Americans’ Credit Card Payments Timeliest in 15 Years

American consumers are, on average, repaying their credit card debt on time at a higher rate than at any time since 1996, according to the latest data released by TransUnion, one of the three national credit reporting bureaus. Overall consumer credit card indebtedness also fell to a level not seen in more than a decade and is way down from the peak reached in the months after the Lehman collapse.

Credit Card Delinquency Rate Lowest in 15 Years

The report’s headline news is that the U.S. credit card delinquency rate fell to 0.74 percent in the first quarter of this year, down 10 percent from the previous quarter (0.82 percent) and nearly 33 percent down from the same period a year ago. It is the lowest delinquency level since the third quarter of 1996 (0.76 percent), TransUnion tells us.

TransUnion’s report is more valuable than the monthly data we get from the credit card issuers in their regulatory filings in that it gives us a more comprehensive picture of consumer credit card trends.

TransUnion measures the delinquency rate as the ratio of cardholders late on a payment to all of their credit cards, whereas the issuers measure the late payments ratio on a per-account basis, rather than per account holder. Moreover, the credit bureau’s report defines a payment as late if it is 90 days or more past due, whereas the card issuers use two different measures: early-stage delinquency rate for payments late by 30 – 59 days and late-stage delinquencies for payments late by 60 days or more.

Following is a list of the leading states by credit card delinquency rate on both ends of TransUnion’s table:

1. Nevada — 1.16 percent.

2. Florida — 1.04 percent.

3. Mississippi — 0.92 percent.

…

48. Vermont — 0.48 percent.

49. Alaska — 0.46 percent.

50. North Dakota — 0.36 percent

Credit Card Debt Lowest Since 2000

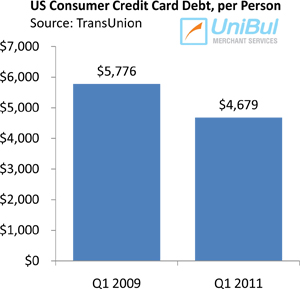

Overall consumer credit card indebtedness in the U.S. has fallen almost as spectacularly as the delinquency rate, we learn from TransUnion. By the end of March of this year Americans had shed 5.8 percent of their outstanding credit card balances at the end of 2010.

Overall consumer credit card indebtedness in the U.S. has fallen almost as spectacularly as the delinquency rate, we learn from TransUnion. By the end of March of this year Americans had shed 5.8 percent of their outstanding credit card balances at the end of 2010.

U.S. cardholders now owe $4,679 on credit cards, on average, down from the previous quarter’s level of $4,965 and 19 percent below the peak of $5,776, reached in the first quarter of 2009. The current level of indebtedness is the lowest since Q3 2000 ($4,695).

Leading states by average outstanding credit card balance per borrower on both ends of the table:

1. Alaska — $6,811.

2. North Carolina — $5,446.

3. Hawaii — $5,303.

…

48. South Dakota — $3,970.

49. North Dakota — $3,903.

50. Iowa — $3,649.

Credit Card Origination Up by a Quarter

New credit card originations continued to trend upwards, marking a third consecutive quarter of growth. In the first quarter of 2011 credit card companies issued 23.6 percent more cards than they did during the same period a year ago, according to TransUnion.

The leading states in the new credit card origination category were as follows:

1. Nevada — 45.7 percent.

2. Maryland — 37.1 percent.

3. Alaska — 34.9 percent.

The Credit Card Takeaway

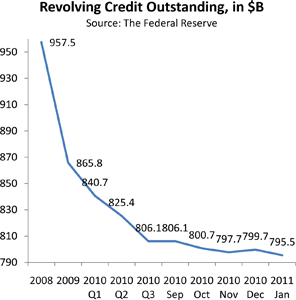

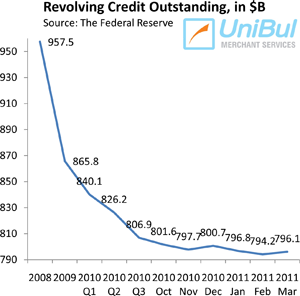

As TransUnion notes in its report, even as retail sales are growing, Americans are now much less likely to use their credit cards at the checkout. It is quite a turnaround from the pre-Lehman state of affairs. Not only are Americans now less likely to use plastic, but they also care much more about their outstanding credit card debt. By March of this year, U.S. cardholders had reduced their outstanding credit card balances by $177.5 billion, from $973.6 billion in August 2008 to $ 796.1 billion, a drop of 18.2 percent, according to the Federal Reserve.

As TransUnion notes in its report, even as retail sales are growing, Americans are now much less likely to use their credit cards at the checkout. It is quite a turnaround from the pre-Lehman state of affairs. Not only are Americans now less likely to use plastic, but they also care much more about their outstanding credit card debt. By March of this year, U.S. cardholders had reduced their outstanding credit card balances by $177.5 billion, from $973.6 billion in August 2008 to $ 796.1 billion, a drop of 18.2 percent, according to the Federal Reserve.

However, on a month-over-month basis, March did register a rise in the Fed’s “Revolving Credit Outstanding” category, comprised almost exclusively of credit card balances. It was only the second such monthly expansion since the beginning of the Great Recession and the first one following a non-holiday month. It is too early to predict whether we’ve seen the end of the period of consumer disillusionment with credit cards, but the fact that delinquency rates continue to fall (both early- and late-stage) indicates that either way, Americans are keeping a much closer eye on their unpaid balances, at least for now.

Image credit: Abril.com.br.