Americans’ Credit Card Debt Slightly Up, Credit Scores Keep Falling

Another day, another report on the U.S. credit card debt situation. The latest one comes from CreditKarma.com — a website that provides free credit scores — and also includes data on non-revolving consumer debt: home mortgages, home equity loans and student loans. The last category was the only one to register a decline from the previous month.

Additionally, Credit Karma reports that Americans’ credit scores decreased in October, by two points on a monthly basis, following a three-point fall in September. Credit scores are down on a yearly basis as well, even as credit card debt has fallen quite a bit since last October. How can that be happening? Shouldn’t we be rewarded for paying down our debt? Well, yes but it turns out that overall consumer debt has actually risen for the year. Moreover, credit scores are comprised of several components, rather than simply reflecting the vertical movement of consumer debt. Let’s take a closer look.

U.S. Credit Card Debt Up 1%, Credit Scores Down 2 Points

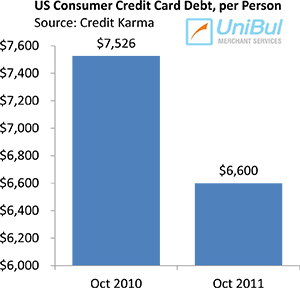

Credit Karma’s Credit Score Climate Report tells us that in October Americans with at least one account owed $6,600 on their credit cards. That is one percent up from September, but still 11 percent down from October 2010. Credit card debt rose the fastest in the following states:

Credit Karma’s Credit Score Climate Report tells us that in October Americans with at least one account owed $6,600 on their credit cards. That is one percent up from September, but still 11 percent down from October 2010. Credit card debt rose the fastest in the following states:

- Alaska — up 10 percent to $8,356.

- Hawaii — up six percent to $7,497.

- Minnesota and Rhode Island — up five percent to $6,407 and $6,603, respectively.

- Massachusetts, Oklahoma and Utah — up four percent to $6,799, $6,438 and $5,978, respectively.

The average month-over-month numbers for non-revolving accounts were reported as follows:

- Home mortgage debt was unchanged at $174,788.

- Home equity debt was up one percent to $47,747.

- Student loans were down three percent to $29,096.

The average credit score was reported at 661, down two points from September and down five points from October 2010. Why is that?

How Is Your Credit Score Calculated?

To understand why credit scores have fallen both on monthly and yearly basis, you need to know how they are calculated. Consumer credit scores are made up of five major components and Ken Lin, CEO of CreditKarma.com, refers to one of them when he comments on his report:

Consumers need to be aware of the correlation between debt and their credit score. Credit card utilization is a major factor in determining a person’s credit score, so carrying a large balance can cause it to decrease.

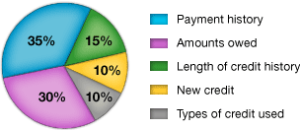

Utilization is a major factor, but it only accounts for less than a third of your credit score. Here is the full list of the components of FICO, the most widely used consumer credit score:

Utilization is a major factor, but it only accounts for less than a third of your credit score. Here is the full list of the components of FICO, the most widely used consumer credit score:

- Payment history. 35 percent of your score is based on your consistency (or lack thereof) in making payments on time. If you don’t make any late payments, your score will steadily improve over time.

- Amounts owed. 30 percent of your score is based on your credit utilization ratio, which represents the used portion of your total available credit, across all of your credit cards. Your goal should be to keep credit utilization below 30 percent both for the total, as well as for each individual credit card balance.

- Credit history length. 15 percent of your score is based on the length of your credit history. There is not much you can do on that score, other than keeping your old credit card accounts open, even if you are no longer using them. Of course, you don’t have to keep them open forever, but wait until you score well on the other factors, before you do so.

- New credit. This component accounts for 10 percent of your score. The more you apply for new credit, the worse affected is your score. Every time you apply for a new account, a credit inquiry is posted on your credit report, hurting your score in the process.

- Credit types. The remaining 10 percent of your score are dependent on the variety of credit types in it. Most of us have a credit card or two, but an installment account (e.g. car loan) or a mortgage can boost your score.

Again, these are the FICO score components, but Credit Karma surely uses a similar formula for calculating its own scores.

The Takeaway

According to the Federal Reserve, the total?áconsumer credit card debt in the U.S. in the third quarter of this year was $789.6 billion, down $15.8 billion from Q3 2010, a decrease of 1.97 percent. However, total consumer debt, including all non-revolving components, has risen by $58.4 billion for the period, to $2,452 billion, an increase of 2.38 percent. So that takes us some way towards explaining the fall in consumer credit scores.

However, the above breakdown shows you that the overall amount of debt you owe is only the second-most important factor in calculating your credit score. To get the complete picture we would need more detailed data on how Americans manage their credit accounts.

Yet, we have enough information as it is to know what we need to do to improve our scores. Make your payments on time every month and for every account, keep each of your account’s outstanding balance under 30 percent of your line of credit, don’t close the accounts you no longer need too soon, don’t apply for new credit too often and open an installment account (a TV or a computer will do). If you do all that, your credit score will slowly improve and will keep rising for as long as you follow these rules.

Image credit: Kathykristof.com.