French Mobile Carriers Form a Mobile Payments Joint Venture

Borrowing a page from their transatlantic rivals’ book, three French mobile operators and a large payment processing company have joined forces to create a mobile payments platform, we learn from a press release.

You may remember that last year on our side of the Atlantic AT&T, T-Mobile and Verizon launched Isis, a mobile commerce network, to enable American consumers to make payments with their cell phones at participating merchants. Isis will be processing the payments through Discover’s network and Barclays, a large British bank, will be doing the underwriting of the accounts.

In the French version the joint venture is named Buyster, the mobile operators are Bouygues Telecom, Orange and SFR and the payment processing company is Atos Origin.

There are, however, two significant differences between the two joint ventures that make me wish we had a Buyster here in the States.

Unlike Isis, Buyster is not backed by a bank. Atos Origin will perform Discover’s functions, but there is no Barclay’s equivalent in the French joint venture.

Here is what the press release says: “Registering to Buyster enables your bank card to be linked to your cell phone number in a secure way.” So presumably any credit card can be linked to your account. This would be a huge benefit to consumers like me who would only use the card that gives the biggest rewards, no matter how convenient using another card might be.

Moreover, Buyster will be “free and available to any cell phone user, irrespective of their operator.” We will need some clarification on this point, as the press release is a bit ambiguous on it. It also states that Buyster “will be offered through the JV’s [joint venture] mobile telephony partners, which together account for over 50 million consumers.” If customers of other operators were really allowed to use it, Buyster would get my vote for the most consumer-friendly m-payment service to date.

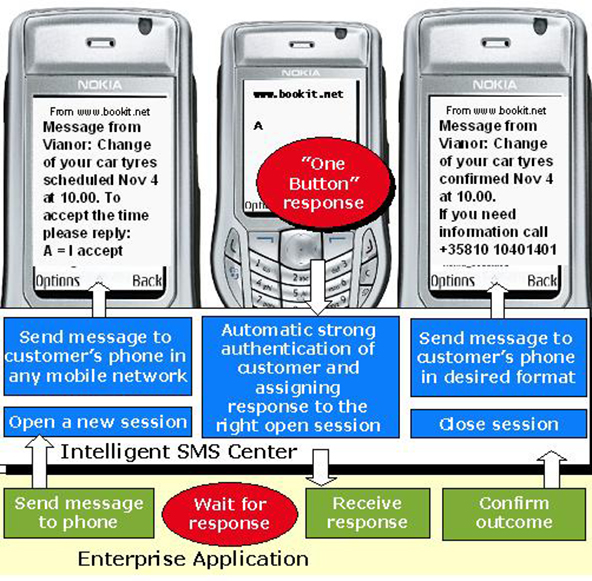

Buyster is also different from Isis in another way. It facilitates online payments, rather than face-to-face transactions. To make a payment at the checkout of an e-commerce website, a Buyster user will have to provide his or her cell phone number and Buyster password.

The joint venture has already managed to secure the backing of some major French e-commerce retailers. Aquarelle, Brandalley, Darty and Rue Du Commerce have all said that they would make the Buyster payment option available to customers at the checkout, according to the press release.

The only remaining hurdle is obtaining Buyster’s payment institution license, which has not yet been granted by the Banque de France. Without it, the joint venture cannot “develop, operate and market the Buyster payment facility in France.”

Payment Processing Takeaway

Rather than focusing on owning the customer accounts, Buyster aims at profiting from the fees it will be charging for processing transactions. In this sense, it acts like a typical payment processor whose goal is to constantly expand its user base, which leads to an increase in the payment volume and associated fees. By contrast, in the U.S. Isis acts more like a typical telecom whose primary concern is owning the customer, rather than the revenue stream from transaction fees. The future will tell which model works better for the service providers, but the French approach is undoubtedly friendlier to consumers.

Image credit: Actu.c4.fr.