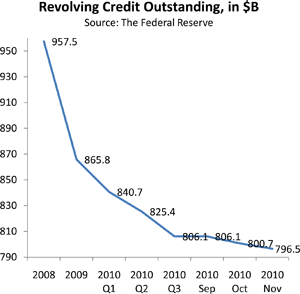

Consumer Credit Card Debt Falls for 27th Consecutive Month

American consumers have again cut back on their credit card spending in November, marking the 27th consecutive month of decline, according to the latest data released by the Federal Reserve. Outstanding revolving credit, comprised mostly of credit card balances, fell by $4.2 billion in November from October, a decrease of 6.3 percent at an annualized rate. This comes after a fall of $5.6 billion the previous month.

Overall, since its peak in August 2008, just before the financial crisis struck, revolving credit in the U.S. has declined by $177.1 billion, from $973.6 billion to $ 796.5 billion, a decrease of 18.2 percent. During this period the average U.S. family with outstanding credit card debt — 54 million by the Fed’s count — has reduced it by $3,280, according to the report.

Overall, since its peak in August 2008, just before the financial crisis struck, revolving credit in the U.S. has declined by $177.1 billion, from $973.6 billion to $ 796.5 billion, a decrease of 18.2 percent. During this period the average U.S. family with outstanding credit card debt — 54 million by the Fed’s count — has reduced it by $3,280, according to the report.

Non-revolving credit, however, rose for a fourth month in a row. This category includes auto loans, student loans and loans for mobile homes, boats and trailers. The increase in November was by an unadjusted $5.5 billion from the previous month.

The biggest increase in the non-revolving debt category belonged to government spending on education, which rose by an unadjusted $3.6 billion.

Auto sales also increased in November, to a seasonally adjusted 12.26 million at an annual rate, and then rose again at a 12.53 million annual rate in December. The fourth quarter of 2010 registered a combined 37.04 million at an annual rate — the strongest showing since the crisis began.

The report showed that the average financed amount for a newly-purchased car fell to $27,433 in November, which represented 82 percent of the total price of the automobile, on an unadjusted basis. The interest rate, however, rose slightly to 4.63 percent in November from 4.52 percent.

Overall, outstanding consumer credit rose by $1.4 billion, or 0.7 percent, to 2.403 trillion in November after climbing by a revised $7 billion in October. It was its fourth consecutive month of increase.

Data from the quarterly regulatory filings of the leading American credit card issuers showed that the rate of delinquent payments continued its downward trend. Early-stage delinquencies — payments late by 30 days or more — fell to 4.38 percent in November, the lowest level in almost three years, according to a Moody’s Investors Service report.

All of the biggest U.S. credit card issuers, including JPMorgan Chase, Bank of America, Capital One and Citigroup, reported lower delinquencies for November. Charge-offs — loans lenders no longer expect to be repaid and have written off their books as losses — rose at JPMorgan and Capital One and fell at the other four big issuers.

Interestingly, even though consumers have now been slashing credit card balances continuously for almost two and a half years, overall spending during this past holiday season jumped by 5.5 percent, the biggest increase since 2005.

The increased holiday spending can be interpreted as an indicator of an improving consumer confidence, which may be further bolstered by a report from the Labor Department, which showed that the U.S. unemployment rate dropped to 9.4 percent in December, as the economy added 103,000 jobs.

Yet, the unemployment rate is still way too high by historical standards and many consumers have limited access to credit, which means that credit card balances will probably continue to fall in the coming months, even though overall spending is likely to continue its upward trend.

Image credit: Moneyandfaithinmotion.com.