Mobile Payment Volume to Exceed $1 Trillion in 2014

We have grown accustomed in recent months to reading an incessant stream of heady forecasts about the wide adoption and huge growth of mobile payments around the worlds. What is amazing about it is that with each new report the projections grow bolder and bolder.

Now let’s take a look at the latest report to come our way. The global volume of mobile payment transactions in 2009 was $37.4 billion and total number of users stood at 351.4 million, according to a study by the IE Market Research Corp. (IEMR), a market intelligence and business strategy consulting firm. So far, so ordinary, we’ve already seen such numbers, so there is nothing extraordinary about this report. Right?

Well, not so fast. The researchers go on to predict that in 2014 the number of mobile payment users will rise to 1.06 billion globally — a compound annual growth rate (CAGR) of 20.5%. The gross volume of mobile payment transactions in 2014 will reach $1.13 trillion, more than 30 times the 2009 value, according to the report. Now, that is something!

Let’s take a look at how the researchers break down the transaction volume by payment channel.

- SMS. SMS made up 76.4 percent of mobile payment transactions in 2009, which is expected to decline to 58.7 percent in 2014.

- Near-field communication (NFC). NFC accounted for 14.9 percent of mobile payment transactions in 2009, which is expected to increase to 32.8 percent in 2014. In 2009, the number of NFC transactions 861 million globally, according to the researchers, who expect it to skyrocket to 35.6 billion transactions in 2014, for a CAGR of 106.4 percent.

- WAP / Browser-based payments and USSD. These two payment channels will only make up about 6 percent and 2.5 percent of the total mobile payment volume, respectively.

- Merchandise purchases using mobile payments. The total volume of mobile payments for merchandise purchases will grow from $7.4 billion in 2009 to $224.4 billion in 2014 — a CAGR of 95.7 percent. The average amount of a mobile payment for merchandise purchases globally was about $12.84 per transactions in 2009, with a total of 576 million transactions. In 2014, the gross volume of such payments is expected to reach $224.4 billion, with the average transaction amount growing to $17.43.

- Prepaid top-ups using mobile payments. This channel includes payments for prepaid services such as mobile, fixed line, internet / broadband services and top-ups for other services such as gaming, utility payments, gift cards, etc. The total volume of such payments will reach $286.4 billion in 2014, up from only $15 billion in 2009 — a CAGR of 76.7 percent.

- Mobile money transfers (MMTs). IEMR expects MMTs to take the shape primarily of mobile-to-cash transactions, rather than mobile-to-mobile ones, and will still require physical agents and banks to deliver the cash. MMTs are expected to reach $148.5 billion in 2014 for a CAGR of 86.2 percent.

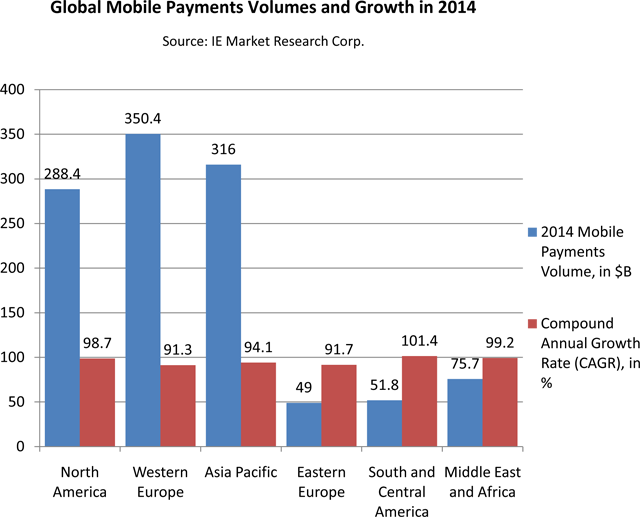

In North America alone, the IEMR researchers expect mobile payments to rise to $288.4 billion in 2014, a CAGR of 98.7 percent. This will be good for a share of 25 percent of the global total. The biggest growth will come from ticketing (CAGR of 138 percent) and digital purchases (CAGR of 120 percent). North America will still be trailing Europe, $350.4 billion mobile payment volume in 2014, and Asia Pacific, $316 billion, but its growth will be faster.

So there it is. Mobile payments are coming at us and coming fast and in all kinds of shapes. Industry heavyweights are busily readying themselves for the upcoming wave, while a slew of start-ups are jockeying for a piece of the pie. Personally, I expect that by the end of 2011 I will be using my phone for purchases as much as I am now using my laptop. What do you think? Share your thoughts in the comments below.

Image credit: Barclays.

Just continue maikng all payments on time every month. Give it time and your score will go up. You may want to open a new account and charge a couple things. Make payments each month. When you have companies giving you positive comments and reports to the credit bureaus, your score will improve. However, before anyone issues credit, they will probably run a credit check. This in itself could lower your score. You also may want to check with your local bank. Get their advice as well. But as long as your payments are on time, it will improve. Just takes some time.