, or $1.4 trillion lower than the peak of $12.06 trillion recorded in the third quarter of 2008, at the end of which Lehman Brothers’ collapsed, ushering in the financial crisis.

The New York Fed gets its data from Equifax, one of the three national credit reporting agencies. Here are the key findings:

- Mortgage balances fell by $134 billion, or 1.6 percent, to $8.27 trillion and are now 11 percent below their 2008 Q3 peak of $9.29 trillion.

- HELOC (home equity lines of credit) balances rose by $12 billion (1.9 percent), to 0.63 billion and are now 11.3 percent below the 2009 Q4 peak of $0.71 billion.

- Credit card balances rose by $0.01 billion, or 1.4 percent, to $704 billion.

- Total household delinquency rates fell by 20 basis points to 9.8 percent. About $1.12 trillion of consumer debt is now delinquent, $824 billion (69.5 percent) of which is “severely derogatory” (past due by 90 days or more).

New Credit Card Accounts, Limits Rise

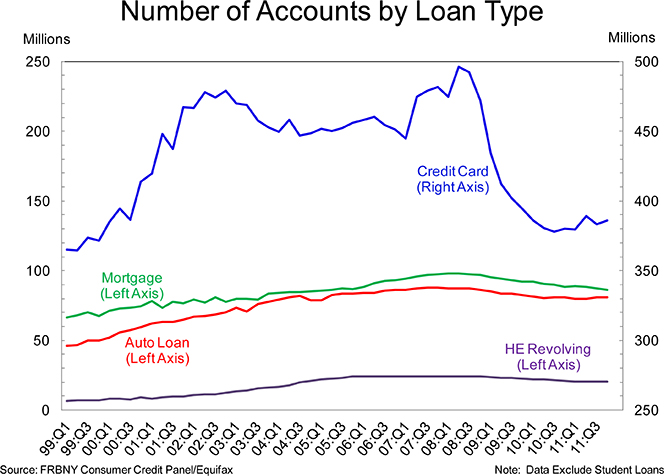

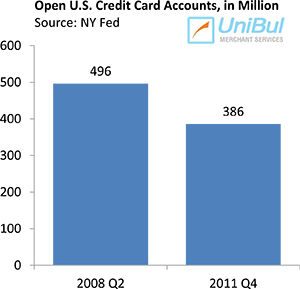

The number of active credit card accounts in the U.S., having fallen by six million in 2011 Q3, rose by three million to 386 million in the fourth quarter, according to the NY Fed. Even so, that is still 22 percent lower than the 2008 Q2 peak of 496 million. The aggregate credit limits across these open accounts rose by $98 billion (3.6 percent) to $2.82 trillion for the period, but are still 23.8 percent below the 2008 Q3 high.

The number of active credit card accounts in the U.S., having fallen by six million in 2011 Q3, rose by three million to 386 million in the fourth quarter, according to the NY Fed. Even so, that is still 22 percent lower than the 2008 Q2 peak of 496 million. The aggregate credit limits across these open accounts rose by $98 billion (3.6 percent) to $2.82 trillion for the period, but are still 23.8 percent below the 2008 Q3 high.

In 2011 Q4, Americans had used 25 percent — $704 billion — of the available credit on their credit card accounts, slightly up from the 23.2 percent ratio measured in 2008 Q3. Moreover, we learn that Americans continue to actively look for new credit. The number of new credit card inquiries within six months was up by 2.7 percent for the quarter, which was also 16.1 percent above the lowest point reached in 2010 Q1.

The Takeaway

The rise in the total number of active credit card accounts indicates that the issuers’ underwriting standards may be relaxing, although there is another variable that affects this total and needs to be accounted for. It is the number of closed accounts, terminated either voluntarily by the consumers or by the issuers, typically following defaults. The NY Fed report does not track the credit card default rate, but we and others do. According to Moody’s, U.S. credit card defaults fell by 0.23 percent in 2011 Q4, on a quarterly basis, which would have given a further boost to the rate of growth of active credit card accounts.

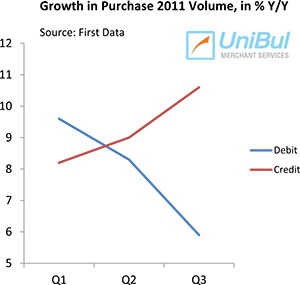

A relaxing of the underwriting standards, if that is indeed what is taking place, has been expected, both because of the improving macroeconomic statistics, but also because of the issuers’ need to drive their customers away from using the now unprofitable debit cards and toward credit cards. The beginning of the fourth quarter coincided with the enactment of the debit interchange limit, which placed a cap on the amount issuers can charge merchants for transactions involving their debit cards. This new limit — about 45 percent below the pre-reform level — does not apply to credit cards, which is what makes them the preferable payment method from the issuers’ perspective. There are data showing that the shift is already happening and I expect the trend to continue.

A relaxing of the underwriting standards, if that is indeed what is taking place, has been expected, both because of the improving macroeconomic statistics, but also because of the issuers’ need to drive their customers away from using the now unprofitable debit cards and toward credit cards. The beginning of the fourth quarter coincided with the enactment of the debit interchange limit, which placed a cap on the amount issuers can charge merchants for transactions involving their debit cards. This new limit — about 45 percent below the pre-reform level — does not apply to credit cards, which is what makes them the preferable payment method from the issuers’ perspective. There are data showing that the shift is already happening and I expect the trend to continue.

Image credit: Flickr / 401(K) 2013.