Why Do Cab Drivers Hate Credit Cards So Much?

The Nevada Senate is well on its way to passing a bill that would be collecting $400,000 from taxi companies operating in Clark County, which includes Las Vegas, every six months, Las Vegas Sun’s Cy Ryan tells us. Clark County cab companies are being penalized for charging a $3 fee to customers who pay their fare by a credit or debit card.

The Nevada cab industry is only the latest one to stir a credit card trouble. What is with cabbies and credit cards?

Cab Drivers Hate Credit Cards

That much we do know. Here in Boston taxi owners sued the city last year for $1 million over the rules regulating the operational status of point-of-sale (POS) terminals inside the cabs. Drivers were not allowed to operate their cabs when the credit card machine was down.

In fact, cabbies have long resisted having to take credit cards in the first place. Amazingly, it was not until three years ago when New York taxis were ordered to place credit card terminals in their cabs. I don’t think legislators should have involved themselves, but think about that for a second; well into the 21st century you could only pay cash for your cab ride!

Anyway, later there were reports that credit card payments actually led to higher tips for cab drivers, however that did not put a stop to their constant grumbles. In fact, quite apart from the constant grumbling, NYC cabbies resorted to “adjusting” the tip option on the terminal’s screen to show the 20 percent as the lowest available choice and the 30 percent one listed as a “reasonable” one.

Why Do Cab Drivers Hate Credit Cards?

This is all a bit bemusing. After all, all other consumer-oriented industries have long ago accepted credit card fees as cost of doing business and moved on. Or at least I cannot think of another one. What makes taxis any different?

I asked a cab driver some time ago what he thought about credit card payments, even though I knew perfectly well how he felt about them. Still, his answer did offer an insight. He said that the main issue was that he had to pay the cab owner at the end of each day, whereas he had to wait a few days to collect his credit card receivables.

Of course, processing fees are an often-cited issue as well. San Francisco taxi drivers, for example, protested earlier this month against a 5 percent fee they were being charged for accepting credit cards. The issue in this case, however, lies with the cab companies, not with the payment processors who charge much less than 2 percent for credit cards and even less for debit. So to a large degree this is a case of self-inflicted pain.

The Takeaway

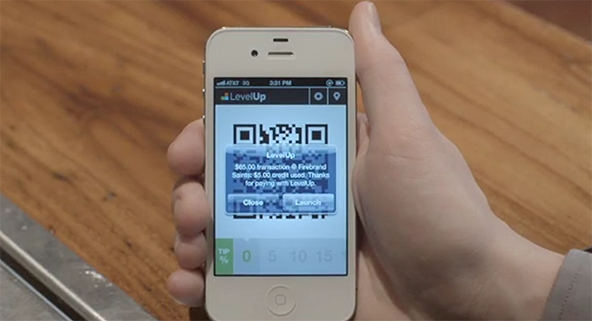

The way I see it, taxi companies are just stuck in the past, stubbornly refusing to enter the present. Credit cards are here to stay and now, with all of the new mobile payments technologies being rolled out left and right, card acceptance is becoming easier than ever. Moreover, customers demand it. I, for one, use my card everywhere I can, because it is convenient, pays me back and because I don’t have to deal with cash and especially coins. I have no intention to quit paying my cab fares by card anytime soon.

That said, what Nevada’s Senate is doing is wrong. Private businesses should be allowed to charge whatever they please for the services they provide and it should be up to consumers to accept it or not.

Image credit: Wikimedia Commons.