Mobile Payments Volume to Total Nearly $1 Trillion by 2014

The worldwide adoption of mobile payments is fully under way, according to yet another report on the subject, issued at the Mobile World Congress in Barcelona, Spain by the Yankee Group, a technology research and consulting firm.

The worldwide adoption of mobile payments is fully under way, according to yet another report on the subject, issued at the Mobile World Congress in Barcelona, Spain by the Yankee Group, a technology research and consulting firm.

We have written about various mobile commerce-related forecasts on multiple occasions previously on this blog. Invariably all of them predict an explosion in the coming years both in the number of m-payment-enabled handsets and services and in the total volume of transactions. This report is certainly no exception.

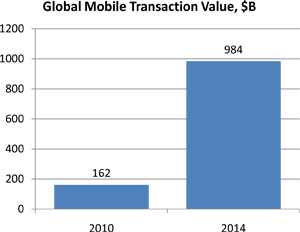

The Forecast: Mobile Payments Volume to Reach $984B in 2014

The Yankee Group predicts that in 2014 the total global value of mobile payments transactions will reach $984 billion, up from $162 billion in 2010, an increase of more than 600 percent.

The report makes other predictions, including:

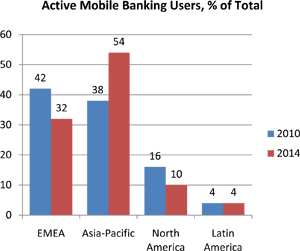

- Asia-Pacific will overtake EMEA (Europe, the Middle East and Africa) as the number one mobile region. The distribution of active mobile banking users will change as shown in the table below.

Active Mobile Banking Users, % of Global UsageRegion 2010

2014

EMEA 42%

32%

Asia-Pacific 38%

54%

North America 16%

10%

Latin America 4%

4%

- Mobile coupon usage grows. The number of mobile coupon users will grow 13 times, rising from 2.7 million in 2010 to nearly 35 million in 2014.

- NFC-based payments explode. Mobile payments based on near-field communication (NFC) technology will explode in volume, reaching $40 billion in 2014, up from only $27 million in 2010. The number of NFC-enabled handsets will increase just as dramatically, grow from just 834,000 in 2010 to 151 million in 2014.

Mobile Payments Adoption: Asia Leads the Way

Another report issued at the Mobile World Congress, this one from Accenture, a technology consulting firm, focused on the issues faced by the mobile commerce proponents. The biggest one among them was a concern among users over privacy security and identity theft, expressed by 73 percent of the respondents to Accenture’s survey.

Another report issued at the Mobile World Congress, this one from Accenture, a technology consulting firm, focused on the issues faced by the mobile commerce proponents. The biggest one among them was a concern among users over privacy security and identity theft, expressed by 73 percent of the respondents to Accenture’s survey.

The most enthusiastic mobile commerce adopters were found in Asia. 69 percent of Asians said that they favored using a phone to make a payment. The equivalent number for Europeans and Americans was just 26 percent. Here is a list of the top four counties in this category:

- China — 76 percent.

- India — 75 percent.

- Korea — 56 percent.

- Japan — 47 percent.

Asian mobile commerce adopters are well ahead of their American and European counterparts in a range of mobile transactions, as shown in the table below.

Mobile Transactions by Users in Asia, Europe and U.S., % of Respondents

| Mobile Transaction Type |

Asia |

U.S. and Europe |

| Check bank account balance |

62% |

33% |

| Make a purchase at a store |

41% |

11% |

| Scan or photograph a bar code in a store to get info |

38% |

16% |

| Transfer money to or from another person |

38% |

10% |

| Display a “digital ticket” for admission to an event |

36% |

11% |

| Check brokerage account |

34% |

6% |

| Purchase of an item or get a coupon from a “smart poster” |

31% |

5% |

| Buy or sell stocks |

31% |

4% |

| Transfer a money-off coupon to or from another person |

22% |

16% |

| Transfer mobile phone minutes to or from another person |

16% |

9% |

The Takeaway

Interestingly, what these reports indicate is that, even though both North America and Europe have been abuzz with high-profile announcements of new m-commerce services, gadgets and platforms, it is Asia that is actually taking the lead in the adoption of the new technologies.

It has to be said, however, that Asians have been using their phones for transactions of various kinds for a long time, while the Europeans and to an even greater degree the Americans are only just beginning to catch up. There is no doubt that we too will become more comfortable with the new mobile technologies, once we start using them.

Image credit: Barclays Pingit.