Square Wants to Replace POS Terminals with iPads, Prospects Unclear

Now that his mobile payments start-up seems to have gained some ground on its rivals in the consumer m-payments space, Jack Dorsey, who also co-founded Twitter, wants to get Square into brick-and-mortar stores as well. What’s more, having recently landed a major deal with Apple, whose stores now sell Square’s card reader, Dorsey is keen to return the favor and get an iPad into every store that signs up for his start-up’s services.

Well, this may turn out to be a bit trickier than he probably imagines.

The News: Square Wants Retailers to Use iPads as POS Terminals

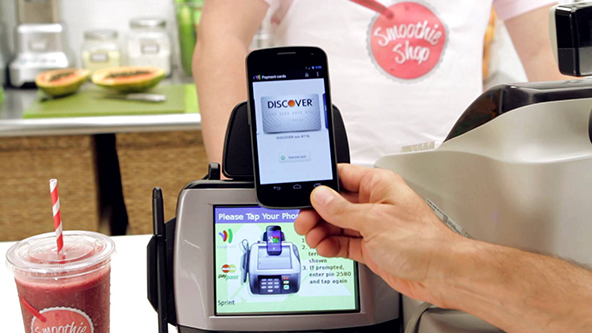

So Square has upgraded its service to make it more attractive to brick-and-mortar merchants and convince them to get rid of their obsolescent point-of-sale (POS) machines in favor of slick, shiny Square-powered iPads, Jack Dorsey explained in a news conference, live streamed for TechCrunch Disrupt.

Retailers who sign up will be able to accept credit card payments through the Square reader plugged into the iPad, just as consumers are. There will be no paper receipts, which will be replaced with electronic ones.

Then there are the cool features, which Dorsey hopes will convince retailers to switch to Square. They come for free and enable retailers to keep track of their customers’ purchasing patterns, send them coupons or otherwise keep in touch with them.

There is something in the new offering for consumers as well. Card Case is a virtual wallet-type of service that will enable users to store their card information with Square, create digital tabs with a merchant and then make payments by providing their names. The corresponding retailer feature, called “Register,” will allow merchants to process and keep track of such sales.

“It gives you data,” Dorsey said about Register. “Every single merchant that uses the Square Register has Google-style analytics for everything they do. They can easily answer the question, ‘How many cappuccinos did I sell today?'”

Is Square Cool Enough?

So Square’s retailer offering is cool, that much is clear. But is it cool enough to win over merchants? There are several major hurdles that the new service will need to overcome, if it is to be successful, and it is far from clear whether Jack Dorsey and company will be able to do that.

First, there is the pricing. As we have pointed out on several occasions, Square’s rates are far above the industry average. The start-up charges a flat rate of 2.75% for swiped transactions and 3.50% + $0.15 for key-entered payments. Retailers can easily get rates of 1.65% for swiped transactions, although there will be a per-transaction fee of $0.20 or so. This is a huge difference and I don’t foresee many merchants going for it.

Then there is the fact that Square is attempting to penetrate a well-established market. Even small merchants today can get their hands on sophisticated POS equipment at very low cost that can be tied up with their accounting systems.

Also, there is the closed nature of the Card Case Register service. It requires that both the merchant and the customer have signed up for Square, before a payment can be made. In other words, it is the brick-and-mortar equivalent to PayPal. However, even today PayPal is not big enough for e-commerce merchants to make it their exclusive payment option at the checkout. If PayPal is too small, what can we say about Square?

Credit Card Takeaway

We have often praised Square as the only service that allows consumers to accept credit cards directly, which is the reason they can afford to charge above market rates. All other similar services are designed for businesses and require a merchant account.

Square does not have such a unique advantage as it enters the highly competitive world of small business card acceptance. I just don’t see how a retailer processing any meaningful volumes of credit cards will agree to be paying more than a percentage point above what they do now.

Image credit: Squareup.com.