Americans Carry an Average of $4,284 in Credit Card Debt

The average American consumer carried $4,284 in outstanding credit card balances in December 2010, according to the latest data released by Experian, one of the three national credit reporting agencies. This represents a drop of four percent from the same month in 2009.

Fewer Active Credit Cards

Americans have also reduced the number of active card accounts to an average of 1.97 cards per person, which according to Experian is 23 percent lower than the equivalent number in 2007.

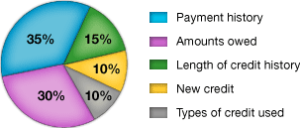

However, the accounts consumers have kept open now have a higher credit utilization rate — the used credit, as a proportion of the total available credit line. This is an issue, because the utilization accounts for 30 percent of the consumer FICO credit score and 23 percent of the VantageScore, which is produced by the three credit agencies. The higher the utilization rate, the bigger the adverse effect on the credit score.

San Antonio Residents Carry the Most Credit Card Debt

Experian’s report breaks down the data by metropolitan area and finds that San Antonio led the nation in the unenviable category of most heavily indebted American city. On the other end of the table was Sioux Falls, SD whose residents owed in December $1,731 less than the San Antonians. Here is a list of the top five cities on both ends of the debt spectrum.

Cities with Highest Credit Card Debt per Resident

| Metropolitan Area |

2010 Card Balance |

Change 2009 – 2010, in % |

Unemployment Rate, in % |

| San Antonio, TX |

$5,177 |

+1.5 |

7.3 |

| Jacksonville, FL |

$5,115 |

+1.8 |

11.0 |

| Atlanta, GA |

$4,960 |

+3.4 |

10.2 |

| Honolulu, HI |

$4,939 |

no change |

4.8 |

| Dallas / Fort Worth, TX |

$4,936 |

-4.5 |

7.9 |

Cities with Lowest Credit Card Debt per Resident

| Metropolitan Area |

2010 Card Balance |

Change 2009 – 2010, in % |

Unemployment Rate, in % |

| Sioux Falls, SD |

$3,446 |

-12.5 |

4.9 |

| Kingsport, TN |

$3,449 |

-10.8 |

8.1 |

| Fort Wayne, IN |

$3,476 |

-24.2 |

9.3 |

| Paducah, KY |

$3,515 |

-2.4 |

7.9 |

| Davenport, IA |

$3,515 |

+1.1 |

7.8 |

As the data show, there is no clear correlation between either the absolute level of credit card debt or its year-over-year change and the unemployment rate.

Southerners Have Lowest Credit Scores

The metropolitan areas with the highest credit scores were located mostly in the Midwest and on the West Coast. Wisconsin claimed the top two spots with Green Bay and Madison. No Southern or Southwestern state had a representative on this list.

“Cities like Minneapolis, that always have great credit scores, actually have higher debt than other cities,” explained Maxine Sweet, vice president for public education at Experian. “But it’s offset by the fact that they never miss payments, and they always have high credit limits.”

The Takeaway: Consistency is Key

Even if you are not able to pay down your credit card debt, your credit score does not have to suffer. Consistency and discipline are key in maintaining a high credit score. The point is that you can ruin your credit score even if you carry very low outstanding balances. A single late payment will not have a lasting negative consequence, but if you are missing your due dates repeatedly, your score will plummet.

Additionally, you should keep both your overall utilization rate across all of your credit card accounts and the one of each individual account below 30 percent. Avoid closing down accounts, even if you don’t use them anymore, because this will reduce your overall available balance, increasing your credit utilization.

Image credit: Rachelinlondon.wordpress.com.